Market On Open - Tuesday 22 August

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Faltering Recovery Continues

Friday last week saw spike-low and reversals in each of the major equity indices. This is the Nasdaq, for instance:

Oftentimes that kind of reversal can mark a low. It represents the lack of any willing sellers below a given level. And so far, Monday this week closed up after a will-it-won't-it start to the day. At the time of writing, Tuesday is up across all four major US equity indices in pre-market hours.

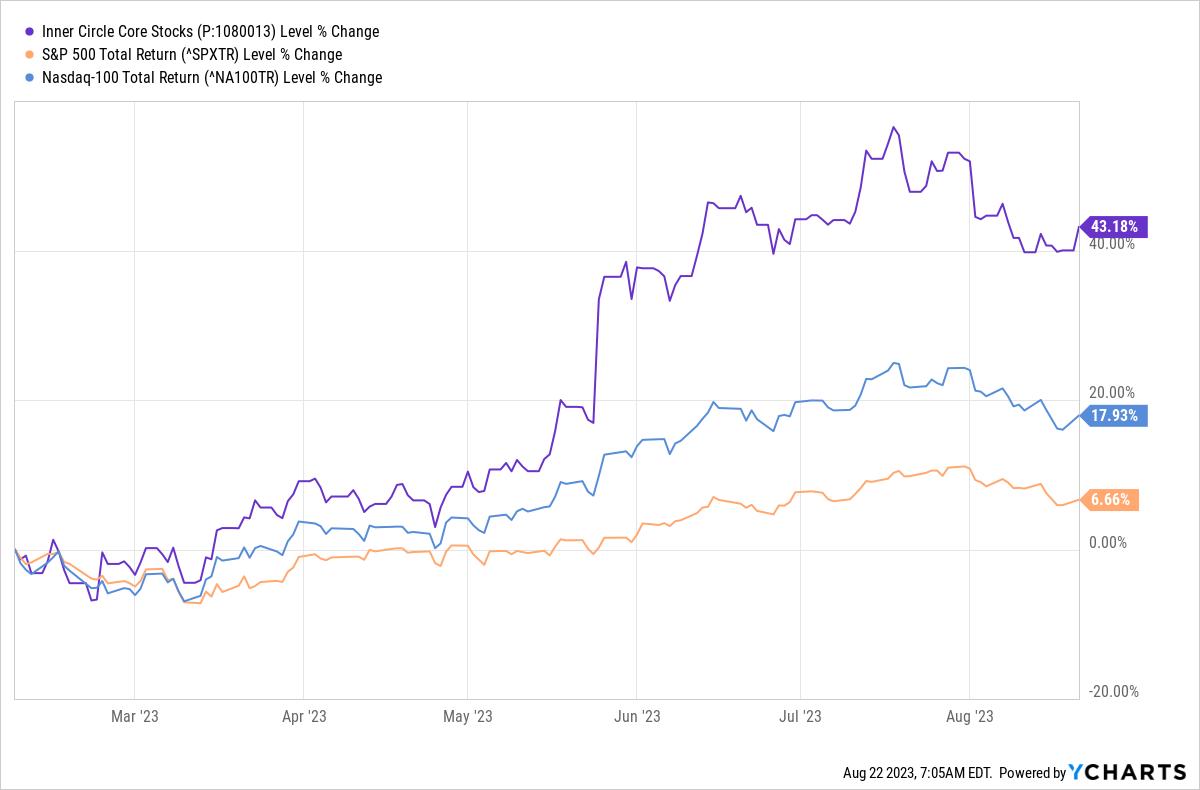

Potholes this week include Chairman Powell's Jackson Hole speech and Nvidia $NVDA earnings. We expect some volatility around the Powell speech in the usual way but we don't believe it will lead to a sustained market selloff. And we're long-term bullish on Nvidia unless something fundamental changes on the earnings print. The company can miss for sure, since the guidance posted for this quarter was so outrageous that one should not be surprised to see a miss (which would likely punch the stock price in the mouth, short term anyway). But the current capex refresh cycle in tech, which has an AI narrative but is overdue anyway, is likely to continue to benefit $NVDA, more so than $AMD or $INTC. So unless we see a fundamental change to the story we will treat any dip as just that, a dip. We'll write up $NVDA earnings in this service since it is a stock in our Inner Circle Core Stocks basket that we initiated on February 7 this year. Here's how that basket is doing by the way.

Now let's turn to our daily market note.

The Heart Of The Matter

For our paying members only we now walk through the shorter- and longer-term outlooks for the S&P500, the Nasdaq, the Dow and the Russell.

We also include more detailed Cestrian staff personal account trading plans in our charts - these are disclosures rather than commandments, we include them to (1) clarify our own thinking and (2) to help explain what we think about the direction of markets. Paying Inner Circle members can reach out in Slack anytime to discuss. You will, of course, make your own decisions as to how to use our charts.