Options Without The Drama

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

I Hate Options

by Alex King, CEO, Cestrian Capital Research, Inc

Actually, what I hate is the stress that comes with trading options. But the more I work with my colleague Jay Urbain, Ph.D., the more I realize that just like trading stocks or ETFs, it’s only stressful if you’re doing it wrong.

A few times over the last couple years I have tried to follow some self-proclaimed options wizards on X. And I found that although, in the end, they probably did make money, the volatility that came with it was (1) vomit-inducing, or would have been had I been learning with meaningful capital allocations as opposed to learning-level-capital allocations; (2) very stressful, because I was always waiting to see what the self-appointed expert would do next and then think what I should do about it; and (3) ultimately a bad risk/reward, because any returns I banked were not enough to pay for the volatility factor. It’s fine to have investments and trades that yo-yo all over the place if (a) you expect it and (b) enough of them pay off enough of the time to make it worthwhile. (That is what VC looks like when you do it right, for instance). Anyway, each time I’ve done this I’ve thought, sheesh, not worth it, I’ll go back to my comfort zone of hedged long/short trading index- and sector-ETFs instead.

Jay is built differently to your regular Options Furu. He is a mathematician and statistician by training and came to options trading as a result of an academic career in the above. He still teaches data science despite the fact that he would make a considerably greater amount of money by just clicking on the screen for those hours instead of trekking to the classroom. He and I have worked together a good deal recently in the development of the SignalFlow AI quantitative research services that we host (here) - we’ve learned a lot from each other and work well together. And with that in mind I thought, well, this options thing he does (where in a quiet moment he will tell you what kind of returns he makes each year, and I can tell you it beats professorial duties), I’ll see if I can make that work for me.

I’ve dabbled a couple of times with his methods but I hit an A-HA! moment this week which I wanted to share here. Here’s what happened at a high level, then I’ll walk you through the detail.

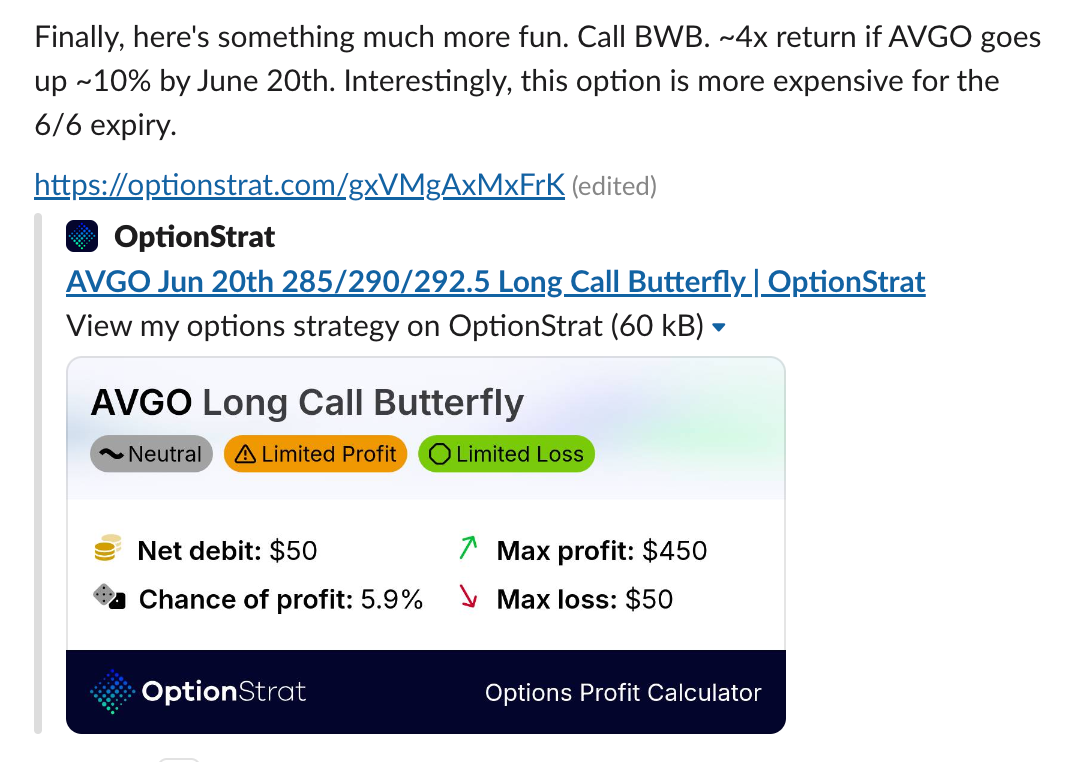

The headliner is that in our Jay’s Options service (here), Jay posted a hedged, net-long trade idea with which to play $AVGO earnings. I was hedged in semiconductor ETFs going into earnings (using $SOXL & $SOXS) and I felt like adding some additional long exposure just in case the market ripped upwards and left me absolutely risk-controlled but lacking profit. So I thought, hm, a hedged long AVGO options trade, that will do me. I put the trade on. AVGO printed - solid earnings (see here) - but the stock dropped on the print in postmarket, was still down in pre-market, and indeed is still down at the time of writing. But the options trade made money anyway - I managed to bank well over 100% gains overnight even though AVGO was down 3% most of today and this was a levered-long trade.

Hedged, Risk-Controlled Options Trades

Personally my happy place is in hedged trading. Why? Simple. Because when I mess it up, which is often, I can always course-correct and get back moving in the right direction. We teach this method - which works with index- and the larger sector ETFs, as well as with index futures - in our Inner Circle service all day long, and I disclose my personal account trades so that (i) it’s always clear which way my own capital is pointing, and (ii) when I mess it up and have to scramble to get back towards the light, there is a source of entertainment for our community and also at least sometimes (iii) when I get it right there are live, real-money how-to examples. Again, what I dislike about options is the unidirectional hero-or-zero nature of them.

But this was the trade idea Jay posted yesterday - he comes up with these all the time by the way, and trades them with his own capital, and discloses his wins and losses in broad daylight.

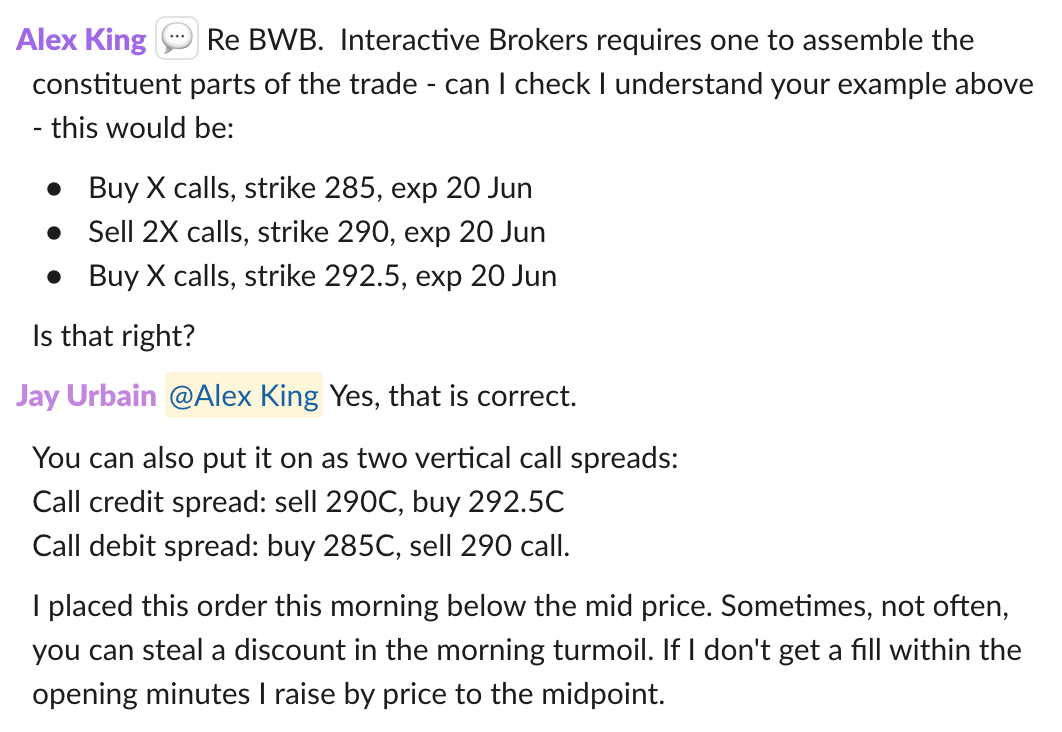

Being an options noob I headed to the Discussion Channel in the Jay’s Options service.

So that is what I did. Let’s use units of 1 for ease of communication.

- I bought 1 unit of capital’s worth of the 6/20 285 strike AVGO calls, and

- I bought 1 unit of capital’s worth of the 6/20 $292.5 strike AVGO calls, and

- I sold 2 units of capital’s worth of 6/20 290 strike AVGO calls.

Taking into account the actual prices of the calls this left me with a small net cost (premium paid to buy the 285 and 292.5 strike calls, minus premium collected by selling the 290 strike calls). Let’s call that net costs 0.5 units of capital. The actual math was a little messier but this is close enough.

So, yesterday after the close, AVGO prints earnings, perfectly reasonable print, stock sells off 3ish% in postmarket, and is at about that level in pre-market trading today.

So, using the hedged trading method that works so well with ETFs and futures, I bought back the 290 strike calls at the open, keeping approx 80-85% of the premium I collected - let’s call that 1.6 units of profit.

I used that profit to buy more of the 6/20 285 strike calls which had dropped 80-85% in value from when I bought them. So using 1.6 units of capital at that low price was a meaningful average down vs. the 1 unit of capital at the original price. I didn’t bother touching the 292.5 calls because it looked doubtful to me that AVGO was going to moon soon.

Then I waited. AVGO was climbing a little, with call options seemingly running ahead of the stock. At one point I was in the money on the 285 strike calls and had I sold then the returns would have been truly remarkable. But I waited a bit longer, then decided I didn’t want to risk waiting still longer and then sold all the calls I owned, returning a total of a little over 1 unit of capital vs. the 0.5 units of capital that the trade had originally cost me. So, >100% gain in less than 24 hours, in a long trade, in a stock that sold off on earnings.

Now that is options without stress if you ask me.

Because you have some control over outcomes. When you place the trade, as you can see from the OptionStrat screenshot above, you know your max loss (which is all your net premium). You know your max profit (if the calls you bought go up, the calls you sold will go up too, net net you will be in the money). And then the method I used to break apart the group after the earnings print is just normal long/short trading. You sell the profitable leg of your hedged pair, and use the profit to buy additional exposure to the unprofitable leg of the pair, wait to see if that was a good idea, then get out of the trade altogether, hopefully at a gain.

So, if you hate options? Join Jay’s Options service. You can read all about it here.

Also, if you love options? Join Jay’s Options service. Because it’s still options.

Cestrian Capital Research, Inc - 6 June 2025