Zscaler Q2 FY7/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Gaining Traction, Hard Going (still)

By Hermit Warrior a.k.a. Richard Iacuelli

That, in a nutshell, describes Zscalers' ($ZS) Q2 print. Although management did a reasonable job in talking up the numbers, pointing to results that exceeded "guidance on growth and profitability" I think the reality was a little more nuanced.

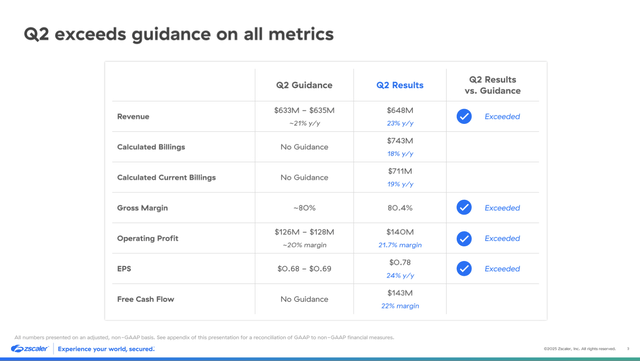

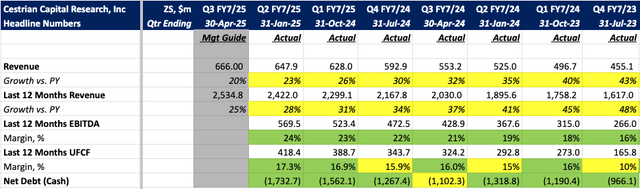

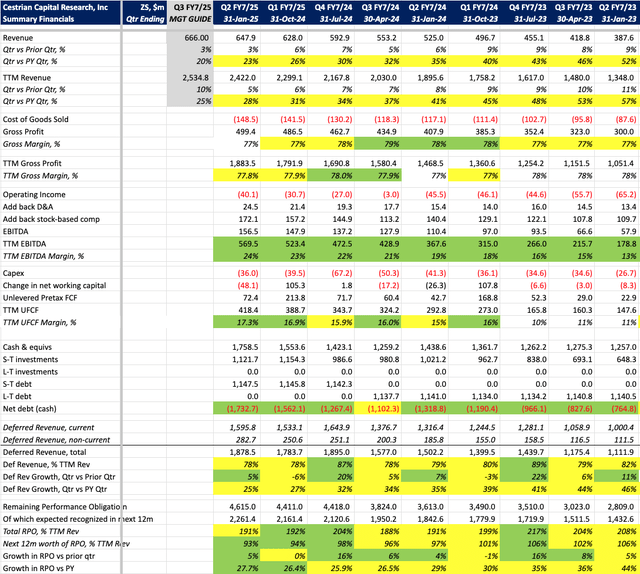

Q2 revenue growth did come in above guidance (at 23% versus the 21% guide) but continued a slow downward slope from 26% in Q1, and 30% in the quarter before that, marking the 11th consecutive quarter of revenue growth deceleration, with Q3 guidance at 20% continuing the downward trend.

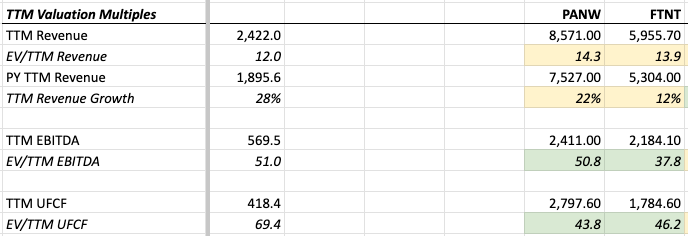

EBITDA and unlevered cashflow (UFCF) margins continued their gradual improvement, however still struggle to compare favourably to those of Fortinet ($FTNT) and Palo Alto Networks ($PANW), their more hardware-dependent competitors (PANW achieved 28% EBITDA margins in their latest quarter, while FTNT did even better at 37%).

Let's take a look at the headlines.

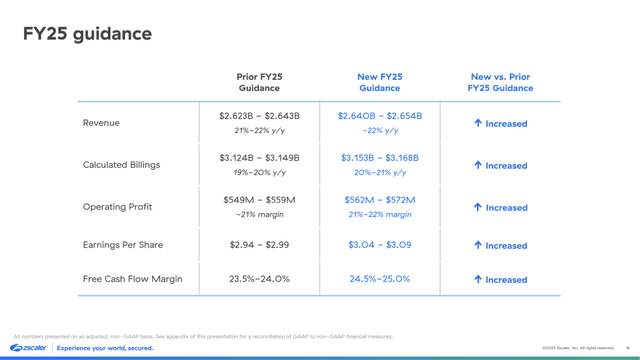

Other than revenue growth, everything is pointing in the right direction, with management guiding to further improvement in margins for the full year, and going so far as to raise their original full year guidance across all their key metrics.

One of the criticisms we've levelled at Zscaler in the past is that they haven't traditionally been very skilful at managing capital markets, however - and it's just a gut feel at this point - I think they're getting better at this. The post earnings reaction, with a modest 6% uptick in the stock, was positive considering these were not blow-out results (and more so given recent market nerves) and banging on the 'beat and raise' drum no doubt helped. I would not be at all surprised for them to also beat that 20% Q3 revenue growth guide.

If the financials were the hard going part of the story, the traction comes from the improving go to market results. This from the CEO's prepared remarks:

Our go-to-market investments are resulting in increased sales productivity, double-digit New and Upsell business growth, and lower sales attrition. I expect sales productivity to continue growth in the second half, driven by ongoing success of our go-to-market initiatives and growing number of ramped sales reps.

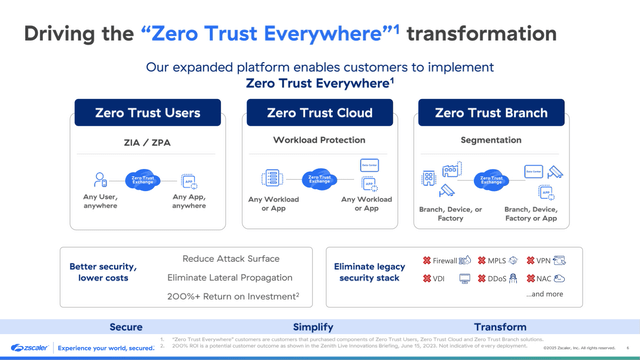

Tangible results from an improving 'account centric' approach (see our Q1 earnings review for more on this) can be measured by the 25% year on year growth in $1M+ Annual Recurring Revenue (ARR) customers, and the newly announced focus on 'Zero Trust Everywhere' - effectively a cross-sell/upsell campaign similar to Palo Alto's 'Platformization' strategy, which is hard to execute without strong, stable relationships between vendor and client.

Of note, the Zero Trust Everywhere directly targets the upcoming hardware refresh cycle expected by the likes of Fortinet. This from the earnings presentation: "Customers can leapfrog into Zero Trust by skipping the appliance refresh cycle, freeing themselves from firewalls and other legacy appliances forever."

Overall, a maturing enterprise sales culture appears to be taking hold, combining direct sales with a close working relationship with large Global System Integrators (GSIs) - basically large channel partners - which together are driving larger deals, more upsell and cross-sell opportunities and improved sales productivity.

Also of interest, and in contrast to some of their peers, AI makes a surprisingly muted appearance. It is briefly mentioned as a tailwind for demand, and as a driver for product development, especially around data loss protection against AI apps such as ChatGPT, DeepSeek and others. That said, Zscaler recently hired an EVP of AI Innovations so the AI strategy may become more visible in due course.

Let's move onto Fundamentals and valuation.

Financial Fundamentals

Overall, fundamentals look healthy. Remaining Performance Obligations (RPO) ticked up, potentially an early indicator that ZS can in time start to slow and eventually reverse the deceleration in revenue growth.

Valuation Multiples

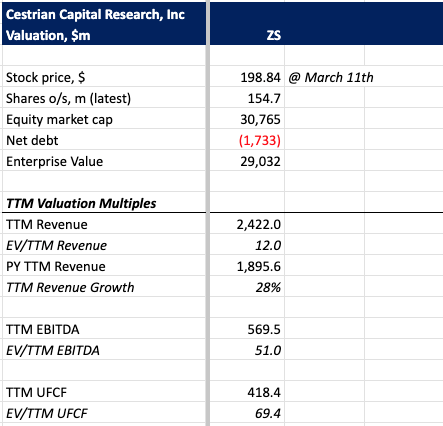

ZS has been relatively unaffected by the recent market turmoil, down a relatively mild 8.5% from it's February highs (compared to a fall of nearly 29% for CRWD and around 15% for FTNT). That said, it hasn't really gone anywhere since Q1 earnings either, which points to some work still to do in convincing the market that growth will eventually accelerate, and that margins will continue to creep up.

Comparing ZS' valuation against a couple of their peers highlights the work still to be done in improving EBITDA and UFCF margins in order to help the market see better value in the stock.

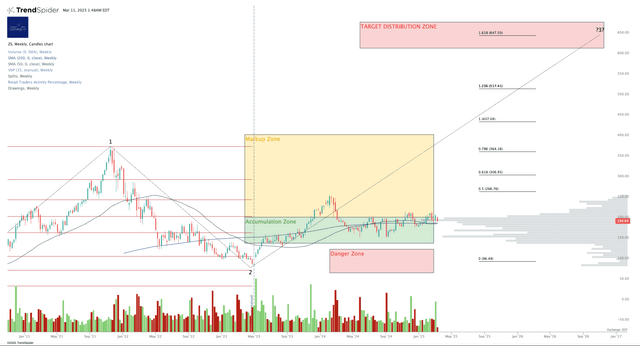

Technical Analysis

I referred to ZS in the last earnings review as 'full of promise' and, looking at the medium term chart, that is still the case. Virtually all the volume since May '23 is concentrated within the Accumulation zone, and arguably towards the upper end. For now it remains rangebound although seemingly making higher lows in the last couple of quarters. You can reach a full page version of the chart here.

Rating

We extended the Accumulation zone to between $140 and $200 back in November of last year to better align with those significant volume nodes. Since then, the stock has zig-zagged between the Accumulate and Mark-up zones.

In a less nervy market, ZS might have held on to the post-earnings gains and perhaps finally started to more decisively break out into the Mark-up zone.

For now we rate ZS at Accumulate.

Consider a stop at the recent support level of $180-$184 should the stock get swept up in the current market swoon after all, at which point - and speaking for myself - it might also be worth jumping ship to one of the more reactive cybersecurity peers, CRWD or FTNT for example - once the market gets its mojo back of course in order to get stronger upside from a market bounce.

Disclosure: Hermit Warrior holds a long position in ZS.

Cestrian Capital Research, Inc - 11 March 2025.