Market On Open - Friday 12 January

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Another Big Money Play - Out-Bore The Smalls

Amongst the many reasons that Big Money is and remains Big Money is that it understands human psychology and emotion very well. Aside from some external stimuli like credit availability and cost, can you really say that there is anything to the market other than a game of cat and mouse where the cat always ends up with not only the cream but, usually, the mouse’s cheese also? The creation of fear and greed impulses amongst small-money players can be achieved by headfaking the market this way and that way before finally settling on a direction - this is often the play around major data releases. Yesterday, CPI day, saw the usual sharp move in direction A (down, as it happens) and then an equally sharp move in the opposite direction (up) to end the day a nothingburger but not before many hopes and dreams were dashed on the rocks. Seesawing isn’t the only tool available to Big Money though - another is boredom. Big Money knows that Small Money loves to trade. And if you can induce folks to overtrade then not only are you getting the good order flow to sell to your buddy down the road - but if you can do so whilst markets go sideways then there is a good chance that the poors will start committing big one direction or another, purely in search of that dopamine high when things start moving. Big Money, however, doesn’t need dopamine. It is immune to the stuff. Big Money just grinds on slowly upwards with a timeframe measured in decades, aeons. So right now, when you see a chart like, say, the Dow, you know that a Big Move is likely afoot - but maybe not today, maybe not tomorrow.

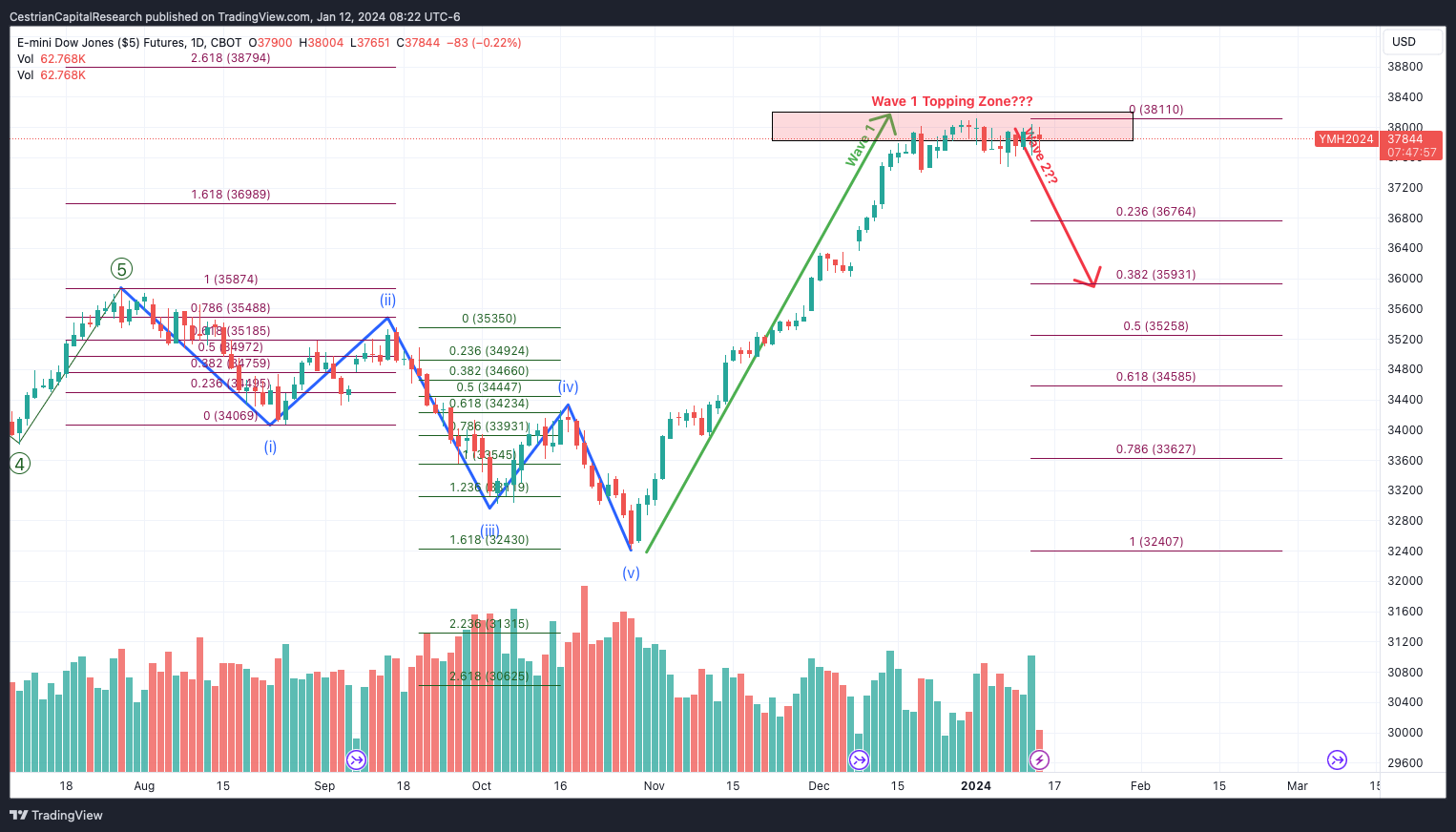

This is the kind of chart of which we speak. (You can open a full page version, here).

You see? Dopamine-free zone. You can bet plenty of smalls are set up for a big move to the upside, and just as many, a big move to the downside. Big Money wins like this - (1) if a Big Move comes in one direction, half the smalls lose out. Win! (2) if no Big Move happens for some time then probably more than half of the smalls lose out because their expiry dates will pass and/or they will be constantly adjusting positions in anticipation of a move that never comes. Win!

CPI yesterday was a little above expectations; PPI today, a little below. Make the argument you prefer as to whether equities are likely to move up or down. For now they remain rangebound and sideways, as they have been since mid December. Easy does it is our view right now; as always we believe, try to be More Like Big Money, and Less Like Chad.

For paying members we now run through our usual charts covering the main US equity indices, associated leveraged ETFs, plus the SOXL TECL and FNGU ETFs as always. Yet to join up? You can do so right from the links below.

Note - to open full-page versions of these charts, just click on the chart headings, which are hyperlinks.