Equity Index Investing And Trading Using Inner Circle Service Resources

Catchy title huh. Read on.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Four Indices, Many Ways To Try To Make Bank

Core to our work here at Cestrian Capital Research is extensive analysis of the four primary US equity indices, being the S&P500, Nasdaq-100, Dow Jones and the Russell 2000. Between our own work and that produced by the independent trading channels that we host, there is a lot of heat and light going into trying to understand the moves the indices make, over multiple timeframes, all at the same time.

Input factors into our equity index work include:

- Macro market conditions. Former pro rates trader Yimin Xu provides superb analysis of the Fed's impact - see for instance his presentation on the debt ceiling, Treasuries issuance and why it matters, here.

- Corporate earnings analysis. Our CEO Alex King is a lapsed fundamentalist and can often be found modelling changes in working capital when he should be doing something less boring instead - see for instance his NVDA note, here.

- Technical analysis in the larger- and smaller degree. This is produced in our daily Market On Open notes - see for instance here - and you'll also find plenty of such work in our Slack chat environment produced by our wise members.

- Intraday technical analysis - produced in our hosted trading channels operated by Van (here) and Gains (here).

And the outputs?

Well, here's how you can trade or invest in the equity indices using the resources in this service. All depends on your timeframe and risk appetite. Our work can be used to help you raise your game, whether you are following the simple Buffett meme of, dollar-cost-average into the S&P500, seeking to better that approach by using leveraged ETFs to the long and short side, or indeed spending all day every day sat watching every tick of the market in order to catch small as well as big moves.

Simple Index Investing

You can use our daily Market On Open notes to help you judge when you may want to make substantial additions to index holdings (our work correctly identified the Covid spike bottom in 2020, and the sideways action at the bear market lows marking the smart-money accumulation phase in the latter half of 2022), to lighten up those holdings (we highlighted loud and clear the bull market high in 2021 - see our recent reviews on this), or to do nothing during the markup phase.

Leveraged Long/Short Index ETF Investing

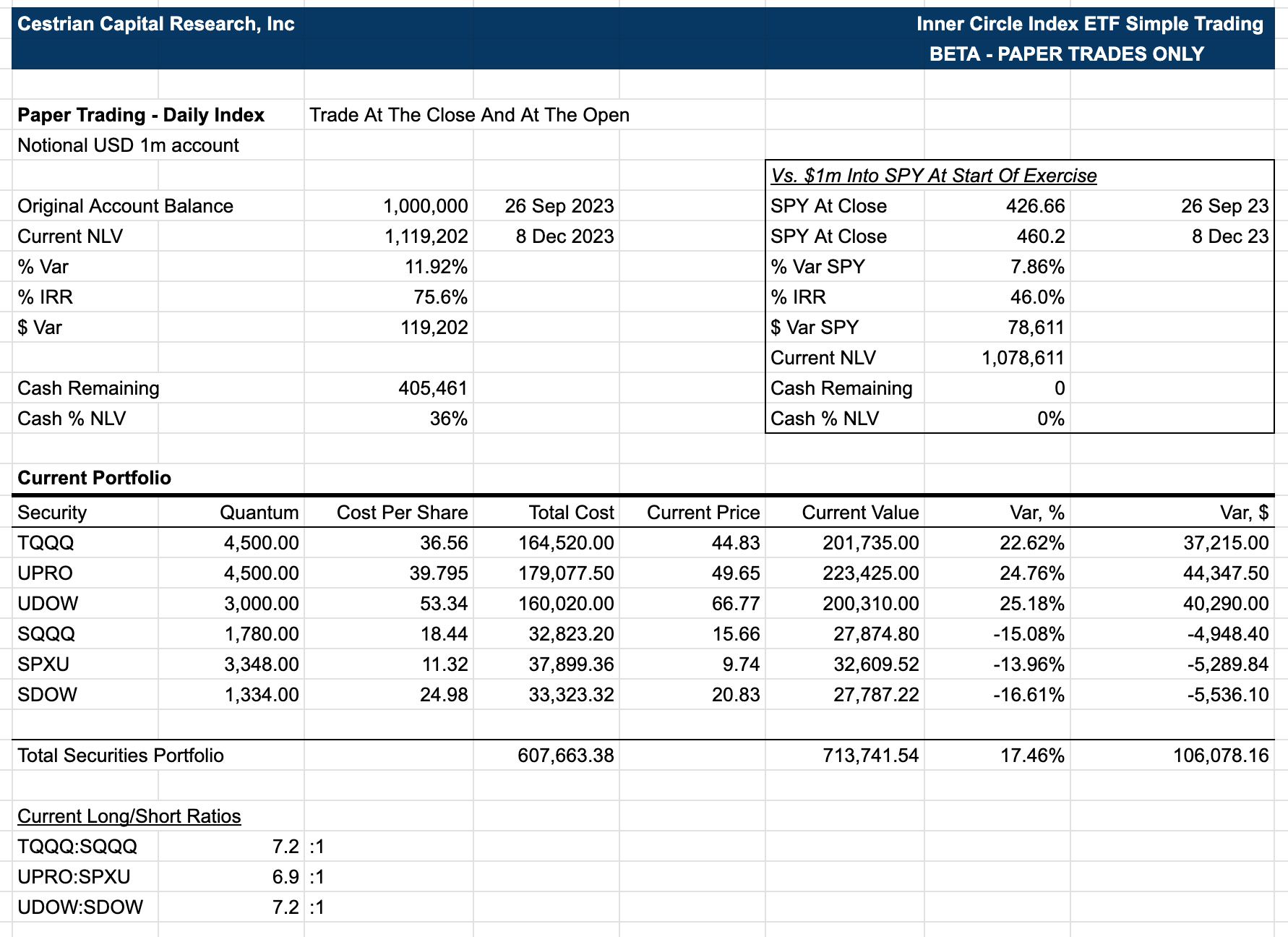

You can use our Leveraged Index ETF Model Portfolio which offers you the ability to beat the S&P500 buy & hold model by timing long and short entries and exits in 3x index ETFs. This model portfolio assumes that you have something to do all day long - a job, friends, family obligations, hobbies, pets, whatever - and so assumes very little trading. We flag buy and sell ideas to be actioned at the open and/or the close each day. On the majority of days our best idea is 'do nothing'. That's because this model portfolio is designed to try to beat passive S&P500 investing whilst being not much more than a passive investor. Here's how that's going so far by the way:

The idea is that this model portfolio can work for account sizes from say $10k to $1bn or so. We use a $1m notional starting account balance in the model. We assume a cash account, no margin facilities, and we aim to keep a healthy 'cash' balance in the model. In short - the goal is, use leveraged index ETFs to try to outperform the S&P500, without the time commitment needed for heavy trading activity or the stress that comes from large margin positions.

Invest Alongside Our Principals

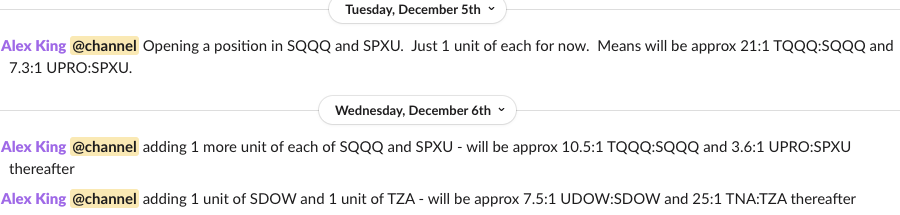

Cestrian staff personal accounts invest in US equity indices precisely according to the approach set out in our Equity Index Strategy note, here. We post Trade Disclosure Alerts in our Slack environment, which you can configure to alert you in the method of your choosing (carrier pigeon requires the 'Off-Grid Plus Pack' subscription module). These alerts are posted prior to any such trades being placed, so you have the opportunity to trade before we do. Like this:

A 'unit' by the way is just a constant amount of capital - whatever you define it to be when you start. It could be $1k, $10k, $1m etc. We express these trades in units so that if you want to follow them, you can do so regardless of account size.

Trade Real-Time

Want to trade the S&P500 and the Nasdaq-100 real time, long and short, using hedges to protect your capital? Then learn to do so - and trade alongside, if you wish - our two live trading room channels. Read all about them, here. Prices for these channels rise significantly on 1 January 2024 - join now if you want to lock in their current low prices for as long as you remain a subscriber.

Any questions, comments, anything - if you're a paying subscriber here you can use the comments field below or hit us up in Slack chat; if you're yet to become a paying subscriber then you can use this contact form on our website to reach us.

This post is free-to-air. Feel free to share it to spread the good word, and again, if you're yet to subscribe here, check out the subscription packages, here.

Cestrian Capital Research, Inc - 8 December 2023.