The October Effect

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

It’s Just The Leaves That Are Falling

by Renee Sylvestre-Williams, who can be found at the superb personal finance Substack, The Budgette.

We are halfway through October. The giant skeletons are up, you’re thinking about Thanksgiving or as we call it up here in Canada, American Thanksgiving.

The reason I bring up October is to talk about a myth that’s attached to October, just like pumpkin spice lattes (ew.) It’s known as the October effect and no, it does not exist.

The idea that October is a bad month for the markets came from a few historical events. Those events were given more significance than they needed and codified into the October effect.

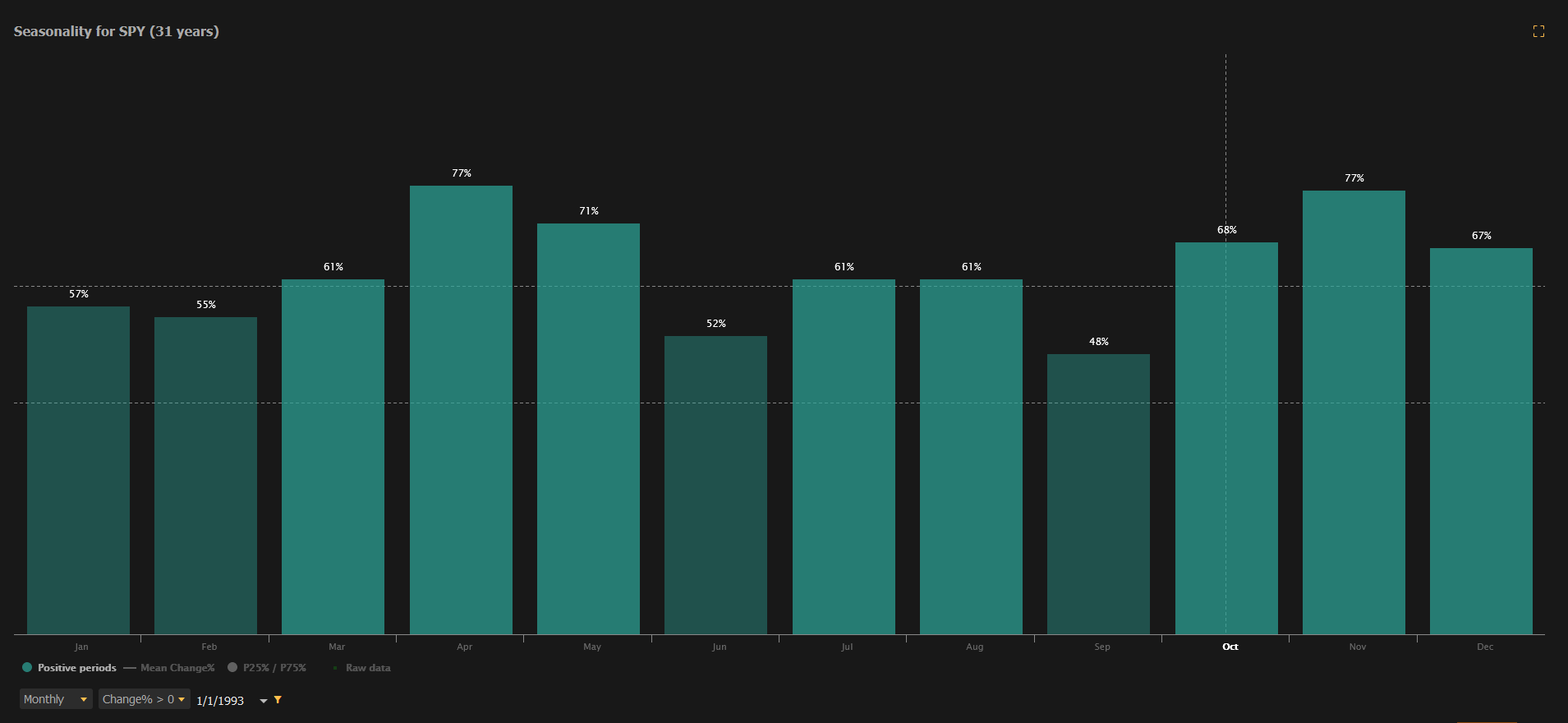

(When I mentioned this to Alex at Cestrian, he went, “What?” And provided me with a chart that pointed out that it was a lie.)

[Editor’s Note - This Chart!]

But why does this myth still linger?

Historical events: Some of the most significant stock market crashes in history have occurred in October. The most famous example is the 1929 market crash, which led to the Great Depression. The 1987 stock market crash, often referred to as "Black Monday," also took place in October. These historical events have contributed to the perception of October as a risky month for the market.

Investor psychology: The memory of past crashes in October may make investors more nervous and trigger selling, which can cause market declines. It's possible that psychological factors, including fear and caution, play a role in market behavior during this month. In other words, try not to let your emotions guide your investment decisions.

Like bond yields. They’ve been in the news lately, yes in October, and it made investors focus on them a bit more than usual. Should you lock in the high-yield bonds?

Corporate earnings: The end of the third quarter and the beginning of the fourth quarter often coincide with corporate earnings reports. Negative earnings surprises can lead to market declines as investors react to disappointing financial results. It’s really just timing.

Seasonal factors: Some analysts have noted that October tends to be a more volatile month in terms of market fluctuations. This increased volatility may lead to larger price swings and potentially contribute to a decline in the market.

It's important to note that while October has seen significant market events, it is not consistently a month of market declines. Other months have had worse declines. Remember February 2020? Yikes.

Keep in mind that market performance is influenced by a wide range of factors, including economic conditions, corporate performance, geopolitical events, and investor sentiment.

And boy, are we having some geopolitical events right now.

Therefore, the market's behavior in October, like any other month, is subject to a complex interplay of these factors, and there is no guarantee that it will always drop during this month.

Don’t rush to make a change to your portfolios. Take the time to research your investment decisions, which is why you’re subscribed to this newsletter. Remember, past behavior is not an indication of future results.

Also, superstition is a terrible way to invest. If you’re going to do that, you might as well buy a giant skeleton. You’ll have a guarantee that it’ll be fun and look cool on your front lawn.

Renee Sylvestre-Williams, The Budgette - 16 October 2023.

You can read Renee’s work, and sign up to receive new content instantly, right here

Thank you for reading Cestrian Market Insight. This post is public so feel free to share it.