Palantir Q4 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Hobbits, Rejoice!

by Alex King, Cestrian Capital Research, Inc

Some stocks, as you know, cannot be traded on fundamentals. They may be stocks issued by actual companies that do actual things but they behave more akin to meme stocks than they do normal stocks. Palantir ($PLTR) is just one of those names.

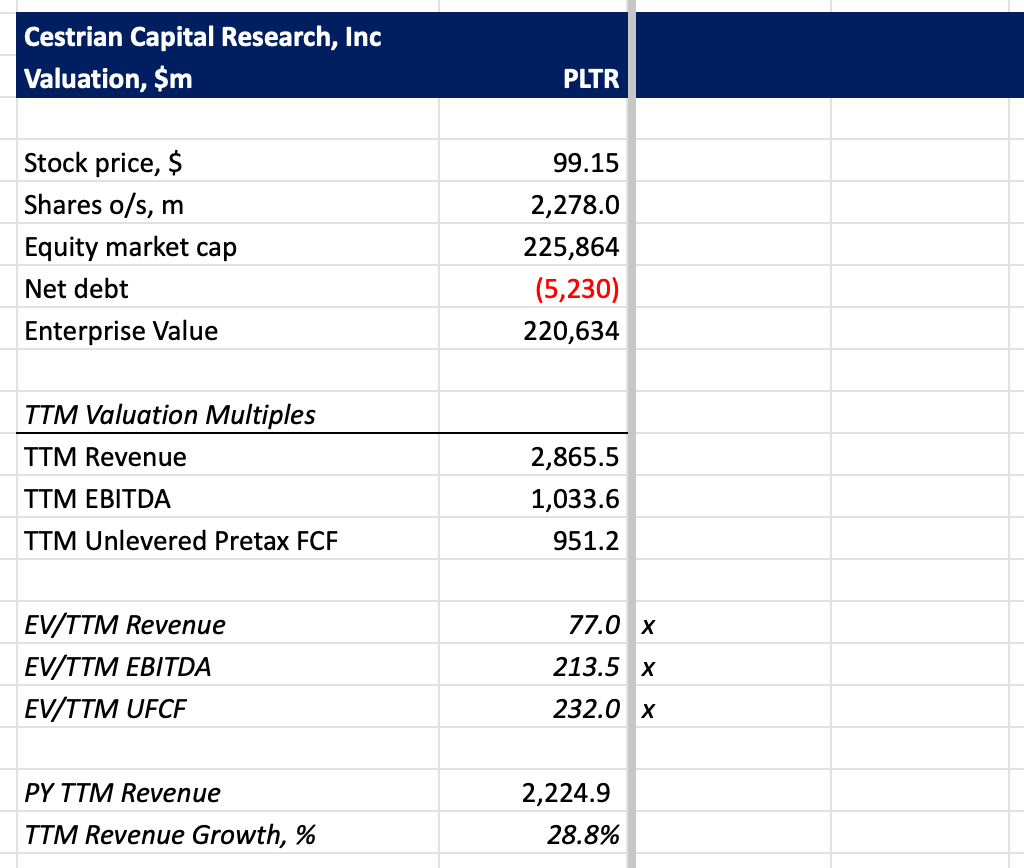

Here are some reasons the stock should not be hovering around the $100 mark this morning:

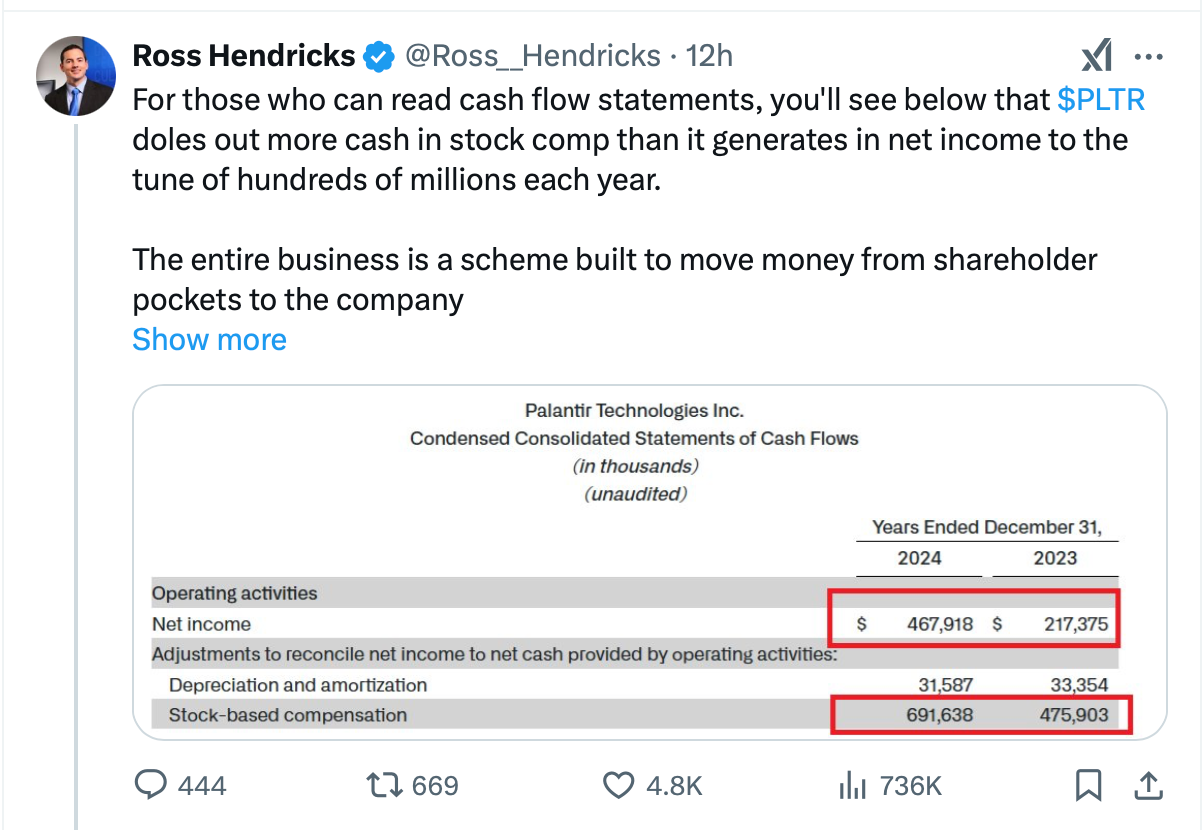

Here are some other reasons the stock should not be at this level:

And here’s why none of that matters:

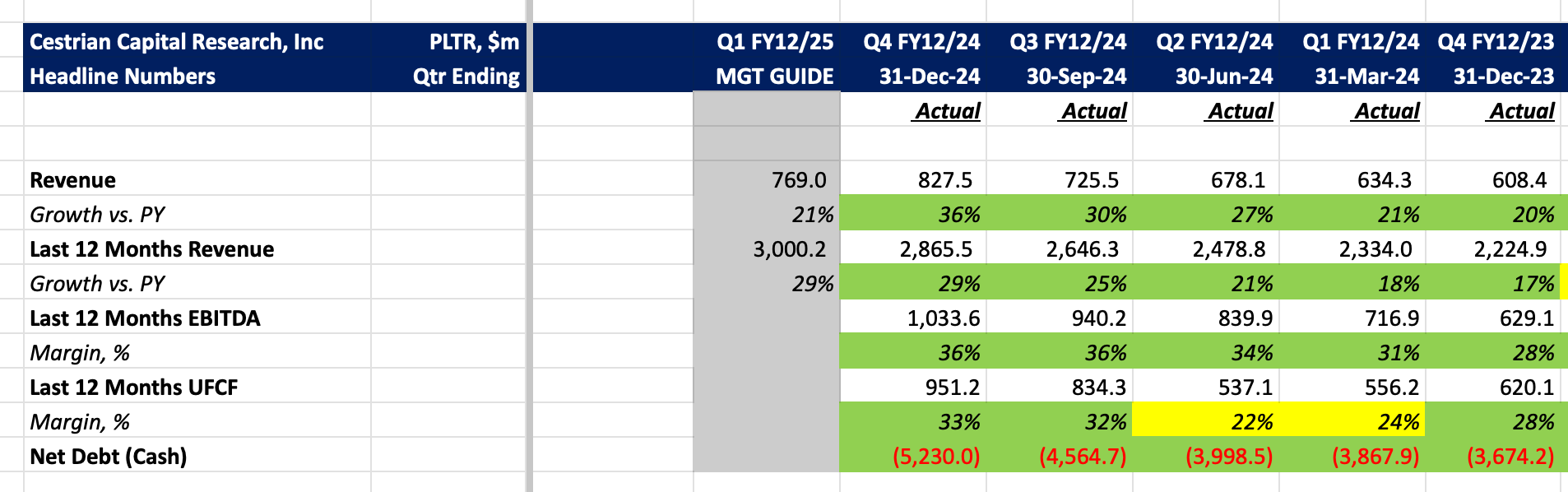

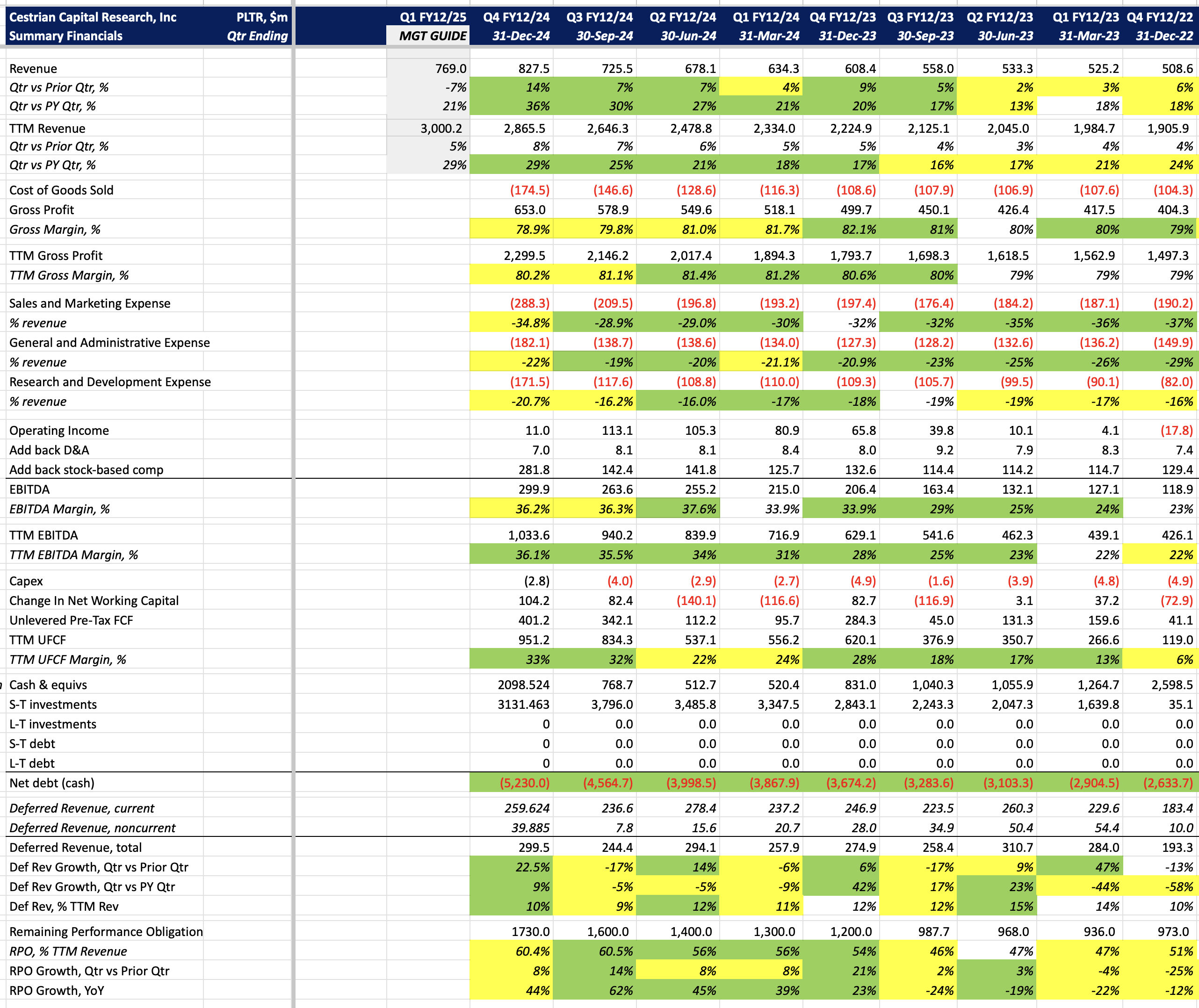

For the record, here’s the summary fundamentals:

But since we’ve already established that none of that matters, let’s get on and look at how the stock behaves on its chart, and where it might be headed from here.

Financial Fundamentals

As it happens, on fundamentals the company is performing extremely well. Revenue growth is accelerating (now +29% on a TTM basis), and the balance sheet is now showing over $5bn in net cash - that’s more or less doubled in two years.

You may notice that operating income was down big this quarter but EBITDA and cashflow were not. That’s due to a large one-time award of stock-based compensation. This goes with the territory with this stock. You can get bent out of shape about it as some do (see the X posts above) or you can just ignore it and watch & respond to the price as one should.

Stock Chart

You see my point about meme stock behavior! You can open a full page version of this chart, here.

This stock, like all moonshots, will fall back at some point. In pre-market today the stock is sat at an 800% Wave 3 extension! I would ignore all doomsayers who claim the company is fake because stock based comp or the stock must go to zero because, well, whatever reason they say. It’s a highly volatile stock and can be traded as such. If you have enjoyed the run up, congratulations, don’t forget about protective mechanisms like trailing stops. If you missed it, and you’re thinking of chasing, I would remind you that’s an 800% Wave 3 extension. So again, you might want to think about managing your risk.

Meme stocks are unpredictable things; PLTR can go much higher from here, or much lower, and I am not sure there is much more to be said about it than that. When the Wave 4 comes it could in theory fall all the way to $30 and still be in a bullish pattern, but I would fall off my chair if that happens anytime soon. More likely a 38.2% or a 50% retrace, the stock declared ALL OVER I TOLD YOU SO by half of FinTwit, before another move to make new highs - that would be my best guess.

Rating

This is a very difficult one to rate. I myself sold my PLTR stocks a long time ago because I got tired of the stock hitting the buffers every time the insiders sold heavily. If I still owned the stock, I would be selling right now in premarket. So on that basis I would rate at Distribute. But the rational thing to do, I think, is to rate at HOLD BUT BE CAREFUL TO MANAGE YOUR RISKS. Meaning that if you own it, consider using stops to protect those gains, and don’t be surprised to see a big selloff at some point - nor a big move up. If you know how to trade crypto successfully, those skills apply here too I think.

DISCLOSURE - Author holds no positions in PLTR stock.