ARM Holdings Q4 FY3/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Show Us The Money

by Alex King, CEO, Cestrian Capital Research, Inc

There’s a lot to like about ARM Holdings and its stock but one thing that I do not like is its cashflow performance. Generally speaking what good looks in business is that most or all of your GAAP earnings translates into actual cash inflow. To the extent it does not, it means that (i) you are not collecting cash from customers fast enough and/or (ii) you are paying suppliers too quickly and/or (iii) your GAAP earnings number isn’t a real number but instead one you wished you had but don’t in fact have.

Let’s discount possibility (iii) with ARM for now. Any company at any time may be inventing its earnings, but generally speaking with big liquid well-covered stocks it is relatively rare, so we should treat it that way here.

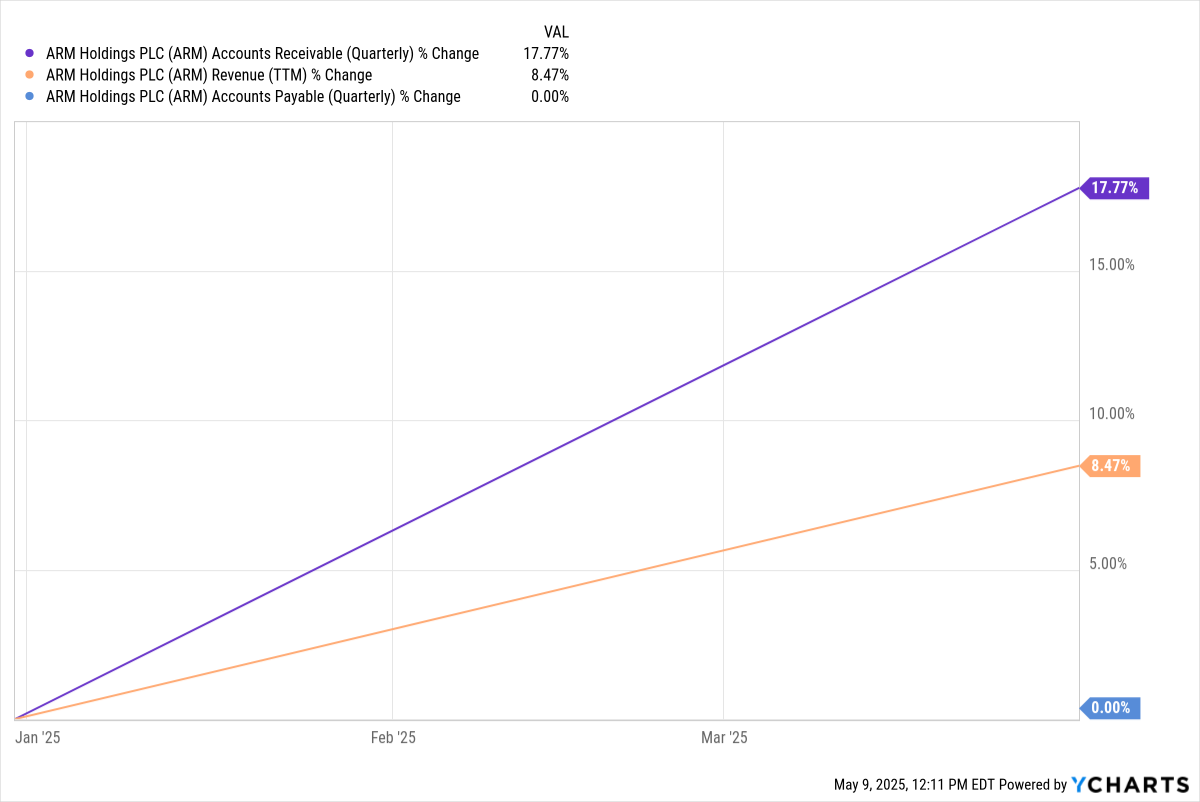

This should lead our attention to change in working capital. And when you go looking you will find that ARM simply does not get paid fast enough. Here’s the change in receivables vs. the change in TTM revenue vs. the change in payables, YTD. The company is paying its suppliers quickly; it is growing revenue; but its receivables are growing much more quickly than revenue.

That's not a good look. It cannot continue forever because at that point it will rather suggest that the revenue recognition would be aggressive. (We aren’t there yet).

There is actually some commentary on working capital in the ARM Shareholder Letter this quarter, as follows:

"Full-year results were negatively impacted by unfavorable working capital movements in receivables and the timing of payroll tax liabilities related to the IPO share vesting event, which created a $573 million benefit in Q4 FYE24 that was subsequently reversed in Q1 FYE25.” - ARM Q1 Earnings Release.

Working capital analysis may seem like the most boring thing in the world, which it probably is. But tracking why profits and cashflows don’t match is an excellent first step in actual due diligence when you think something may be amiss at a company.

ARM, in my view, has to see a significant swing in change in working capital back towards the positive, ie. it needs to start seeing some quarters where cash is generated from working capital, not sapped by it. If it doesn’t, then investors will start to ask about revenue recognition policies and whatnot (especially in the light of the 97% gross margins which themselves indicate a degree of aggression in how the company chooses to account within GAAP).

Let’s leave the boring behind for a moment and get into the numbers, the valuation, our stock chart and ratings.

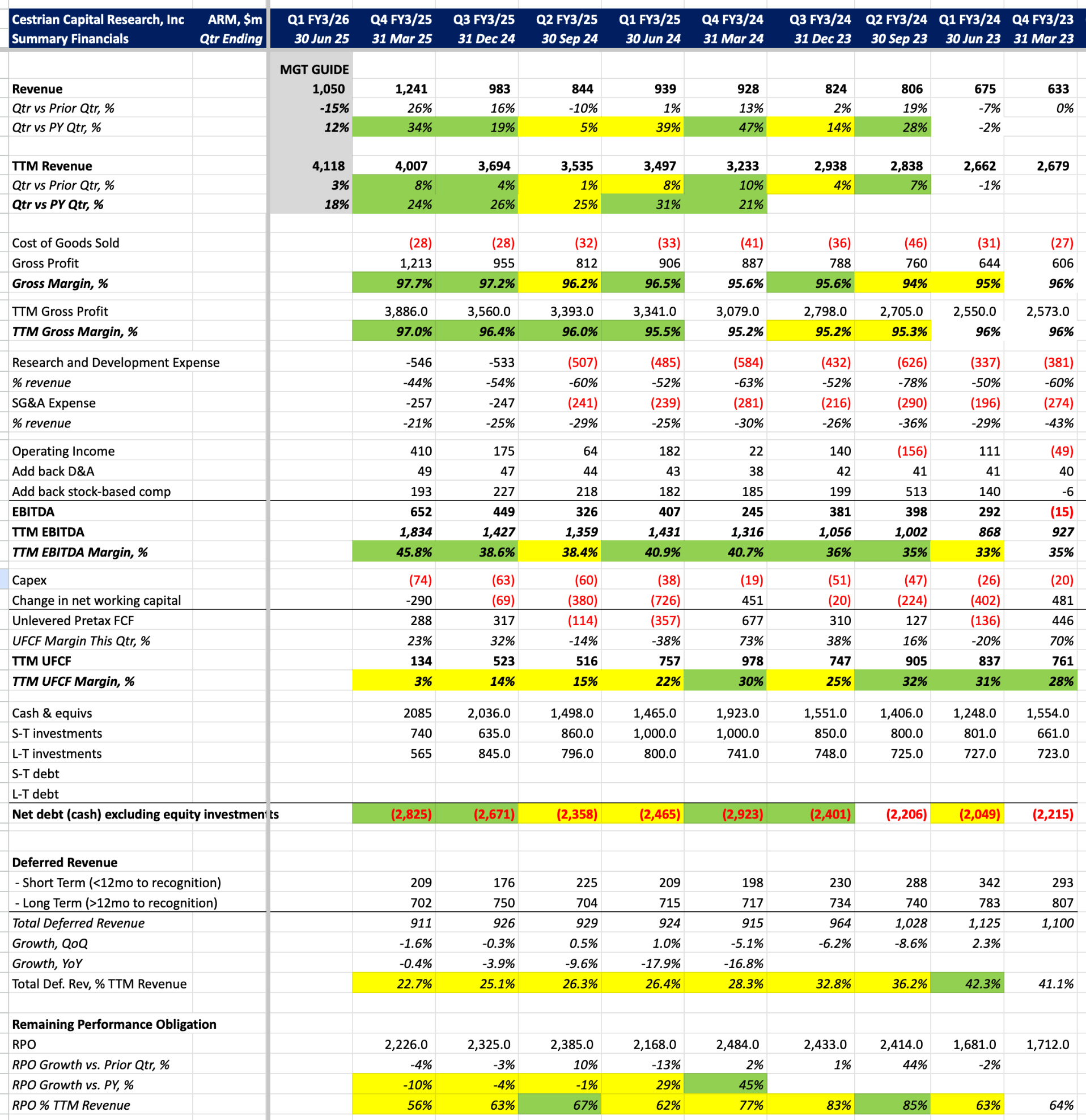

Financial Fundamentals

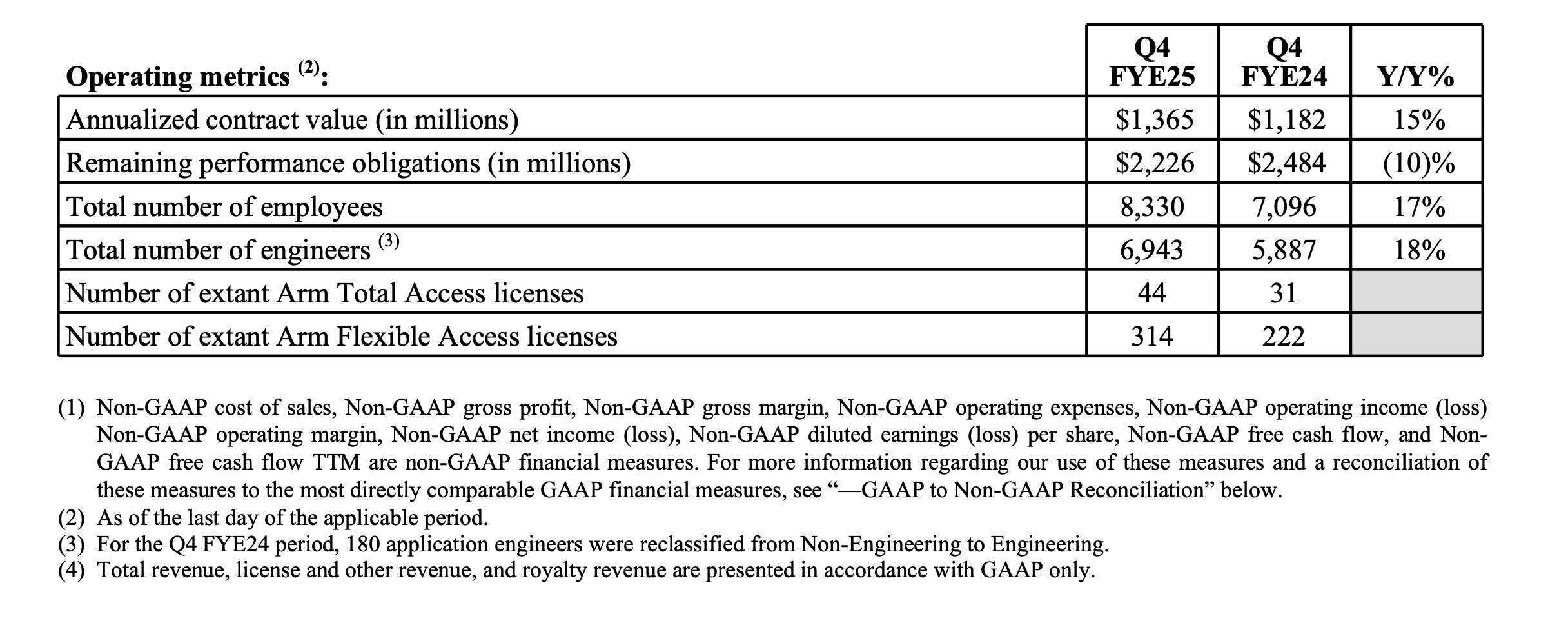

I would also draw attention also to the declining order book (“RPO”), a US GAAP measure which is falling at the same time that the company is highlighting the growth in Annual Contract Value (not a US GAAP measure). The company flags this themselves actually.

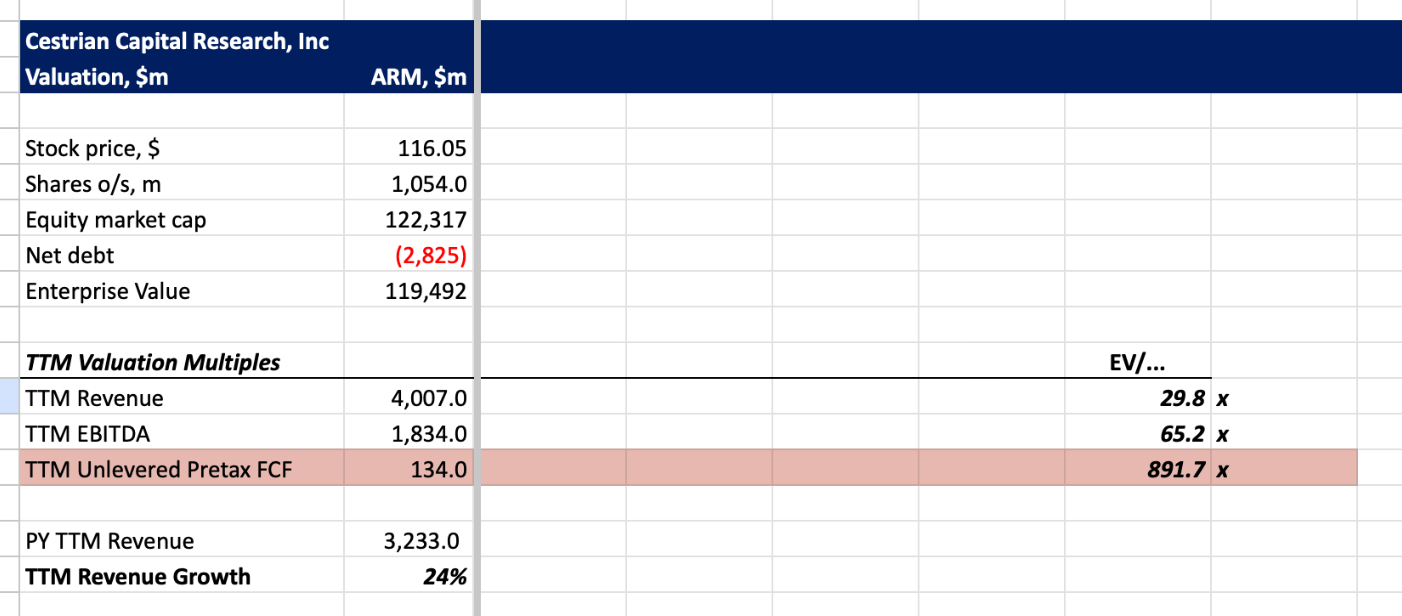

Valuation

The vast gulf between EBITDA and UFCF multiples is a function of the cashflow issues discussed above. It’s not pretty.

BY THE WAY - Palantir looked a little bit like this in 2021/22 but has since more than solved for cashflow, and you know how that stock worked out, so please don’t assume that any of these issues persist or are damaging to the stock. These are just things that caught my eye.

Stock Chart

On technicals we rate the stock at Accumulate between $94-124/share. You can open a full page version of this chart, here.

Cestrian Capital Research, Inc - 9 May 2025.