Rotation 101

We check in on those Inner Circle Stock Baskets.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

All On Track, In Theory!

One of the features we offer on the paid side of our Inner Circle service is a series of stock baskets that we pick from time to time, collate into groups, and then model and manage over time. We hesitate to call them model portfolios because none of them is supposed to offer a complete solution to anyone's investing or trading needs, but we do think they are viable baskets that can generate solid total-return gains over the medium term.

We've assembled the following so far, with the logic we explain in each case below. Each basket is five stocks, equal weighted, no rebalancing or re-investing of dividends as time goes by. We track their performance on a total-return basis ie. inclusive of dividends collected.

Inner Circle Core Stocks

Early in the life of this service, back in February this year, we picked as broad a spectrum of names as we could within just five slots. The idea was to include growth and value names, tilted towards growth since the market was still hating on growth names so it seemed a good time to be buying some. The 'Core Stocks' basket was established 7 February 2023 and includes L3Harris ($LHX), Microsoft ($MSFT), Nvidia ($NVDA), Taiwan Semiconductor ($TSM), Dynatrace ($DT).

Pretty happy with that. Within the group, LHX has lagged and NVDA has led.

Inner Circle High Beta Stocks

In case $NVDA wasn't scary enough for anyone, we put together a group of five high-growth companies whose stocks are high beta ie. over-react to the market changes compared to the S&P (and in this case, compared to the Nasdaq also). The five names are: Cloudflare ($NET), CrowdStrike ($CRWD), MongoDB ($MDB), The Trade Desk ($TTD), ZScaler ($ZS). The inception date of this basket was 17 March 2023.

No complaints there either. $MDB put in an early sprint, $TTD is up nicely too, but we think $ZS has the best prospects for now.

Inner Circle Financial Stocks

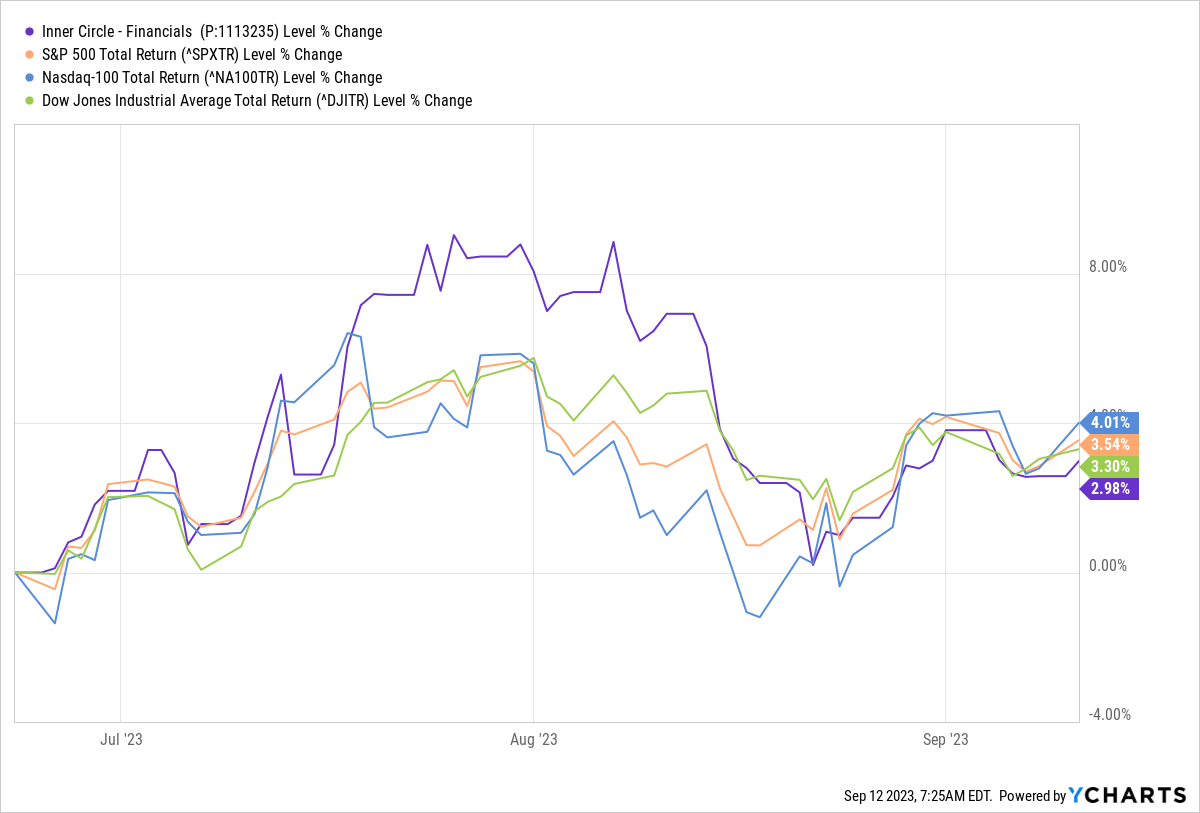

So, with a couple early wins under our belts, we thought the next move should be to look for a sector that in June 2023 felt like tech did in Q4 '22, which is to say, that no-one other than Big Money would be seen buying. Out of favor, declared ruined forever and so forth. And what better sector, in the light of a slew of US regional bank collapses, than US financials? We chose Bank of America ($BAC), Bank of New York Mellon ($BK), BlackRock ($BLK), Citi ($C), Chicago Mercantile Exchange ($CME). Inception date, 23 June 2023.

Up, but lagging all three equity indices for now. We cover each of those stocks individually within Inner Cirle and we remain bullish on each name. So let's see how this basket plays out in the coming months.

Inner Circle Dowtards

In July we went looking for names in Grandpa Dow that were even slower to move up than had been Grandpa himself. The 'Dowtard' stocks. The notion again here was find some solid companies with sullied stocks that nobody wanted to own, at least in public. (Again, what we are really looking for every time is names that Big Money seems to be accumulating on the quiet whilst Small Money is focused on the shiny things on CNBC and Twitter). We chose Disney ($DIS), Home Depot ($HD), Intel ($INTC), Nike ($NKE), Dow ($DOW).

Again, up, but lagging the indices. The star performer here has been Intel, with Disney continuing to mope along like Eeyore.

So What Next?

Next we're working on the next basket of rotation opportunities ie. things to buy when everyone has declared them unbuyable, but when volumes are spiking, suggesting that Big Money thinks otherwise. And we have to think about holding vs. trimming on those two first baskets which are doing so well.

Want to get in on the ground floor for the next basket, or if we decide to re-up our opinion on the Financials and/or Dowtards? Then join the Cestrian Inner Circle service today. Free members get occasional content like this note; paying members get the actionable stuff, including extensive notes, earnings analyses, daily market analysis, trade disclosure alerts whenever Cestrian staff personal accounts place trades in covered stocks or ETFs, 24/7 member chat, and a live weekly ask-us-anything webinar and subsequent video.

Unsure? Check our testimonials, here.

Then come join us!

Cestrian Capital Research, Inc - 12 September 2023.

DISCLOSURE: Cestrian Capital Research, Inc staff personal accounts may hold long, short or no positions in any stocks or ETFs mentioned. For a full statement of Cestrian staff personal account positions (long / short / none) in stocks and ETFs covered in this service, check our Stocks Coverage page, here.