Market On Open - Wednesday 22 November

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The AI Bubble LOL

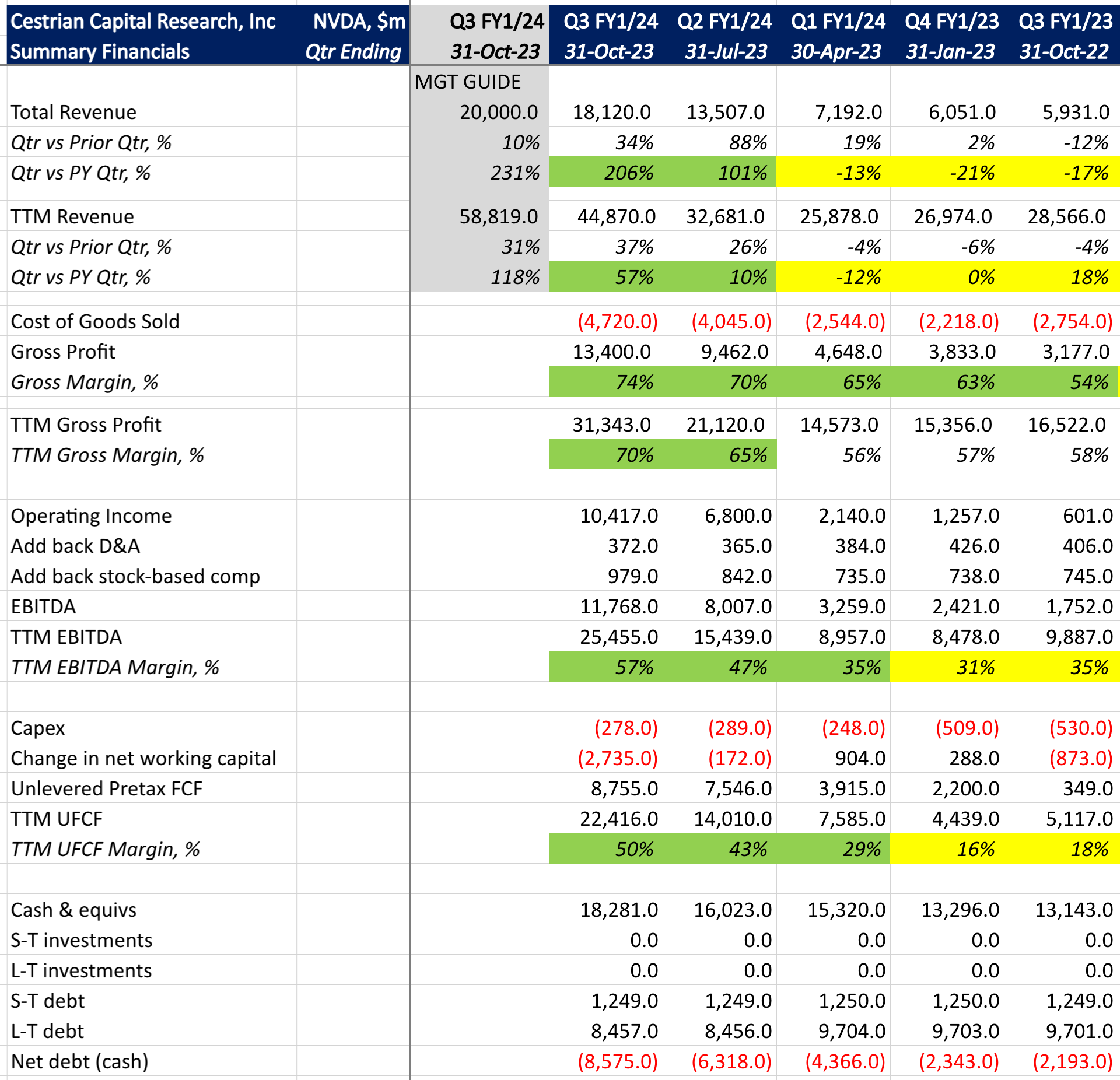

Nvidia printed its Q3 earnings yesterday after the close. If anyone wants to tell you that this AI thing is a bubble, not real, whatever, I suggest you point them to the NVDA Q3 numbers. The company put in an incredible +206% YoY revenue performance, meaning +57% YoY TTM revenue performance - on a TTM revenue base which now sits at $45bn. And if that wasn't enough look at the gross margins, EBITDA margins and cashflow margins.

That's evidence of the importance of AI in the tech landscape today. AI is undoubtedly not as powerful as claimed, but there are real advances in machine learning, processing and content creation that are happening; the compute power that this next paradigm demands is massively greater than the last generation of hardware, software and networks (yes, networks - look for capacity upgrades in public and private networks to be a coming spending wave). Tech capex can sustain an up-move in the Nasdaq and now the S&P and the Dow too (remember both MSFT and AAPL are Dow-30 constituents, as is INTC, CRM, CSCO ... the Dow is now Grandpa Tech!).

So if our bull case for the Nasdaq is correct and if it has any fundamental underpinning whatsoever, it's likely tech capex, which is to say, capex. There isn't a major company in the world today that isn't spending money on AI one way or the other. Comparisons to the dot-com bubble are erroneous from a stock price perspective to my eye, or at least, from a valuation perspective, but where the comparison is absolutely correct is that in the mid to late 1990s, companies everywhere were scrambling to work out what this World Wide Web thing meant for them, what they should do with it, how to do it, and so on. Most everyone knew it was going to be a Big Thing but it took at least 10-12 years for large corporates to find their feet in the new world. Likely AI is the same. But along the way we think a lot of GPUs, CPUs, VCSELs, PHYs, software applications, operating system upgrades and consulting hours are going to get sold. A lot. As in, a lot-lot.

Right. Onto our charts for the day.

Only Nine Days Left To Lock In Today's Low Prices

If you're a free subscriber here, be aware that our prices rise on 1 December for our annual and monthly subscriptions. Monthly goes up from $249/mo to $299/mo; and Annual from $1999/yr to $2499/yr. Once you sign up, you don't get hit with a price rise. Only new joiners pay more. That way, the sooner you join, the less you pay.

You can sign up for a monthly or an annual subscription at the button below. If you want to take our best-value option, an extended 6-year membership (a 50% discount on the monthly, and a 25% discount on the annual), you can do so by clicking here.

(Monthly and annual members can upgrade to an extended membership anytime & we'll deduct any unused portion of your current subscription from your upgrade cost).

Any difficulties signing up, or if you have any questions whatsoever, you can reach us using this contact form - we'll get it done for you.

Let's Get To Work

Note - to open full-page versions of these charts, just click on the chart headings, which are hyperlinks.