Taiwan Semiconductor (TSM) Q4 FY12/23 Earnings Review

Image source: Taiwan Semiconductor Manufacturing Company Limited

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

We wish our readers a very happy and successful 2024. No paywall today, enjoy.

Gear up for Tech earnings season! Not a paying member? Subscribe for fundamental and technical analyses of 40+ stocks. Hit the button below now!

Enjoying our work? 🌟 Help us grow by sharing our newsletter with your social network. 🚀

Two risks for TSM stock

There are two risks to TSM stock in our view and they are:

- The annexation of Taiwan by China, and/or

- A major decline in sentiment for stocks generally

Otherwise the stock can keep moving up in our view. This is one of two, maybe three at-scale semiconductor fabrication companies worldwide (the others being Intel in the US and SMSC in China). If global GDP is reasonably healthy then annual spend on semiconductors rises and with that so too does the revenue opportunity for the manufacturing services players. With so little competition and such a big technical lead over the other two competitors - Intel is making headway with its small-node production as is SMSC but they remain laggards - we don’t see material competitive threat eating into TSM margins or growth. So it’s all about the macro questions for us.

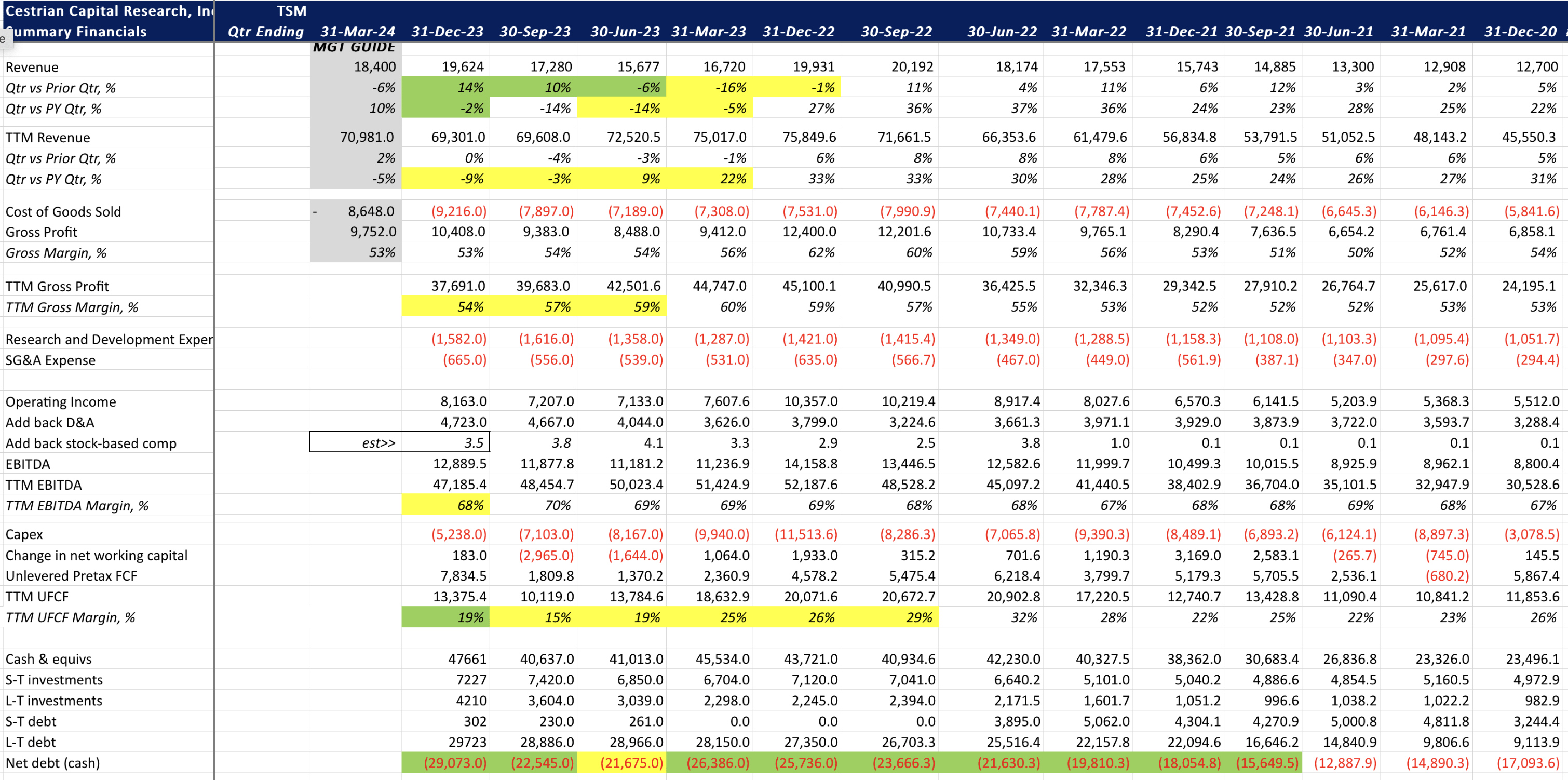

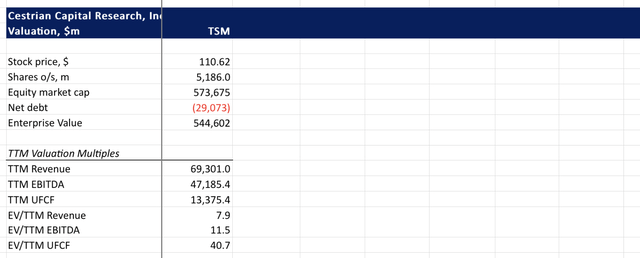

Numbers, valuation and chart below.

Fundamentals

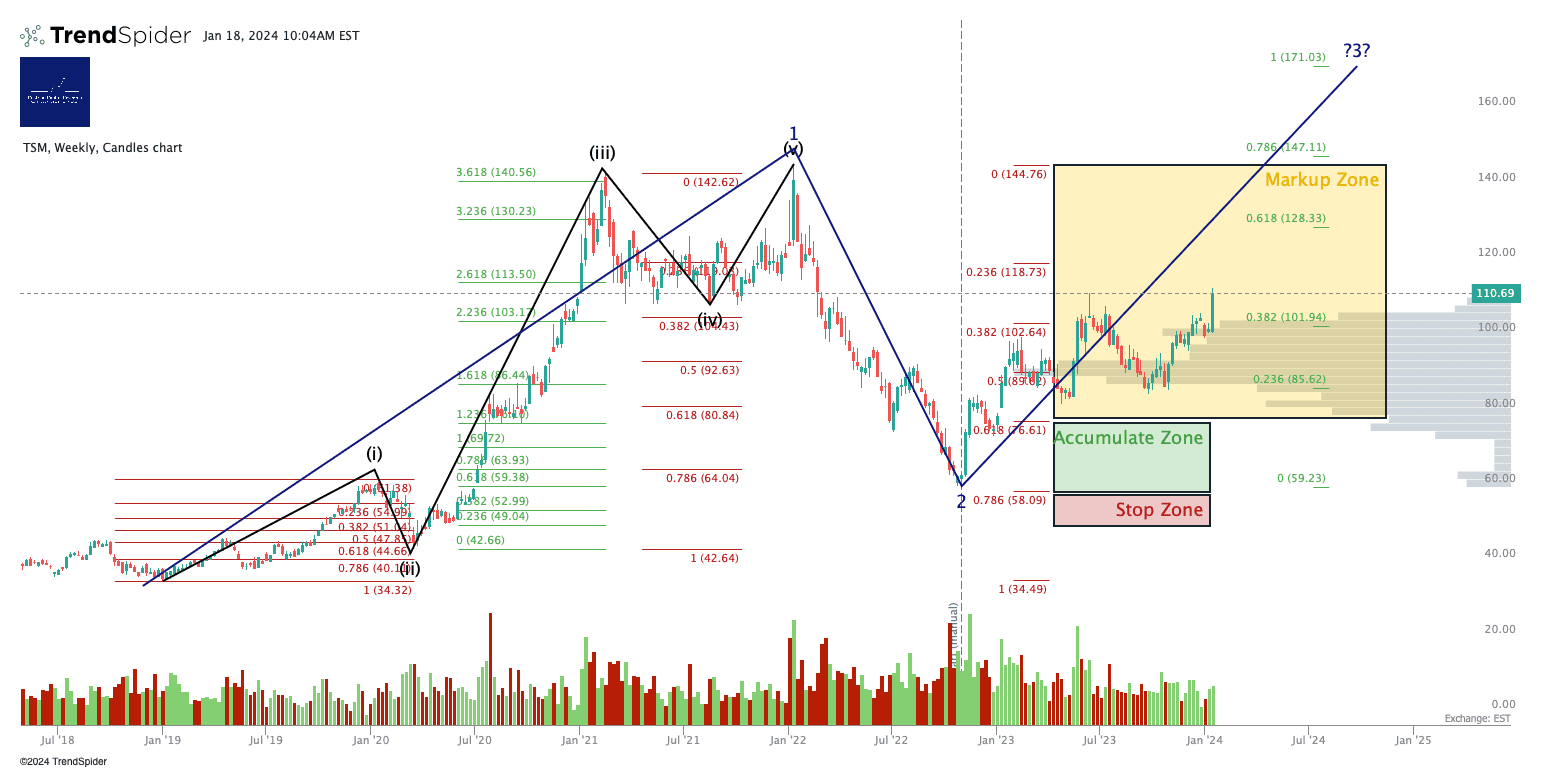

Technicals

We continue to rate at Hold as the stock moves through our Markup Zone. You can open a full page version, here.

Any questions, remarks, suggestion- post a comment below.

Enjoyed this article? 👍 Hit the like button — it'll make us smile! 😊

Cestrian Capital Research, Inc - 20 Jan 2024