SentinelOne Q4 FY1/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Snakes And Ladders

By Alex King

SentinelOne ($S) is a cybersecurity business, endpoint focused, competes head on with CrowdStrike ($CRWD) albeit at a lower price point and typically with slightly less sophisticated target customers. The company is doing fine - growth is good, cashflow margins still weak but getting steadily less bad, balance sheet has multiple years’ worth of cash on hand even at the current burn rate, all fine.

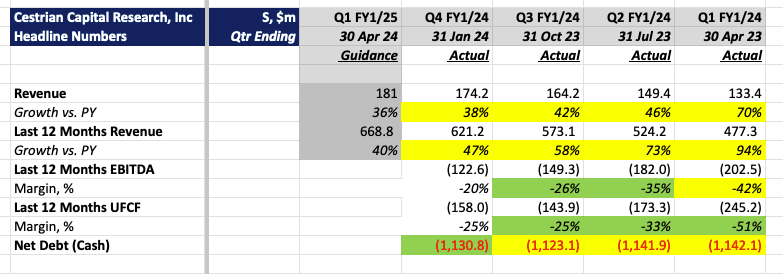

Here’s the headline numbers.

The stock is trending upwards too, not that you would know it from the post-earnings dump today. In truth though, the name is just in the throes of an a-b-c correction after a big 5-wave move up from the 2023 lows. You can open a full page version of this chart, here.

Read on for our fundamental, technical and valuation analysis, latest stock charts and rating.