The Gains Train Is Now Leaving The Station

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Real Money Snowball Now A-Rolling

As 2023’s mighty bull market draws to a close we were delighted last month to launch what will become a family of third-party services running on our Cestrian Stocks Symposium platform.

Now that is a highfalutin and some may rightly say pretentious name for what in all truth is just a Slack Workspace, but our idea with Cestrian Stock Symposium is that it plays host to a collection of exceptionally high quality, serious stocks, options and futures services that leave FinTwit in the dust.

Right now we have two services live and starting to click in the wins.

We’ll tell you about Trading With Van, which covers Nasdaq and S&P500 futures, another time.

Today let’s take a look at Trading Gains, run by the eponymous Gains, a financial analyst by training and real-time trader by choice.

The channel offers ETF trade setups in:

- US equity indices (Nasdaq, S&P500 primarily, using TQQQ, SQQQ, SPXL, SPXS and others)

- Oil (OILU, OILD)

- Volatility (UVXY, SVXY)

- US Treasury Bonds (TMF, TMV)

- Gold (GOLD, SHNY, DULL)

In addition, for longer term setups, options opportunities & strategies are presented and openly discussed with consideration to market conditions for indices or even some individual stocks where they look compelling.

This is not a Discord / FinTwit YOLO swing for the fences approach.

Risk management is built into each and every trade idea; be that the use of stops or hedges or both.

There is also extensive trader education in the service through the day, covering general topics and also explaining actual and potential future trade setups.

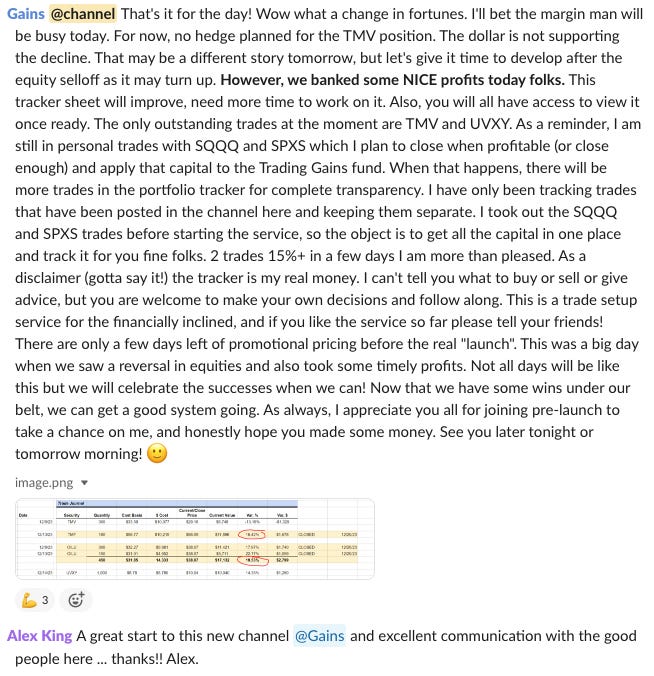

Here’s an extract from today’s work in the Trading Gains channel.

There are only a few days left to sign up with launch pricing.

Until 31 December you can join Trading Gains for just $498/yr - and you’ll keep that price for as long as you remain a subscriber.

From 1 January the price rises to $798/yr for anyone joining after that date. As will all our family of services, the price you sign up for on day one is the price you keep for as long as you stay subscribed.

We’re delighted with the new Trading Gains channel and hope you decide to join. You can learn more by just clicking here.

Cestrian Capital Research, Inc - 20 December 2023.