Market On Open, Wednesday 5 February

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Bonds

by Alex King, CEO, Cestrian Capital Research, Inc

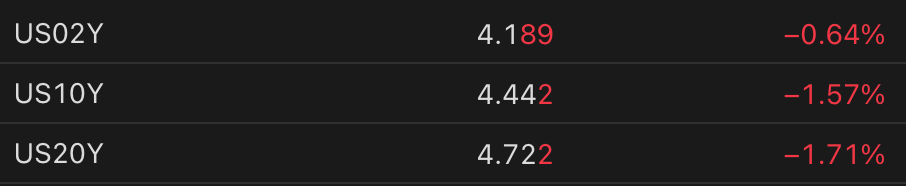

Well, as discussed and disclosed in our Inner Circle service, I have been accumulating US government bond ETFs for a little while now and this may be beginning to pay off. I suspect the current cost-down initiative in DC and beyond has at least one intended audience, being the bond market, the better to cram down those stubbornly high yields. Today yields are falling across the spectrum.

If this pattern continues we may see the justification for all the institutional accumulation in US government bond ETFs in recent months.

Probably but not definitely, falling yields would be supportive of equities at this point in the cycle too. On a day when Google and AMD both got hit on earnings, the Nasdaq is down less than a half point; something else must be supporting that and my guess is it is money getting cheaper.

Now, before we get to work on today’s charts I want to flag that our Trading Gains long/short ETF service sees prices rise substantially at midnight TODAY. So, last calls for joining up to lock in the current low prices! Details below.

Prices Rise For Our “Trading Gains” Service At Midnight On Wednesday 5 February

This long/short ETF trading service is earning fantastic subscriber testimonials. I would encourage you to read the latest, here. Prices rise midnight Wednesday for new joiners - existing members keep their original price. The sooner you join, the less you pay. You have till midnight tonight.

Short- And Medium-Term Market Analysis

If you want this daily dose of pattern recognition, and you aren’t yet a subscriber of course, you can read about and choose from all the subscription services that include this note, here.