Meta Platforms Q1 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Do Your Own Research

If you want to get to grips with how the economy is doing and you don’t care for all the unders and overs, exclusions and inclusions, definitions and whatnot as regards GDP calculations, may I suggest a reductionist alternative:

Take the most important companies in the US and watch their fundamental financial performance. If most of them have growing revenues then probably the economy is growing. If most of them have decelerating revenue growth then probably growth is slowing; if most have accelerating growth then most likely the economy has some good news in the wings.

So far Q1 has been a good news story for most of the companies we cover, which suggests to me at least that perhaps the economy is not (yet) in the degree of trouble that the various talking heads would have you believe. Personally I am looking closely at company guidance, since corporates have every justification at present to cut or indeed cancel guidance, citing tariff and general trade policy uncertainty. So far, CDNS has raised its guide, VRT raised the midpoint, and META looks like it has held its outlook at least in line. The company stated its capex would rise as a result of increasing hardware costs, likely a reflection of tariffs hitting the sector.

Let’s take a look at Meta financials, valuation and the stock chart.

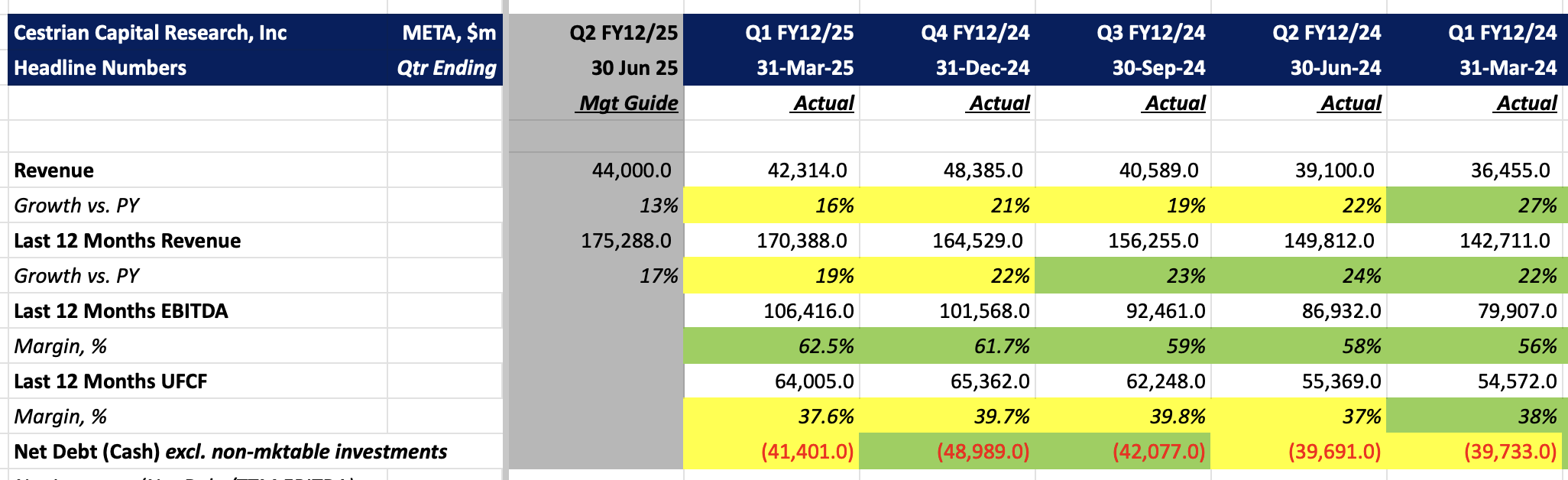

Here’s the headlines.