Market On Close - Tuesday 25 July

MSFT + GOOG + FOMC = ?

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Let's Keep It Simple

Microsoft and Google reported after the bell today; GOOG is up nicely and MSFT down. MSFT numbers look fine to us as does the chart, so we anticipate any selloff to be temporary. Let's see how the indices are looking right now. FOMC tomorrow means all the pieces are going to get thrown up in the air - we'll see where they land.

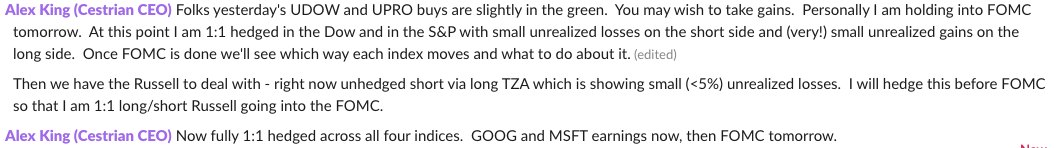

As our paying members will be aware, in staff personal accounts we closed today out by hedging all our equity index ETF positions 1:1 long:short so that we can stare FOMC in the eye and react to it thereafter. Here's what we posted real-time in our Slack room before the close today.

By the way, if you're interested in hearing more about how we do our work, you might care to listen to me droning on about stuff in this podcast hosted by Seeking Alpha.

OK. Next.

For our paying members only we walk through the shorter- and longer-term outlooks for the S&P500, the Nasdaq, the Dow and the Russell. If you've yet to sign up to the paid plan here, you can do so right from the link below.