Market On Open, Thursday 10 July

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

When It’s Summer, It’s Already Fall

by Alex King, CEO, Cestrian Capital Research, Inc

The quarterly rhythm to which public companies operate is also true, to a degree, of equity markets. Large asset managers often use quarter-ends as their rolling portfolio protection dates, using option positioning to do so. The most famous of this is of course the JP Morgan Hedged Equity funds, which since 2022 have taken on their own mystical quality amongst folks who spend too much time on FinX. But any asset manager with an eye to risk management uses quarter end expiries to do so. Quarterly options expiry days usually provide the most liquid positions, meaning that it is more straightfoward for said asset manager to exit their puts and/or calls close to expiry in order to replenish cash reserves and go again the next quarter. Quarters also often see a changing of the guard from the point of view of sectors and large single-name stocks. Stocks which start to moon early in a quarter were likely those under quiet accumulation in the prior 2-3 quarters; stocks and sectors selling down early in a quarter were likely those under quiet distribution of late. Rotation from stock to stock, sector to sector, is how large capital managers make money from thin air. They cannot make enough money by simply owning the index; they have to turn their market-moving power into a strength (because they can create momentum from nowhere) not a weakness (which it can be, because the market can be on to their game before the game has really gotten started).

If you manage money as it should be managed, which is to say quietly, with little drama, and continued solid success, then right now it may be only early July, but you are already very focused on September quarter end and how you are going to position yourself then. If, for instance, you believe a particular sector and/or index is likely to see weakness in the coming quarter, you will be quietly accumulating puts or other short positions (eg. via the futures market) now, whilst everything looks rosy, in order to cash in those gains on a decline and then have the cash reserves to buy at the lows.

This is the circle of life in securities, and if you live well, you can live a long time in the market. You won’t see any of this kind of asset manager driving a fancy car, nor boasting about recent returns, nor punching the air on any given outcome. You also won’t see them declaring success this year, next year or any other year. Managing money this way is merely the act of making money using money. It’s a lifelong exercise. Control the highs, control the lows, grow funds under management, rinse and repeat. Like that.

Everything Is Token. Soon, Anyway.

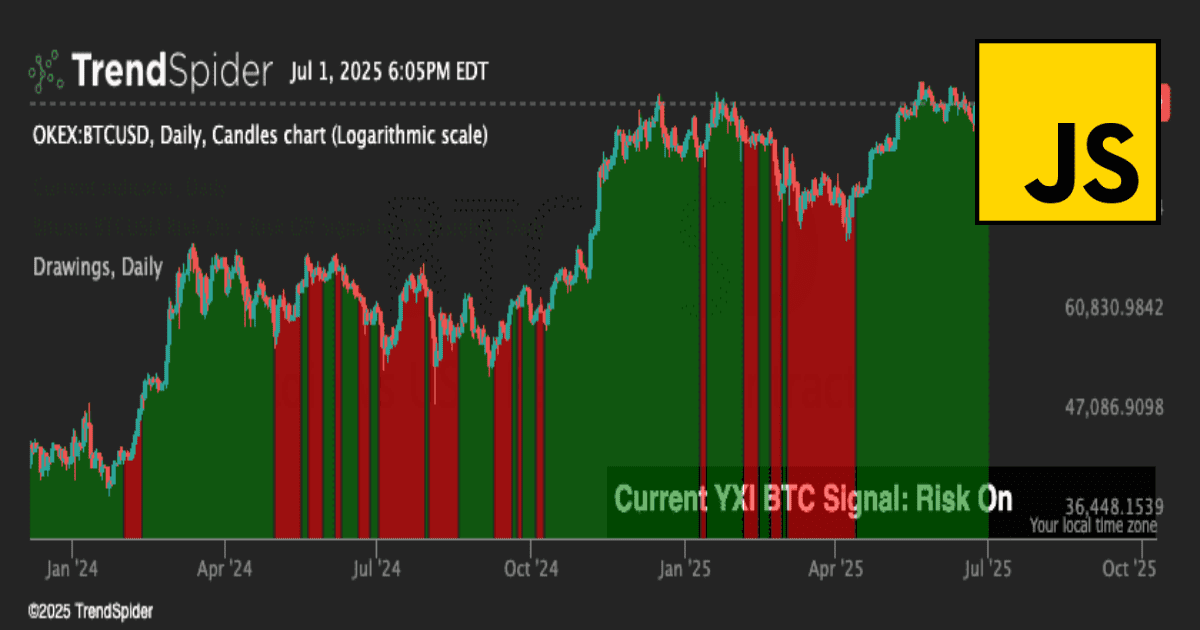

We'll be talking a lot about tokenized assets here in the coming months; and we’ll be talking a lot more about Bitcoin, Ether and Solana as a result. More of our work will include crypto, because the tokenization of the world is real and just beginning, and to token you need to crypto. Fear not - all will be explained.

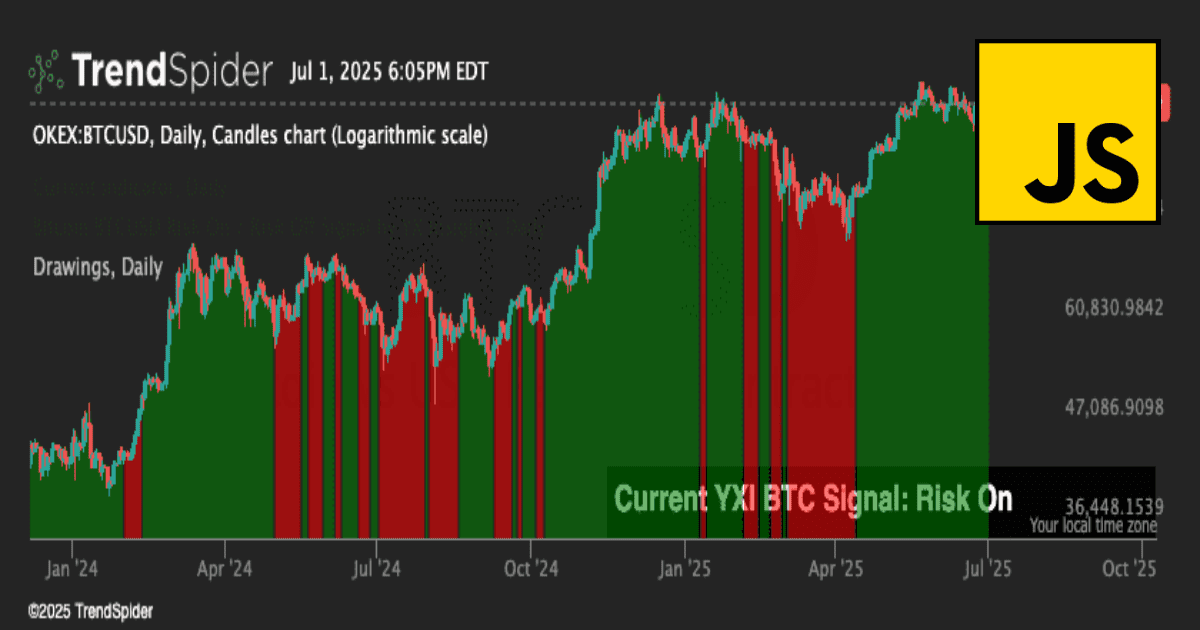

To this end, last week we launched our first AI signal service to be embedded in third-party charts - we chose to start with Bitcoin on Trendspider. You can read all about it here, but the punchline is: so far it’s Bitcoin but without the vomit-inducing selloffs. That has to be worth your time to check out.

Now let’s get to work.

US 10-Year Yield

A nice move down in the yield yesterday, good news for bondholders and bond ETF holders.

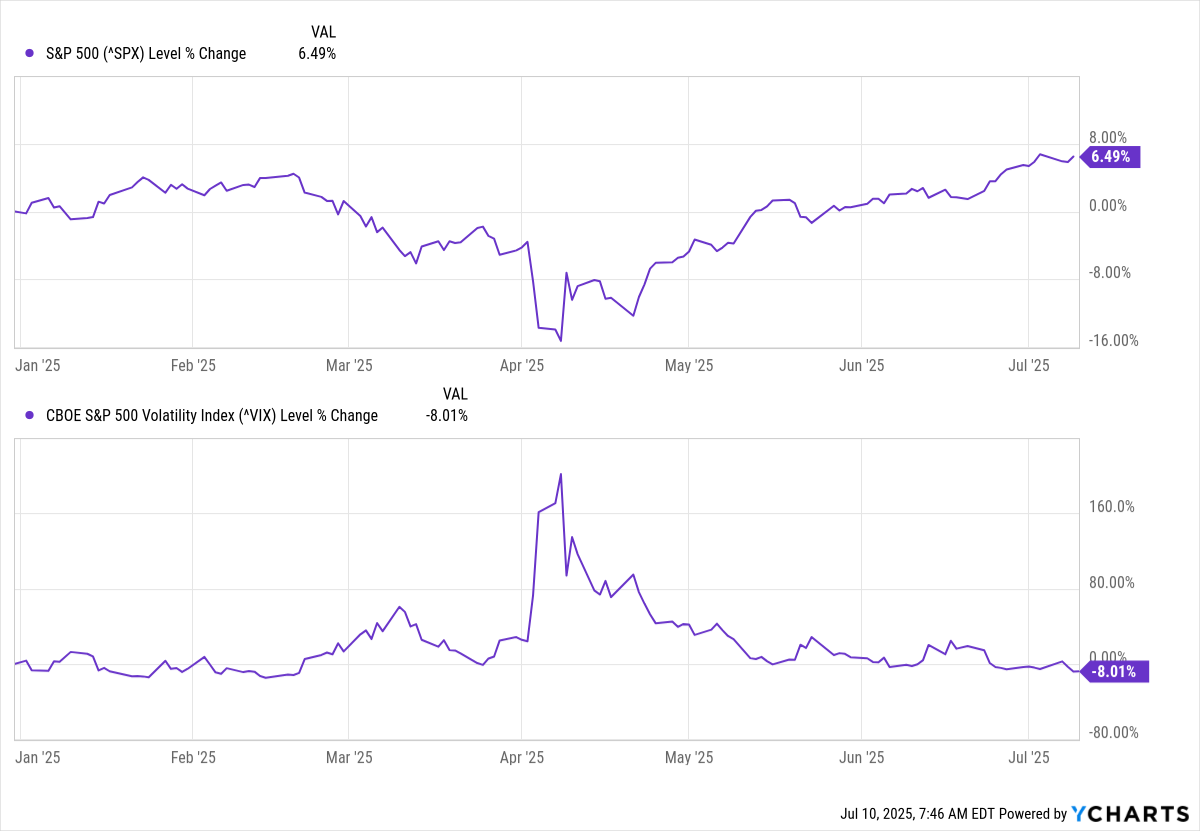

Equity Volatility

The Vix is now back at a level last seen before the Liberation Day event.

What you can say about the Vix - volatility - is that it will spike, you just don’t know when, how big of a spike, and for how long it will stay elevated. All you know is that whenever people stop worrying, it’s time to start worrying. If you are the cautious asset manager discussed above, you’ll be using this time to accumulate portfolio protection at low cost; Vix low, IV low, option premium low. And because you aren’t paying too much premium for the protection, if the market moons and you lose all the premium, you can live with that. But if a Vix spike comes along, you can profit from your preparation.

Disclosure: No position in any Vix-based securities. Long some puts because no-one is worrying so … it’s probably a good time to start worrying.

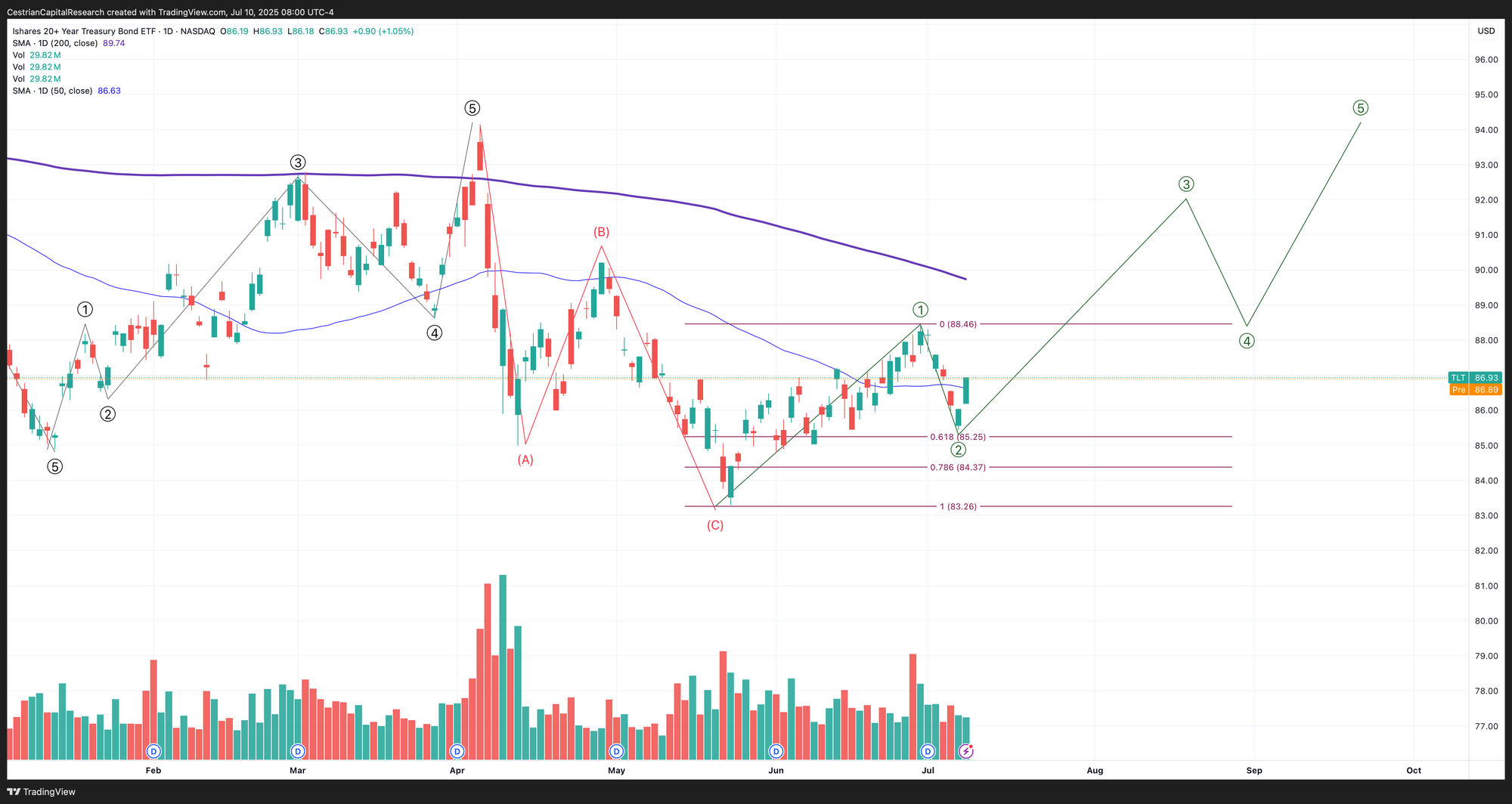

Longer-Term Treasury Bonds (TLT / TMF)

Still looking bullish to me.

Closed back over the 50-day yesterday; above $87 confirms a Wave 3 in progress.

By the way if you want to run with the big dogs in bonds? Join our SignalFlow For Bonds service. This is a super-super-simple signal service that is designed to help you rotate capital through cash, shorter-term and longer-term bond ETFs. It’s an inexpensive service, I use it personally, and so far it has performed well. Boringly effective, which is a compliment in my view!

Read more about it, here (just scroll down to “Long Only Bonds”):

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Closed right under the 50-day. Has to reclaim it to continue the bull move.

Disclosure: I am unhedged long $TLT, $TMF and similar EU UCITS ETFs.

Bitcoin

A convincing break of the recent downtrend.

NEW! We now offer Bitcoin risk signals embedded in TrendSpider charts. You can view the Cestrian Algo Store on TrendSpider by clicking below or here.

Disclosure - I am long $IBIT.

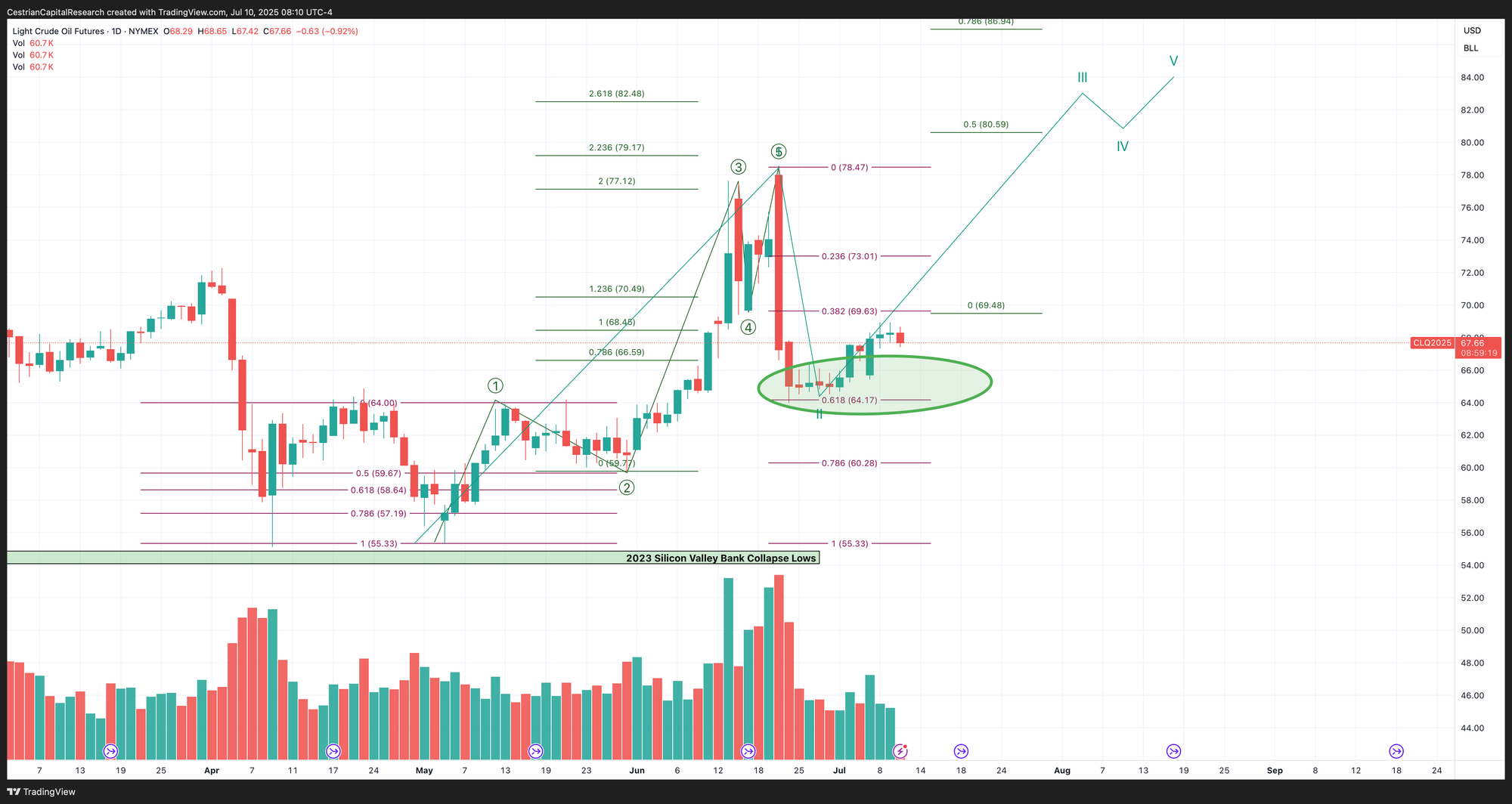

Oil (USO / WTI / UCO)

I am not smart enough to second guess whatever is going on at OPEC+ right now, so I took my modest gains in USO and sold.

A correction remains in bullish territory if it holds over say $65 (that would be a .786 retrace of the last few days’ move up).

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Bullish if over $23, same logic as CL_F.

Disclosure: No position in oil.

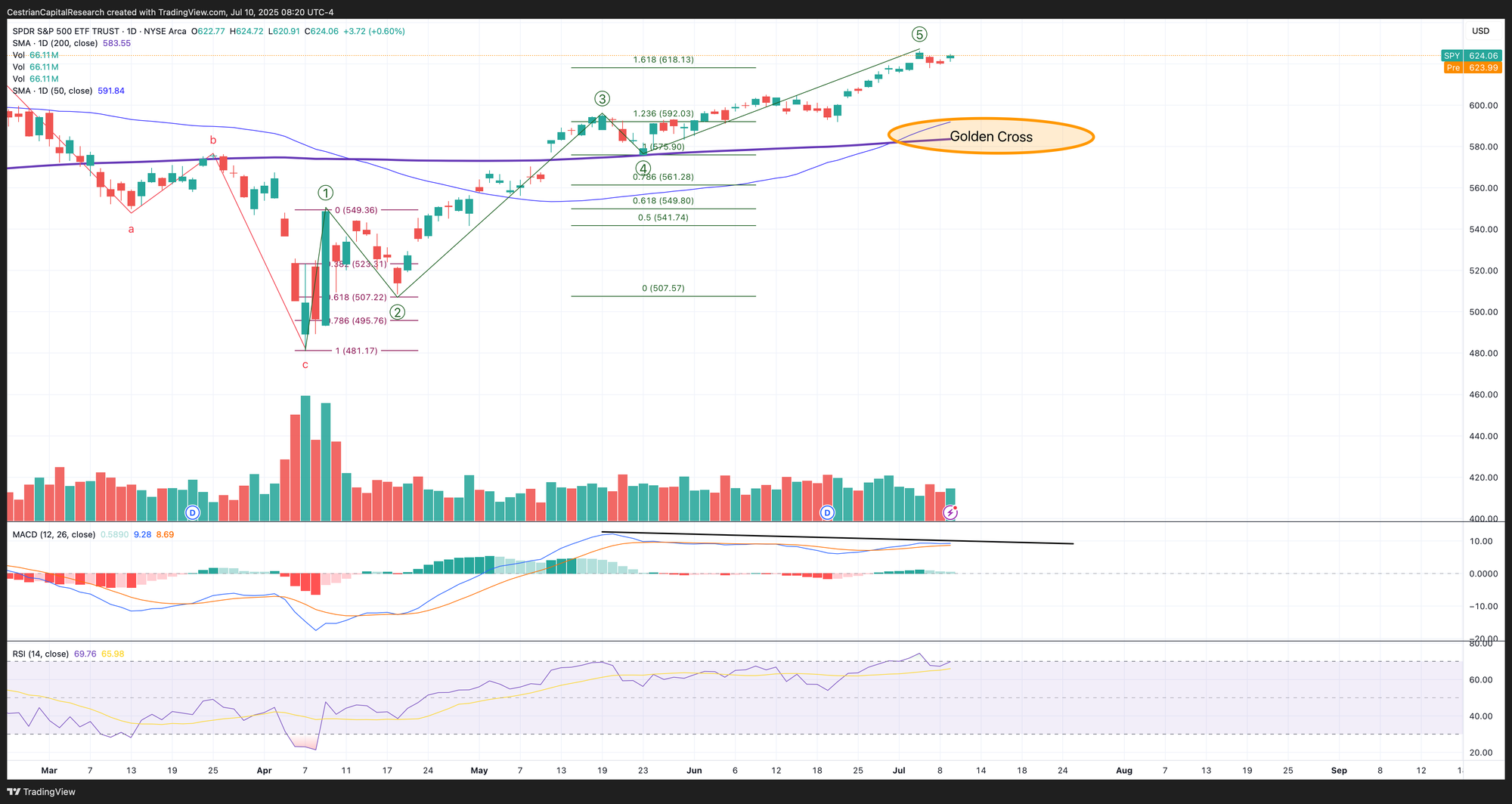

S&P500 / SPY / ES / UPRO

Yep still bullish. Anything can happen today, this week, this quarter. But we’re bullish into year end.

No change. Still looks like a short-term correction “ought” to happen. Hasn’t happened yet. Choose your timeframe!

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Same as for SPY.

Disclosure: I am long $IUSA and long SPY puts for September expiry. Overall net long the S&P500.

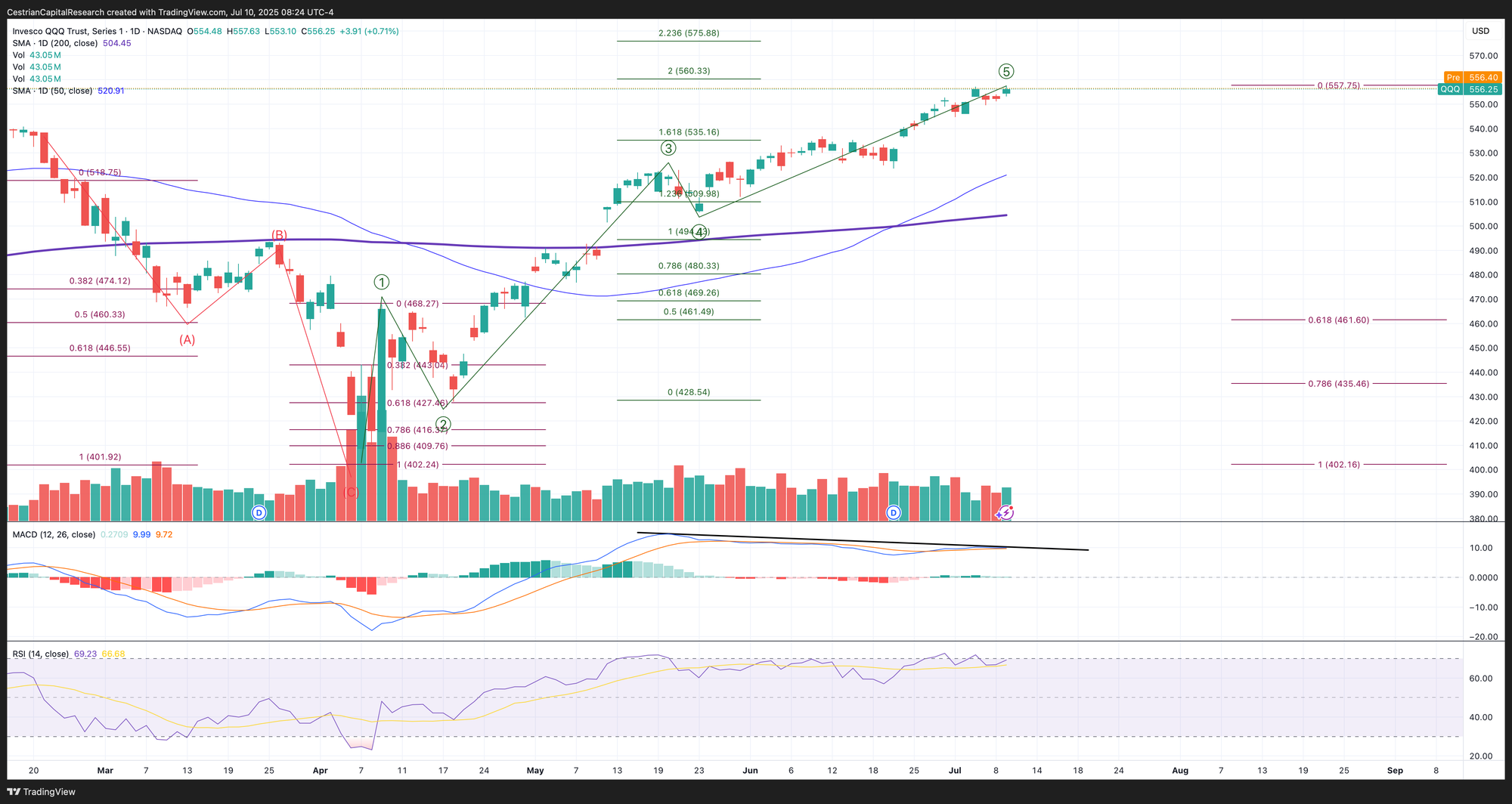

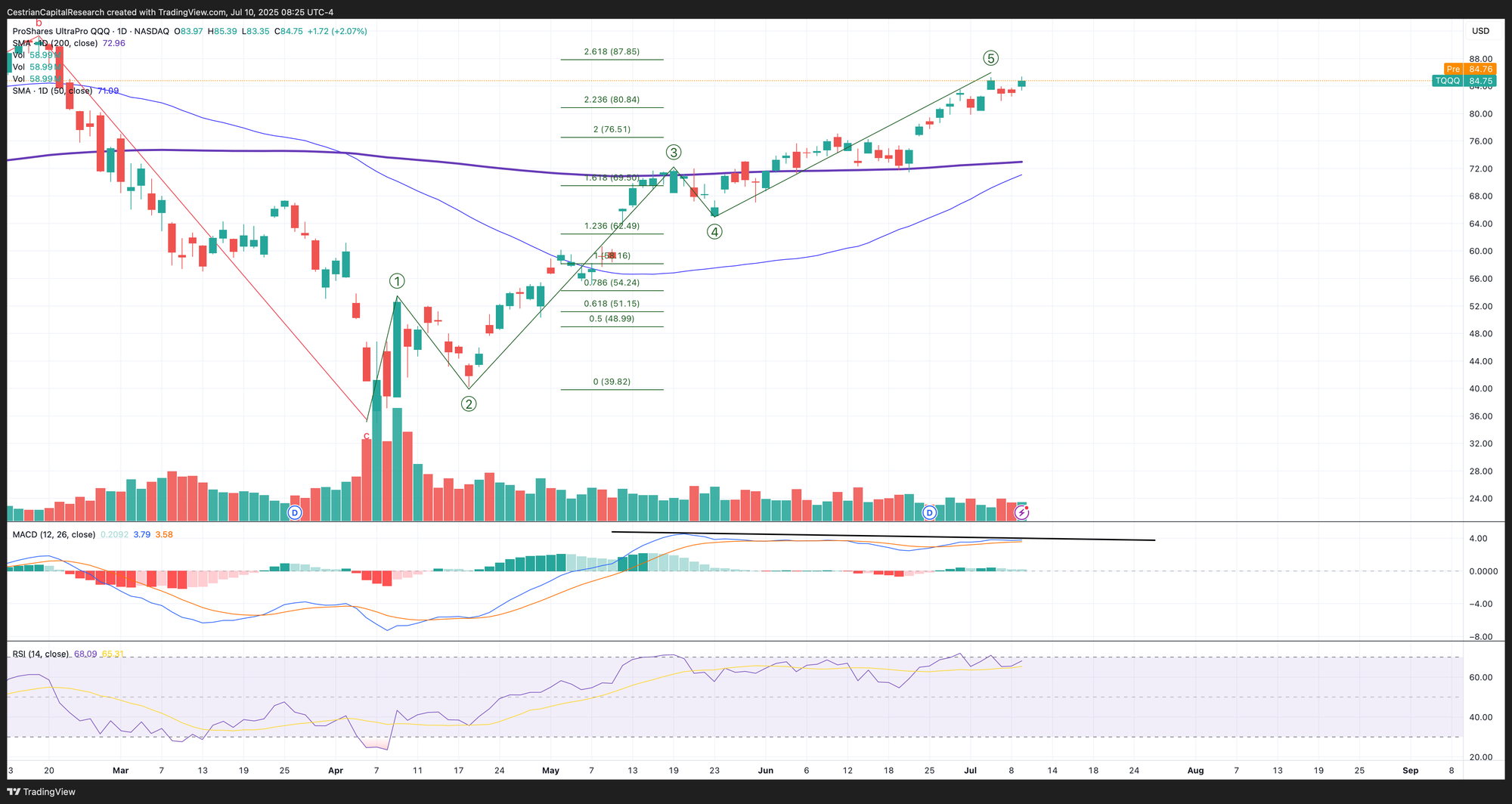

Nasdaq-100 / QQQ / NQ / TQQQ

Still bullish looking to year end.

No change. Same as SPY - looks ready for a short term correction, no such correction happening yet. Trade the chart in front of you, not the chart in your head.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Following QQQ.

Disclosure: I am hedged 1:1 $TQQQ:$SQQQ and have $TQQQ and $QQQ puts for September expiry. Overall broadly neutral the Nasdaq.

The full morning note, available to Inner Circle members, also includes coverage of: DIA, UDOW, XLK, TECL, SOXX, and SOXL.

Alex King, Cestrian Capital Research, Inc - 10 July 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, TQQQ, SQQQ, SOXL, SOXS, IUSA, TLT, TMF, DTLA; also long SOXS calls and September TQQQ, QQQ and SPY puts.