Market After The Close - Thursday 16 November

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Wen Hangover?

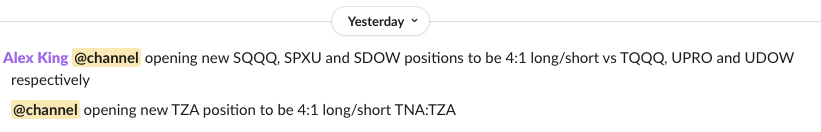

The three main equity indices mooned once more yesterday and then hit the deck, indicating a potential selloff was en route. Personally I added a little short exposure, as alerted at the time to our paying members by way of our real-time Slack channels.

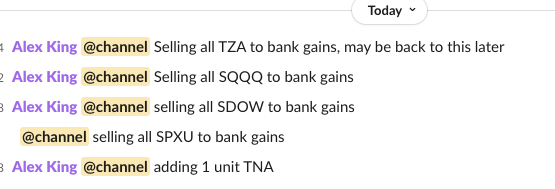

Come the morning, AAPL was up, MSFT was looking like it could do well, the S&P500 looked like it would be glued to the 4500 zone courtesy of monthly options expiry, and all in all, not much of a day to be running across the road in front of Mack trucks trying to gather short profits. I took short gains on all four indices early in the day - nothing much but free money is free money. The Russell then promptly dumped, of course! I added a little TNA as a result.

As we approach the close, the Russell is beginning to recover from its major acts of self-harm today, and the other indices are in nothingburger territory. Whilst one can construct many arguments as to why the Yuge Move in recent days will be sold off and retraced, the fact is that so far that has not happened. And so we keep looking upwards until there is a reason not to.

Below we walk through our latest take on the market.

Only Two Weeks Left To Lock In Today's Low Prices

If you're a free subscriber here, be aware that our prices rise on 1 December for our annual and monthly subscriptions. Monthly goes up from $249/mo to $299/mo; and Annual from $1999/yr to $2499/yr. Once you sign up, you don't get hit with a price rise. Only new joiners pay more. That way, the sooner you join, the less you pay.

You can sign up for a monthly or an annual subscription at the button below. If you want to take our best-value option, an extended 6-year membership (a 50% discount on the monthly, and a 25% discount on the annual), you can do so by clicking here.

(Monthly and annual members can upgrade to an extended membership anytime & we'll deduct any unused portion of your current subscription from your upgrade cost).

Any difficulties signing up, or if you have any questions whatsoever, you can reach us using this contact form - we'll get it done for you.

Let's Get To Work

Paying members, scroll right down for our latest take on markets. As always we look at the 10-year yield, the S&P500, Nasdaq-100, Dow Jones and the Russell 2000; we consider long-term and short-term outlooks, and we lay out staff personal account trading plans in each of the indices. We add Bitcoin and Ether futures pricing for good measure. And - NEW! - we now include the 3x index ETFs TQQQ, UPRO, UDOW and TNA.

Note - to open full-page versions of these charts, just click on the chart headings, which are hyperlinks.