Snowflake Q4 FY1/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Zzzzzzzz

Today we cease coverage of Snowflake Software because … I can think of 1000 things better to do with one’s time and/or capital than worry about Snowflake stock. The company has seen decelerating growth since it joined the public market. Cashflow margins meander around the place but have yet to put in a clear uptrend to offset the downtrend in revenue growth. The order book (RPO) had seen accelerating growth in recent quarters but that has not translated into accelerating recognized revenue growth and in any event RPO is now slowing once more. The stock has been rangebound since 2022. This company is not, I believe, core to tomorrow’s tech stack and the stock is not, I believe, core to large investors’ holdings. So … why bother?

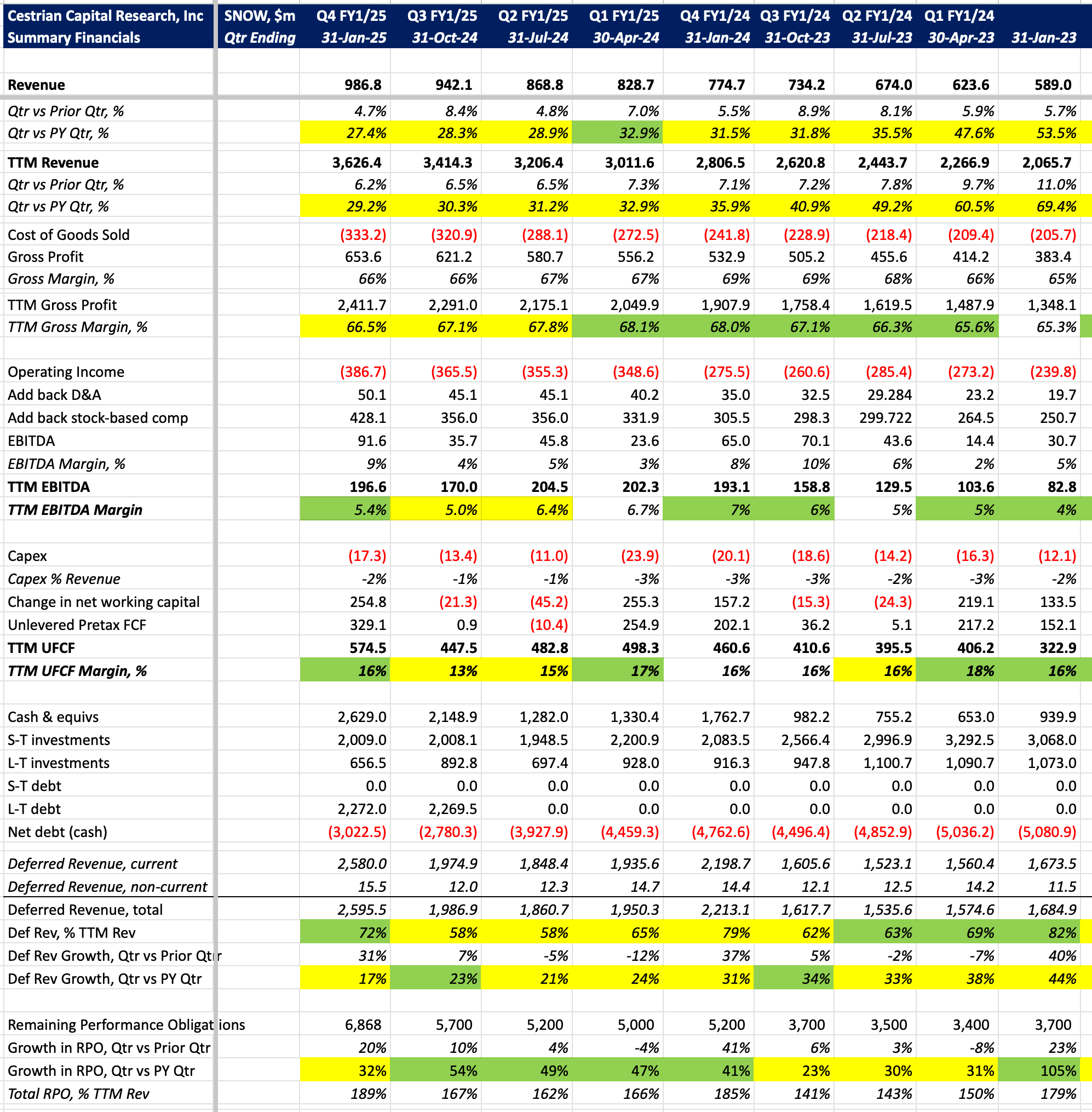

For good order the fundamentals, valuation multiples, and stock chart are below.

Fundamentals

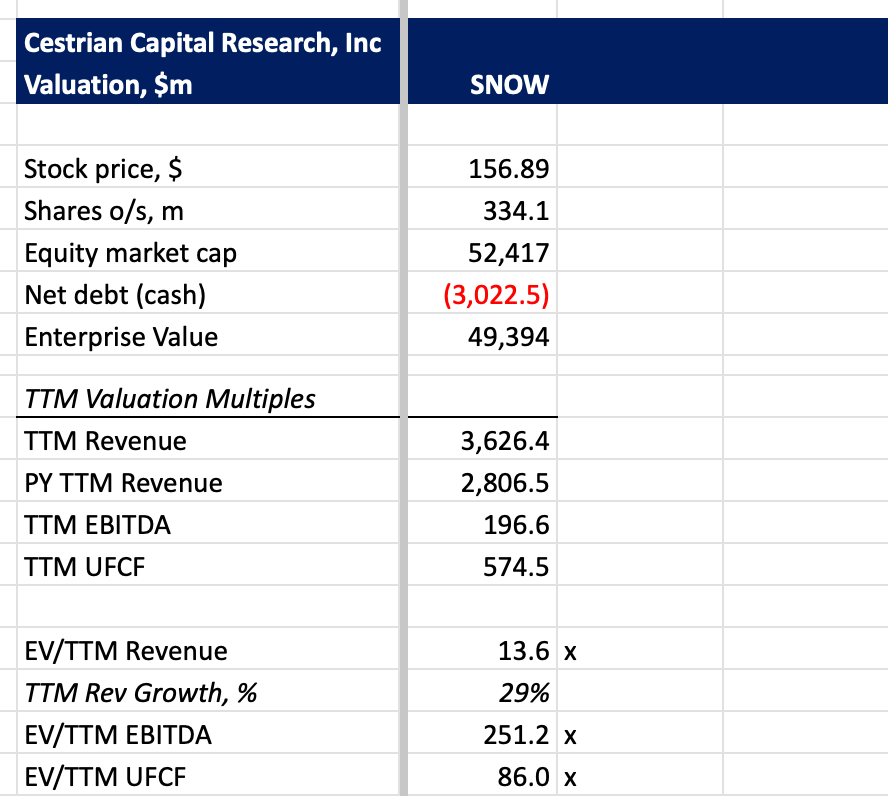

Valuation Multiples

It’s not often in tech I think “that’s just silly”, on account of valuation multiples being usually silly vs. any classical valuation theory but … this is just silly. 86x trailing twelve months’ cashflow? No thankyou.

Stock Chart

Sideways and rangebound for three years. That’s fine by the way in an index because you can just trade the index long, short, long, short for as long as the sideways action lasts. A very profitable pursuit in fact. But in a single stock name with earnings risk and no cheap & easy way to play the short side, and the risk of getting badly hurt on the shorts if the market rips? No thankyou.

You can open a full page version of this chart, here.

We move to Not Rated and hereby drop coverage. (Obviously the stock will now moon. I can live with that).

Cestrian Capital Research, Inc - 30 April 2025.

Afterword

By the way if you’re a free reader and you want to get our coverage of the stocks we do find of interest … click here.