The Software Stock That 2023 Forgot

Autodesk remains in the Accumulation Zone.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Still In The Doldrums Because Recession

Whilst much of the enterprise software sector has headed skywards in 2023, a number of high quality companies in this category have been left behind. First among these laggards is Autodesk ($ADSK). We believe sentiment remains low on $ADSK because its appeal is tied to the development spend of commercial property owners, capex-commissioning CFOs, and the like. In a world where the general populace is concerned about the effect of a recession? Nobody wants to own the leading design software company.

We beg to differ. Actually a lot of folks beg to differ, but they aren't saying. They're just accumulating the stock quietly. We rate Autodesk $ADSK at 'Accumulate' with a medium-term price target of $296 (that's +38% from today's close) and a longer-term target of a new all time high (being over $345, or +61% from here).

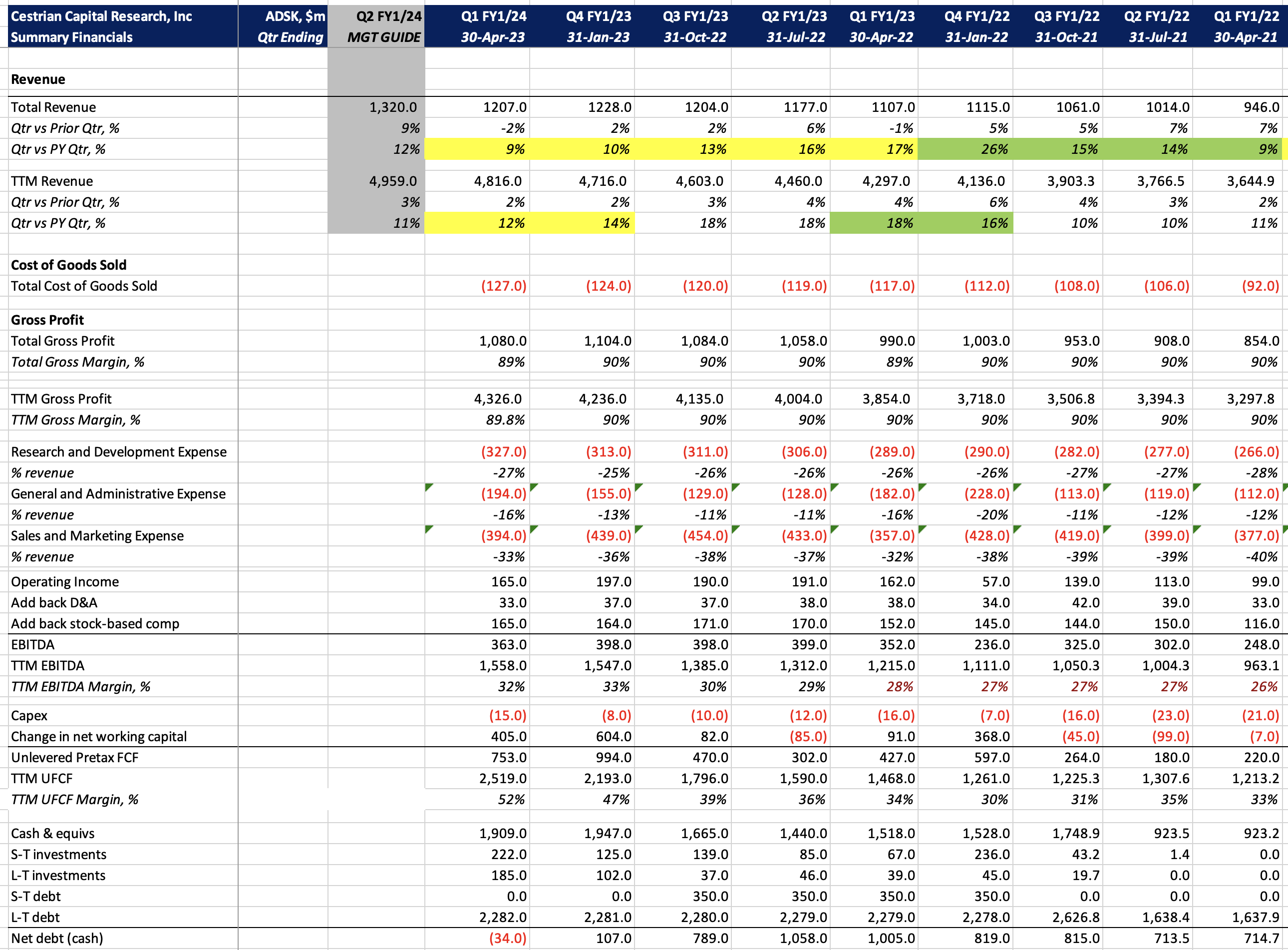

Let's first take a look at the fundamentals.

- Revenue is growing at +12% per annum on a TTM revenue base of almost $5bn. The company has seen a sequential slowing of growth from the +26% vs. PY achieved in Q4 of FY1/22, bottoming at +9% vs PY in the most recently reported quarter, Q1 of FY1/24. The management guide is for +12% next quarter - that's a big increase in growth and suggests that even if that guide is missed by a country mile, then the growth rate is headed back up.

- Gross margins in the high 80s / low 90s% is best-in-class in enterprise software.

- TTM EBITDA margins in the low 30s% range is good, but belies the true cashflow margins of the company - +52% TTM UFCF margin this quarter just reported - exceeding EBITDA due to the low capex and the heavy-on-the-upfront-payment revenue model delivering positive change in working capital most quarters.

- The balance sheet is capable of sustaining significant leverage but is instead sat with a just net-positive quantum of free cash. Purists may worry about this being insufficient; but the company could raise >$5bn of debt tomorrow if it needed (that would be sub 2x TTM UFCF) so this balance sheet can be considered safe.

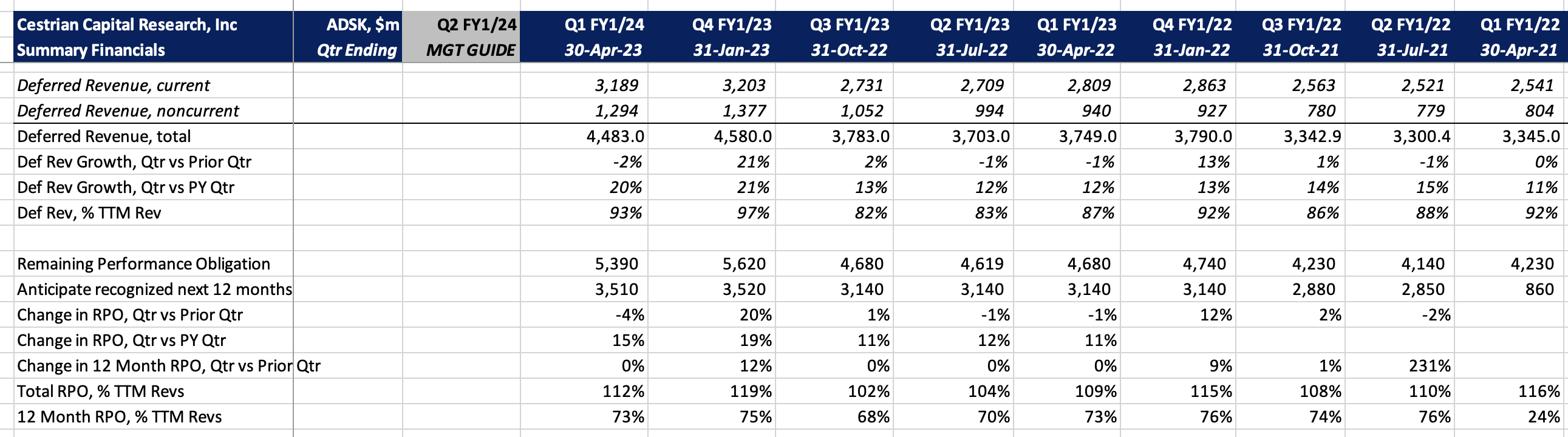

Let's now look at the forward visibility of revenues.

Remaining Performance Obligation - that's the total forward order book - sits at 1.1x TTM revenue, and it's growing at 15% pa, faster than is recognized revenue. So whilst we cannot make a direct, linear read-across, we can say that RPO growth is faster then TTM revenue growth = meaning that it's unlikely ADSK misses a revenue number in any meaningful way in the next 1-2 quarters.

Deferred revenue - that's the subset of RPO which has already been invoiced - sits at 93% of TTM revenue and right now is growing at +20% per annum - quite a pace for a company with a deferred revenue balance of $4.5bn already. Again, whilst one cannot make a direct read across to recognized revenue growth, we can say that the buildup of invoiced sales is rapid and has every chance of delivering an acceleration in the rate of recognized revenue growth. And acceleration in recognized revenue growth on an earnings print has every chance of delivering an upward re-rating to the stock. So whilst it's neither exciting nor headlineworthy to go poking around the 10-Q to find the RPO numbers, or mooching through the balance sheet measuring deferred revenue, it can often pay benefits for the patient investor.

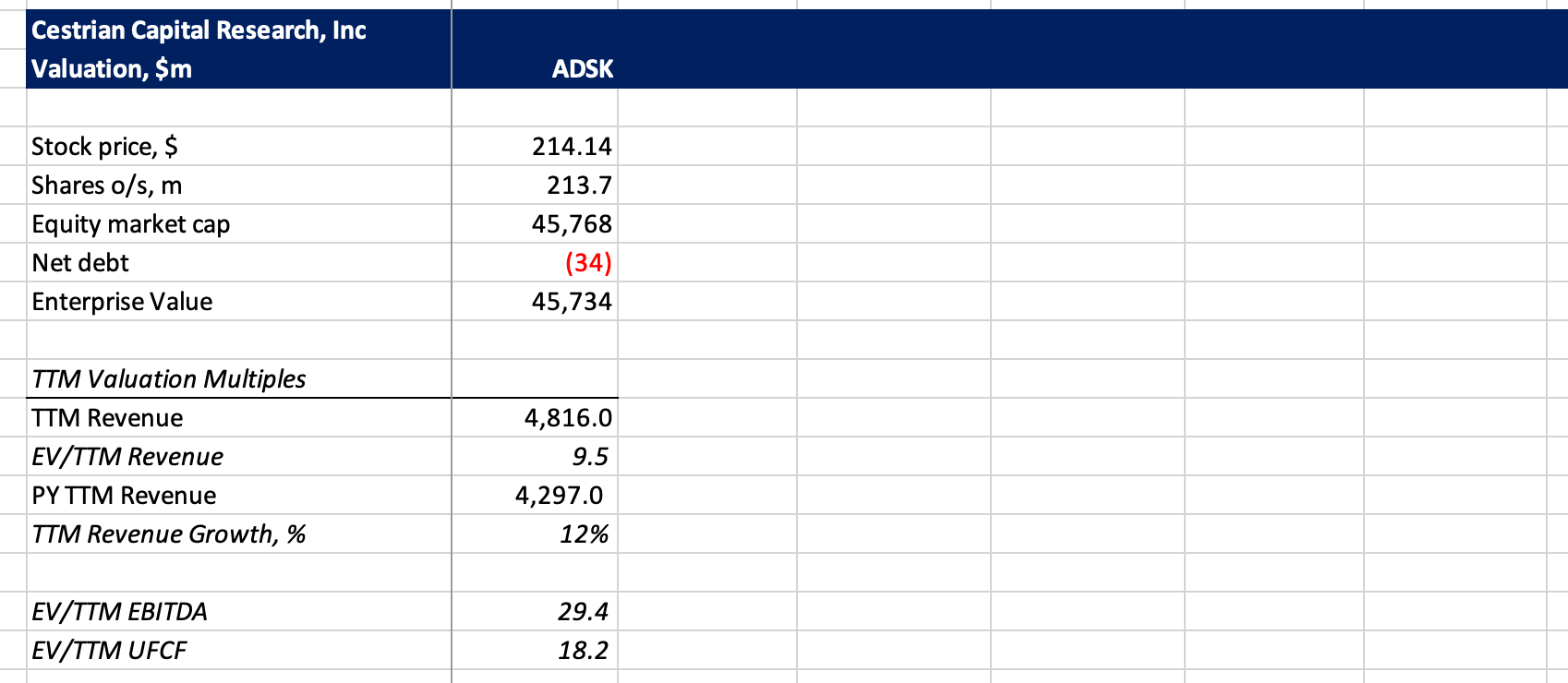

Valuation?

As of today's close, the market is asking you to pay 18.2x TTM unlevered pretax free cashflow for this thing. You'll pay more than that for an ex-growth defense contractor. This is not expensive for a company with this degree of revenue visibility, growth, and cashflow margins.

Finally let's turn to the stock chart, where we can see evidence that plenty of large-account players have gotten the memo on $ADSK and are in the process of accumulating the name - we believe in advance of tipping the wink to the market in the normal way to commence the move up into the Markup Zone, where late buyers gather to bid up the stock of the smart money buying here at the lows.

You can open a full page version of this chart by clicking this link.

The high volume nodes at the lows, measured with the clock starting at the all-time highs, tell the story. Those are the breadcrumbs, the eddies in the probability field, the disturbances left by Big Money's accumulation programs, which we look for in such opportunities. This is what mainline enterprise software stocks looked like in H2 2022 (except without the underlying acceleration in growth - that is particularly appealing here at $ADSK).

We rate the stock at Accumulate, and will be opening new positions in staff personal accounts at the open on Monday 17 July.

Cestrian Capital Research, Inc - 14 July 2023.