Market On Open - Thursday 19 October

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

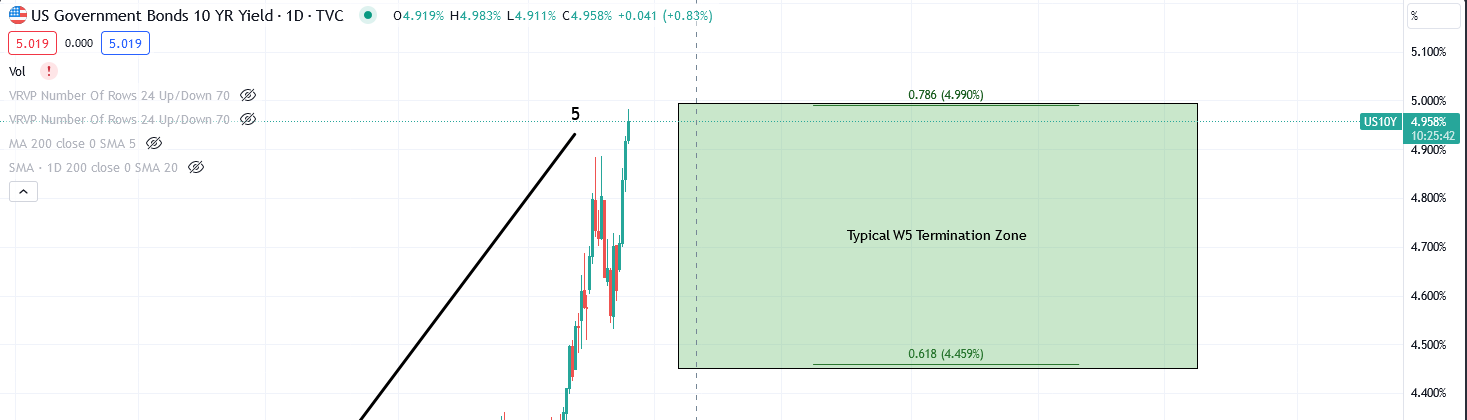

The Big Five-Oh

Here's the thing that is spooking more market participants than you might care to believe.

Yup. 5% bar the shouting. Now, if you had told folks back in October 2022 when the yield stood at around 4.3% that equities - particularly the rate-sensitive Nasdaq - would be up bigly in twelve months' time, but so would the yield? Then the right-thinking amongst them would have declared that hopium at best and nonsense at worst. Yet here we are - a huge decline in bond prices driving up the yield, but the NQ still sat at around 15,000.

The relationship between asset classes - equities vs. bonds vs. commodities - is complex indeed and we don't subscribe to a long-lasting mechanical relationship between them. For periods of time you can point to specific relationships between them but all such eras pass and the relationship changes. We've been saying for some time on these pages that we thought yields could keep climbing at the same time as stocks, which is what has happened through much of 2023.

Now, if our chart on the 10-year holds water we should see a decline in the yield in the near future. It can run up over 5% for sure, but that's the level at which the chart starts to break down and we need to look again.

Let's get back to today.

Paying members, scroll right down for our latest take on markets. As always we look at the 10-year yield, the S&P500, Nasdaq-100, Dow Jones and the Russell 2000; we consider long-term and short-term outlooks, and we lay out staff personal account trading plans in each of the indices. We add Bitcoin and Ether futures pricing for good measure.

Price Rises Coming Soon For New Joiners

Want to sign up as a paying member? Our 'Extended' 6-year membership pricing rises 1 November; Annual and Monthly memberships rise 1 December, so, now's a great time to beat the raise.

If you currently pay monthly, and want to move to annual, or if you're on a monthly or annual subscription and you want to move to Extended, same logic applies.

Note - to open full-page versions of these charts, just click on the chart headings, which are hyperlinks.