Market On Open, Wednesday 7 May

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Chairman Powell Takes The Stand

by Alex King, CEO, Cestrian Capital Research, Inc

Markets continue to drift upwards from the post-Liberation Day lows. There is a skittishness still - a spike upwards on any hint of rapprochement between the US and China, a spike downwards on news of international conflict - but the dominant trend is up, for now.

Persistent volatility in the market makes this an attractive environment in which to trade long/short indices. On Monday and Tuesday this week, if you had your wits about you, there was free money available via inverse ETFs or futures, which could be cashed and the profits rolled into the longs at the lows.

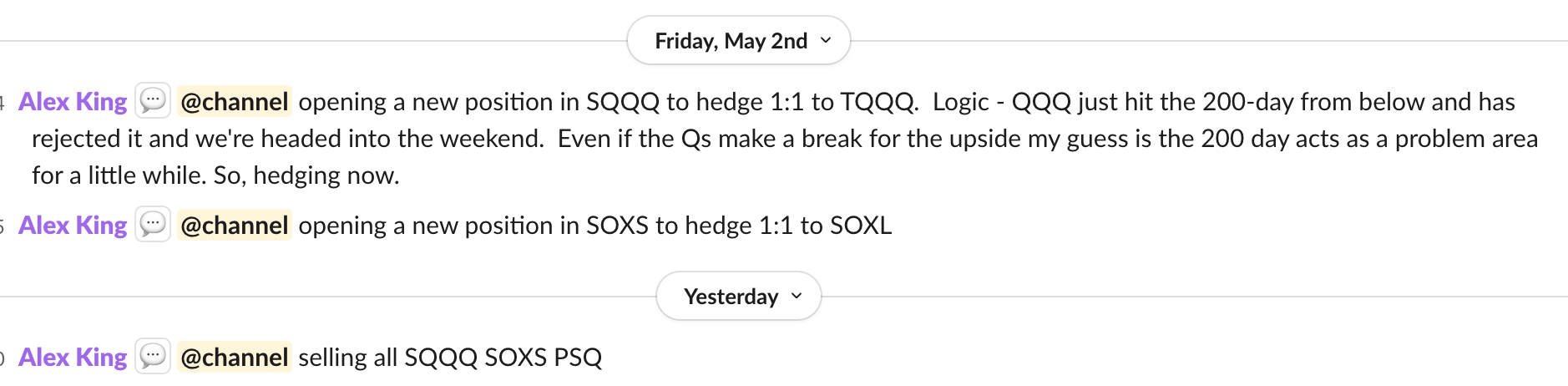

In our Inner Circle service here at Cestrian we teach this long/short hedged trading method all day long, and evidence it with live, real-money trade disclosure alerts. Yesterday was a great day to sell short positions at the lows of the day and roll the profits into longs. Here’s the alerts sent to subscribers Friday and Tuesday showing the buying and selling of short hedges.

We have the post-FOMC press release and Chairman Powell speech today; this is almost always a volatile time for markets, regardless of what Mr. Powell says. Why? Because market makers and large institutional asset managers use FOMC as an Event, capital-E, to move the market in whichever direction they first thought of anyway. It is difficult, in my experience, to achieve any kind of consistent win rate trying to guess ahead of time how the market will react to FOMC. It’s often prudent just to hedge holdings going into FOMC and then let the reaction play out. Sometimes you get a violent one-way directional move after the committee reports, but usually the market swings up and down and all around with seemingly no sense - until you realize that the whole point of the apparently crazy market behavior is to (1) relieve investors of their money by taking out both bull and bear stop-losses all in one session and (2) attempt to fry the brain of anyone considering committing capital in the immediate aftermath such that they hopefully deploy it in the wrong direction, thus providing yet more free money to the system architects. And so very often, a hedged position going into FOMC can generate gains for you on both sides, as long as you are patient. Initial spike up followed by prolonged selling? You can sell the long side of your hedged trades early and keep the short for later. A dump that gets bought up? Take gains on your shorts and then ride the long back up. And so on.

If this sounds a little tricky to achieve - making money on both sides of the bull/bear divide all in one timeframe - well, it can be. But with practice, any sensible, thoughtful, calm investor can do it. If you’d like to learn the art, join our Inner Circle service right away. (Details here).