Trupanion $TRUP Q3 FY12/23 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Nothing New Under The Sun

by Alex King

You can read our prior work on Trupanion at the link below. Just click on the handsome chap in the picture, who will take you right to the meat on the bone:

A Cold Look At Trupanion

Cestrian Capital Research, Inc • Oct 5, 2023

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied …

Read full story →

If you’re new to this company, it’s a pet insurance business which has some problems. Our job is not to opine on the morality thereof or indeed comment on the myriad oddities at the company, although we should mention the rate of executive departure, not least the CFO earlier this year then the head of IR right before the earnings print. Oh and also the General Counsel a while back. Not a great look.

No, our job is to look at the numbers and the stock chart, as we do all the other stocks we cover, and and take a view. For disclosure, we are short in staff personal accounts.

OK, let’s do the numbers first. Here we simply report what the company printed in its Q3 earnings release. We make no attempt to validate or disprove what they say, though if you go looking you will find a group of folks who take a more cynical view. Twitter is the place to look. You can find very detailed analysis from PAA Research, and shoot-from-the-hip opinion from storied short seller Marc Cohodes. Recommended reading on both counts.

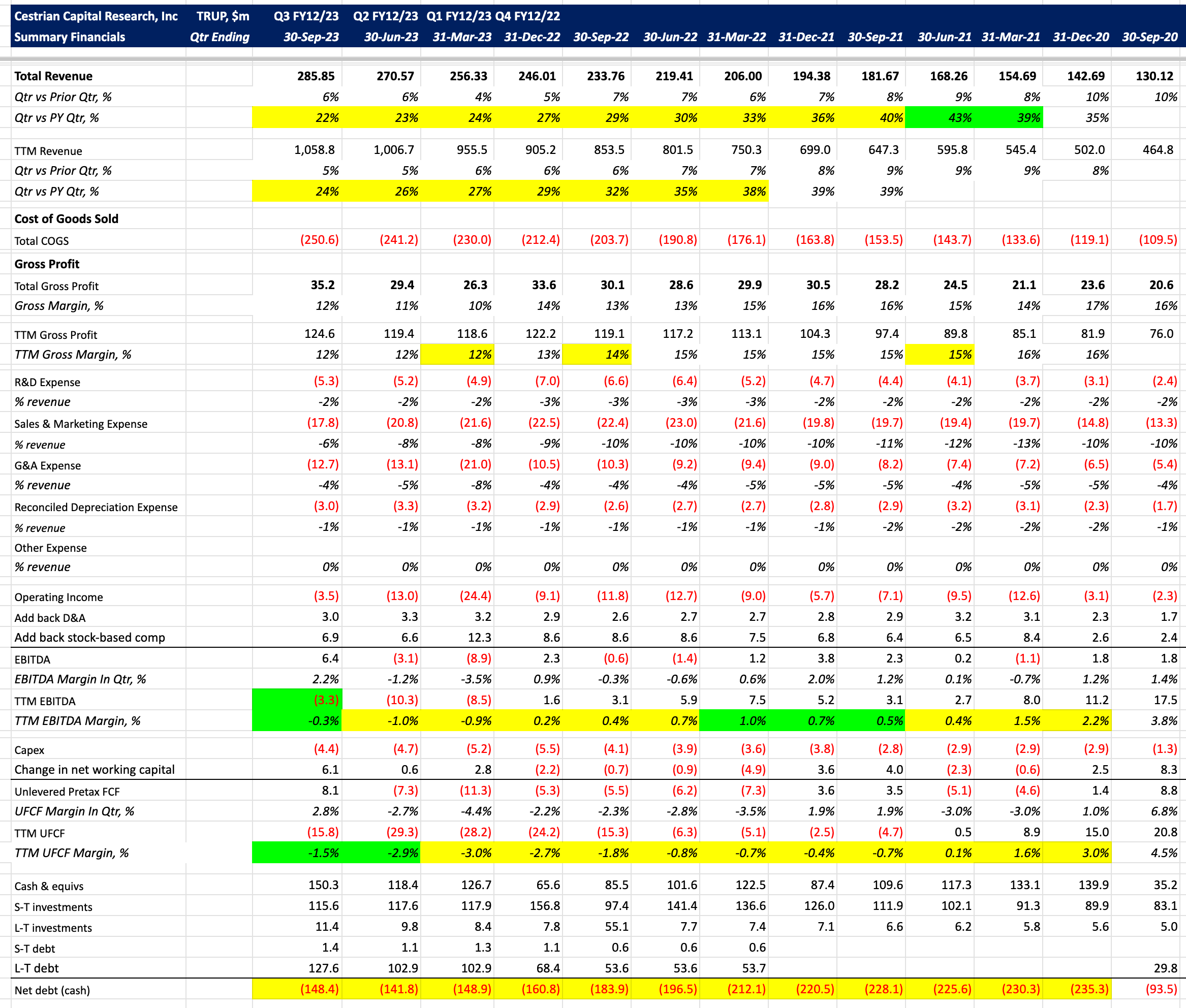

Trupanion Q3 FY12/23

Here’s a few highlights and lowlights.

- Revenue growth continued to slow, to +22% YoY in the quarter, +24% YoY on a TTM basis. Revenue growth has slowed every single quarter since the June 2021 period.

- Gross margins ticked up a point on the quarter but remain at just +12% on a TTM basis - that’s up from the lows (+10% in the March 2023 quarter) but a business with 12% gross margin is not a good business model, whatever anyone tells you. It means that 78% of the revenue recognized is being paid away to third parties or as internal cost of sales. Trupanion has the lowest gross margin of any stock we cover. By comparison, DataDog (which reported today before the open) has one of the highest, at 80%. High gross margins mean a lot of value created internally and not much externally. Low gross margins mean the opposite. (You can read our DataDog earnings review here, by the way).

- Thanks to a fall in sales & marketing spend - which the company describes as “new pet acquisition expense” - and a hard cut to G&A costs - the company delivered improved operating income, negative $3.5m on the quarter. Adding back depreciation & amortization, and stock-based compensation, gets you to EBITDA of $6.4m. That’s the biggest quarterly EBITDA for a very long time. Note, EBITDA is about the most management-friendly measure of profit, particularly when you add back stock based compensation to get there. We use this method across all our work and it’s fine, but you have to know what you are measuring. It’s the brightest, shiniest form of accounting profit there is. In our work we treat EBITDA as interesting, but what we really look to is cashflow.

- Now, Trupanion made great play of its cashflow performance this quarter. And using our own calculation methods we can say the company delivered unlevered pretax free cashflow of $8.1m in the quarter. That came about through (1) $3m of cost savings vs. the prior quarter - that’s a remarkable cost cut to achieve in one quarter by the way - and (2) $6.1m swing in net working capital. (Net working capital is, simply put, the difference between how quickly you pay suppliers and how quickly you collect cash from customers. Pay fast and collect slow, negative change in working capital. Collect fast and pay slow, positive change in working capital. Simple. Don’t let folks tell you it’s difficult. It’s not.). If you were to go digging in the balance sheet - and again we’re just looking at their own numbers here, nothing forensic - you will see that in the last twelve months, when revenue grew at +24%, there was a 71% increase in “reserves for veterinary invoices” which sounds a lot like working capital management - paying people more slowly - to us. And if you were to look on Twitter once more you would find a lot of folks saying unkind things about Trupanion, related to the pace at which they settle claims, authorize treatment and so forth. Finally we should note that on a TTM basis, cashflow remains negative to the tune of -$15.8m.

- The balance sheet is thin and thinner. Now $148m net cash, down from $183m this time last year.

Thank you for reading Cestrian Market Insight. This post is public so feel free to share it.

TRUP - Fundamentals Summary

Source - Company SEC Filings, YCharts.com, Cestrian Analysis

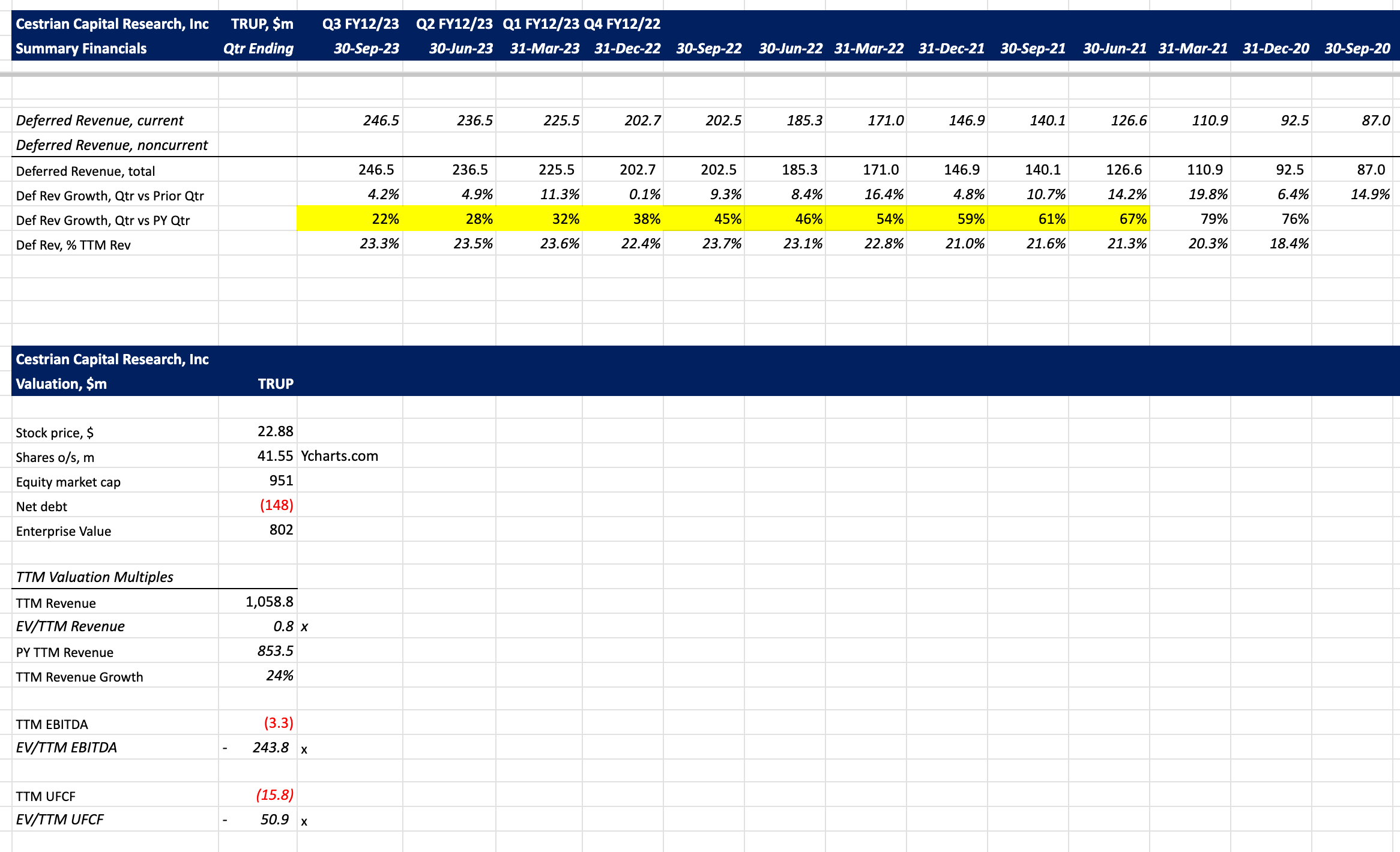

Deferred revenue - that’s invoiced amounts that have yet to be recognized as revenue, a good thing, you want a lot of that because it gives you revenue visibility (when invoiced but not yet paid) and upfront cashflow (when invoiced and paid) - is seeing a sustained slowdown in growth, from +61% YoY two years ago to +22% just now. That tells you that the growth in underlying sales and invoicing activity at the company is slowing, quite quickly in fact, since growth was +28% YoY last quarter, +32% YoY the quarter before that and so on.

Finally valuation. 0.8x TTM revenue looks cheap, but isn’t, because remember this thing pays away almost 80% of its recognized revenue to third parties and internal variable cost centers. And you can’t measure valuation as a function of EBITDA or cashflow, because there isn’t any. How about 6.4x TTM gross profit? That’s about the most sensible metric we can find. Gross profit is up 16% in a year. So, 6.4x TTM gross profit for 16% gross profit growth. Still not cheap.

OK, lastly, before you go read the good stuff on Twitter and cast this boring numbers-y stuff to one side (except don’t. Numbers are the best source of opinion on a company and its stock), let’s take a look at the stock chart.

Trupanion Stock Chart

You can’t use technical analysis on this stock chart, because (1) there’s no liquidity and (2) there’s only one story to tell which is, the stock has to hold $20. Above $20, it has some hope. Below $20, there’s no support to speak of and the fundamentals won’t save it.

You can open a full page version of this chart, here.

We’re short in staff personal accounts.

Any questions, comments, opinions, anything, post ‘em in comments below, on Substack Notes, on Twitter, wherever. We read them all and endeavor to get back to you as quickly as we can.

Cestrian Capital Research, Inc - 7 November 2023.

Want Our Best Work? Sign Up For Cestrian Inner Circle, Here.

Thank you for reading Cestrian Market Insight. This post is public so feel free to share it.