Market On Open - Tuesday 12 March

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Take Yesterday’s Witchity Brew And Toss A Hand Grenade At It

by Alex King

Yesterday in this note I flagged the importance of Q1 opex; if you missed the note, do take a moment to read it, here.

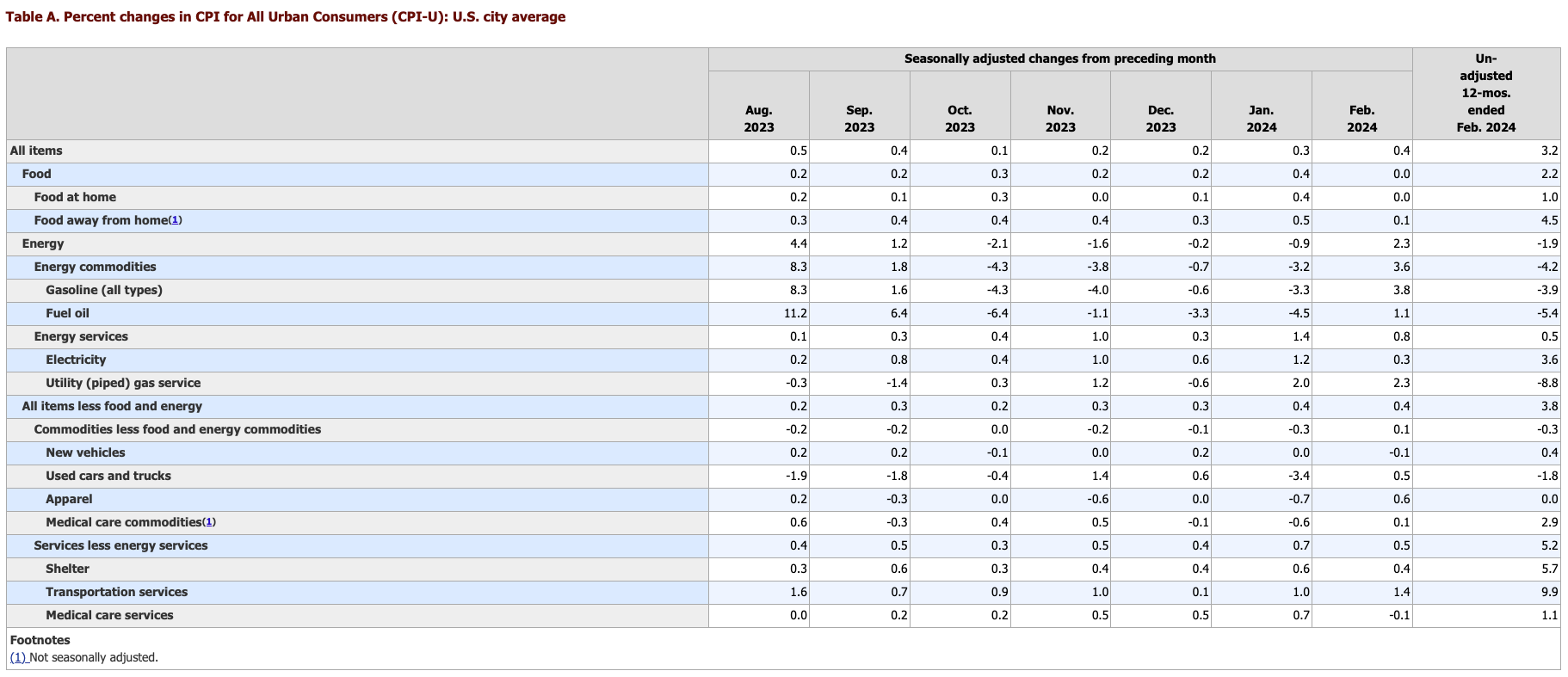

Today we take the unholy admixture of bear hate, bull fear, Q1 hedging flows, and into that turmoil we toss CPI data. At 0830 Eastern today the CPI print was per the below (full report, here).

As you can see, inflation is trending up slightly, but on an annual basis remains in the 3% zone. Yes, the Fed has a notional 2% target, but that’s just a made-up number anyway, and at 3% nobody will be stressing too much about annualized inflation levels. So whilst you may see all manner of screamy bear memes stressing out about the Fed hiking rates to control RUNAWAY INFLATION, that’s probably not going to happen. And everyone sensible knows that. Which is why the market is up on the print, at the time of writing (0840 Eastern) anyway.

Right now is a tough time to make major directional bets, because opex. Personally my expectation is a sustained bull market but in the near term, opex can cause equities to blow this way and that, so I won’t be surprised to see big swings in either direction in the coming days.

Remember if you’d like to know more about why options expiry drives equity pricing, and how to profit from it, join our Jay’s Options group - you can learn all about it here.

Below we dive into our usual charts where we walk through the S&P500, the Dow, the Russell 2000, the Nasdaq-100, and then a clutch of specialist ETFs, being SOXX / SOXL (semiconductor), FNGU (tech majors) and TECL (also tech majors).