Tesla's Desert Dilemma: Searching for a Strategy, Not Just a Cybertruck (no paywall)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Tumbleweed

by Alex King

Tesla is wandering around in the desert, and it’s not a Cybertruck it needs to haul it home, it’s a strategy. All-EVs in a world where Chinese competitors are eating away at margins and European / US competitors have an ICE business to fall back on if EV demand continues to wane - that’s a difficult place to be. The product range continues to age. The energy business - solar roof, Superchargers, Megapacks etc - has potential but it is small. Dojo - OK but let’s look in a couple years to see whether there is any actual revenue there.

In short the company had a wonderful hand and played it well, but has failed to lay out the next three moves ahead in the way that companies in high-innovation industries need to do to remain leaders. And if the company is simply a carmaker, well, that’s not a high innovation business so the valuation multiples will likely fall.

It is difficult in my opinion to be very negative on Tesla stock because the fastest way to get poor in the last ten years has been to short Tesla. Multiple forces, some real and some other-worldly, have acted in concert to burn bears good and proper. There are so many other ways to try to make money in this world - why look for a difficult way? So, short? No thanks. Long? No thanks. Do nothing.

Gear up for Tech earnings season! Not a paying member? Subscribe for fundamental and technical analyses of 40+ stocks. Hit the button below now!

Enjoying our work? 🌟 Help us grow by sharing our newsletter with your social network. 🚀

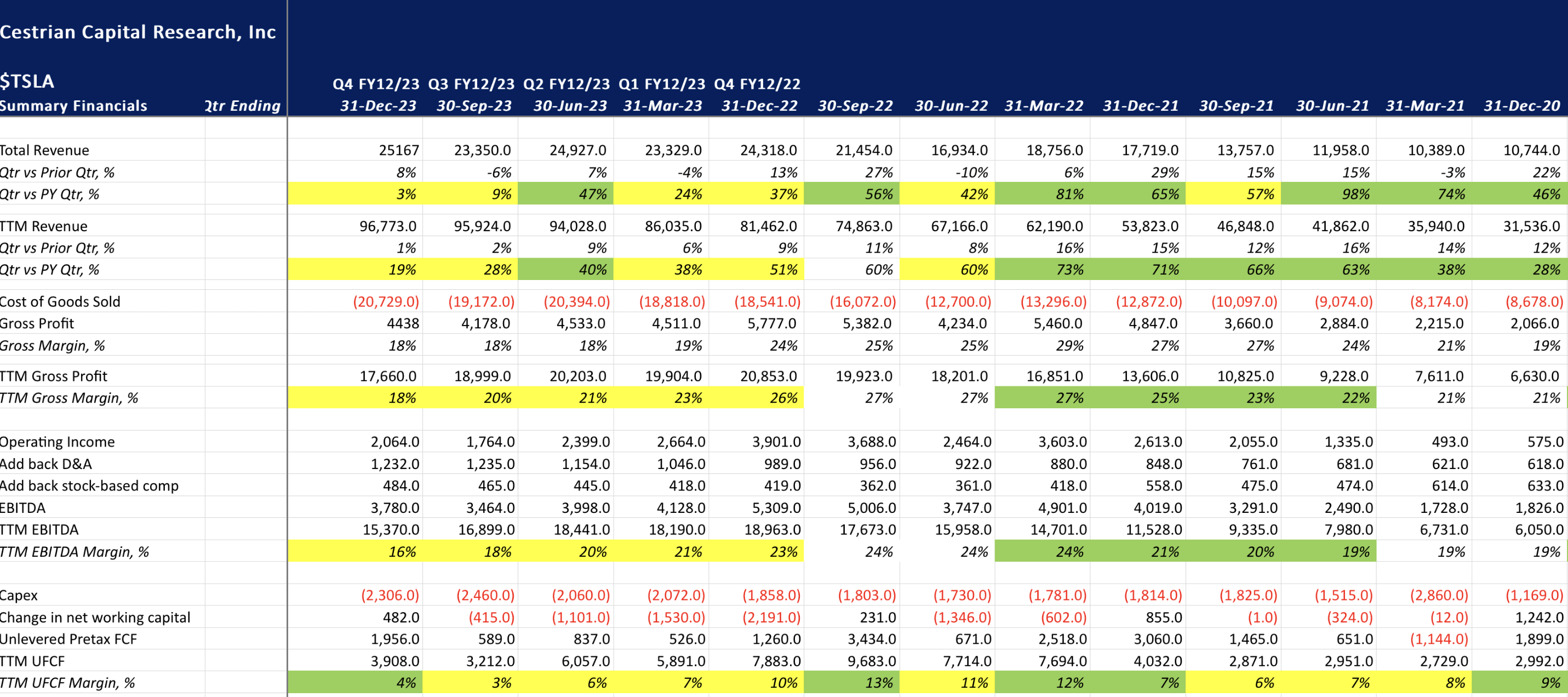

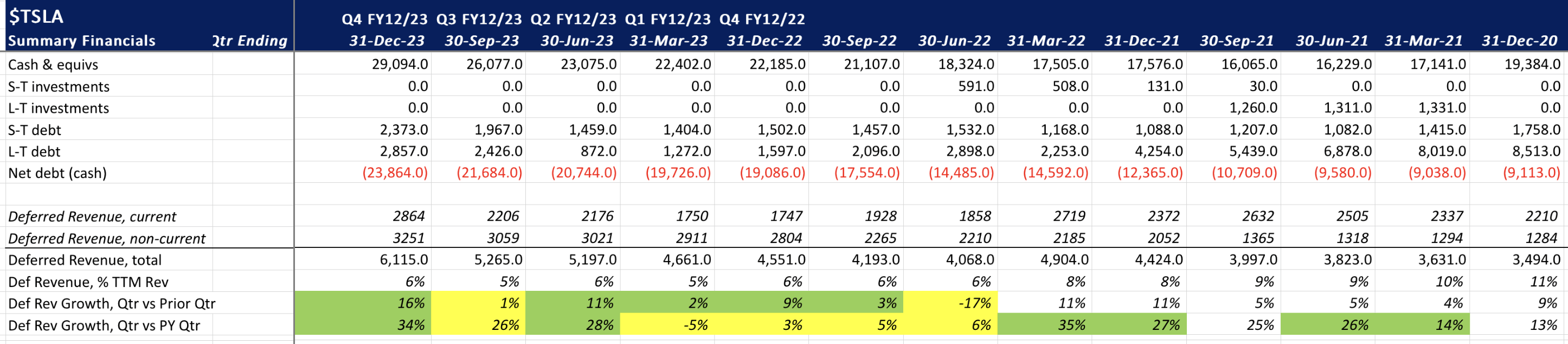

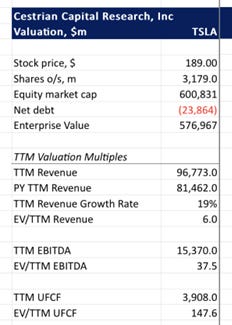

Financials

147.6x TTM cashflow; 3% YoY revenue growth this quarter. Er, no thankyou!

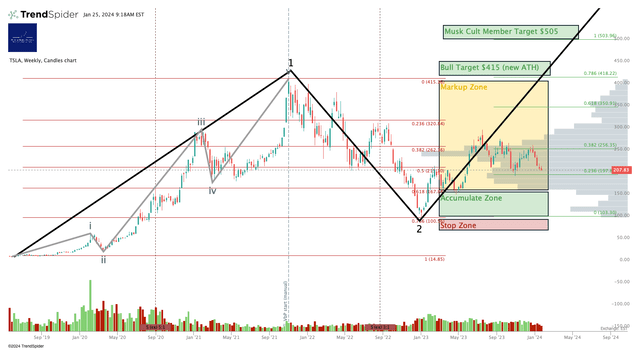

Technicals

You can open a full page version of this chart, here. Note the pattern is purely technical. If I thought it was heading for the Musk Cult Member Price Target any time soon, I would own it.

Rating: Do nothing

Enjoyed this article? Hit the ❤️ button — it'll make us smile! 😊

Cestrian Capital Research, Inc - 25 January 2024.