Synopsys Q2 FY10/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Show Us The Money

by Alex King

As everyone knows, M&A destroys value. It must be true, because everyone says so. Er, except Larry Ellison at Oracle, which is a serial acquiror of software companies. And except Marc Benioff at Salesforce, which has conducted and integrated many large and high-priced acquisitions to good effect in the last ten years. Oh, and except the entire leveraged buyout industry, which seems to continue to make a good living doing, you know, M&A. But, apart from all those people, it has to be said that M&A must be bad.

Which is why Synopsys ($SNPS) may offer an opportunity right now. We rate the stock at Hold on technicals, but the name is trending sideways at present whilst the market decides what to make of the acquisition of Ansys ($ANSS) which is pending. This is a game-changer for SNPS; for good or for bad! The deal has yet to clear all regulatory hurdles and is not a certainty. Personally I have no position in SNPS; I am happy to wait it out to see what happens with the deal. Most such acquisitions hit an air pocket at some point - a missed quarter or a restatement of acquisition accounts or something of that nature - so there may be an opportunity in the future to buy a dip here. For now, sideways, Hold rating.

Oh by the way - there were some snafus in the balance sheet section of our SNPS Q1 earnings review - now fixed.

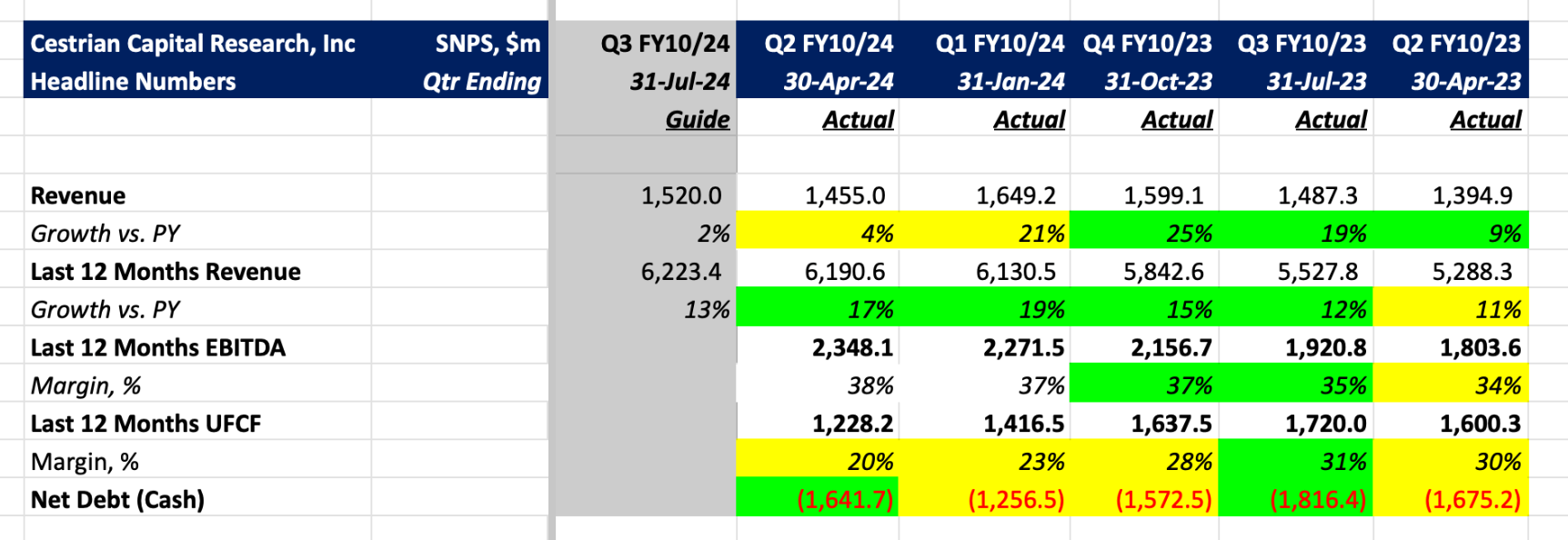

Headline Financials