Market When Open - Friday 7 June

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

When Are More Jobs, Not More Jobs?

by Alex King

NFP numbers were up a lot today, except if you stood on one leg, squinted and drank three espressos in quick succession whilst looking at the numbers, they were down. Apparently.

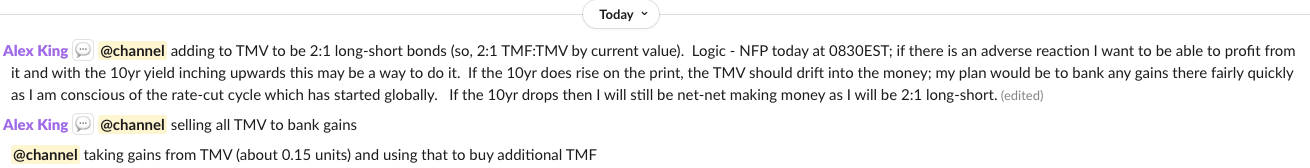

Personally I prepared for NFP by hedging my long TMF position 2:1 using TMV, which is to say being 2:1 long:short US government bonds heading into the print. I did not hedge my equity positions. My logic was, if the market moons on the print, I really and truly don't want stranded short equity positions sat around the place. On the other hand I did want to be able to profit from any adverse reaction. The 10-yr yield was looking ready to reverse upwards anyway so I figured that adding a little TMV might be a good idea. But only 2:1 long short so that if wrong, my TMF would move up faster than TMV moved down and, net net, I would be up anyway.

As it turned out, it worked out rather well. Shame I didn't hedge the equities too, which would have been even better. Here's the Trade Disclosure Alerts I posted in Slack for our Inner Circle members prior to placing the relevant trades earlier today.

If you missed it, do take a moment to read up on yesterday's note about how to trade hedged ETFs. There's no paywall on the note. You can read it here.

Let's get to the matter at hand. Now that NFP data is somewhat digested, let's see where markets stand.

As always in these notes, today we cover all four primary US equity indices (the S&P500, Nasdaq-100, Dow Jones-30 and Russell 2000); bonds (TLT), volatility (the Vix), oil (USO) and sector-specific ETFs.