Inner Circle - Model Portfolio Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Backgrounder

This is a no-paywall post. Below we review the performance since inception of each of the model portfolios we run in our Inner Circle service. In each case, these portfolios were created, and since tracked, like this:

- These are model portfolios - paper trades - not real money trades. (We do disclose all Cestrian staff personal account trades in our Slack chat service by the way). Since they are model portfolios, all references to buy / sell / dividends received etc should be viewed on that basis ie. model, not real.

- All stocks were bought on the day of the relevant portfolio inception; no cash was left in the model portfolio at that time.

- All dividends received are modelled as re-invested into additional purchases of the stock that issued the dividend.

- We assume no fee burden on each portfolio, since they are intended to be self-managed portfolios.

- No changes, rebalances, sells or buys have been applied to any of these portfolios.

OK, so, here goes. In each case we calculate total return (that's inclusive of those dividends re-invested) vs. the S&P500, the Nasdaq-100, the Dow Jones-30 and the Russell 2000.

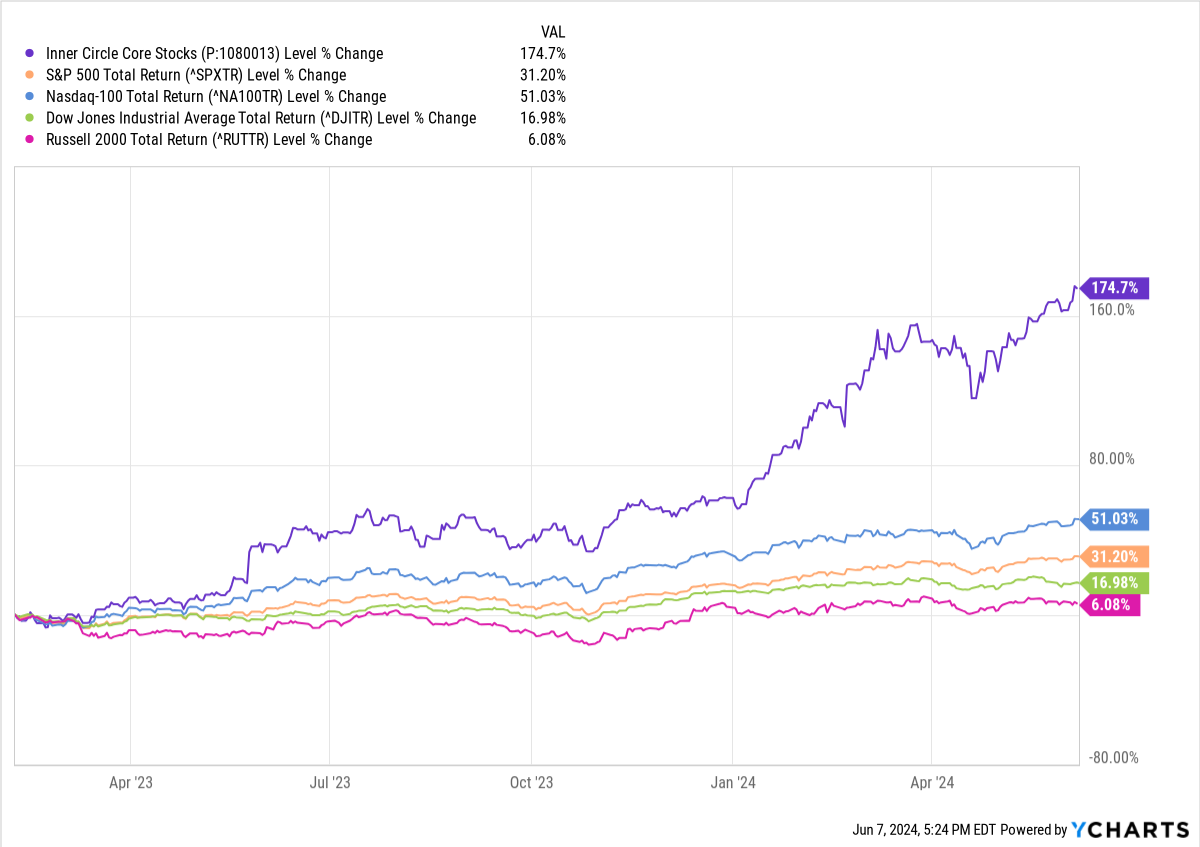

Core Stocks - Created 7 February 2023.

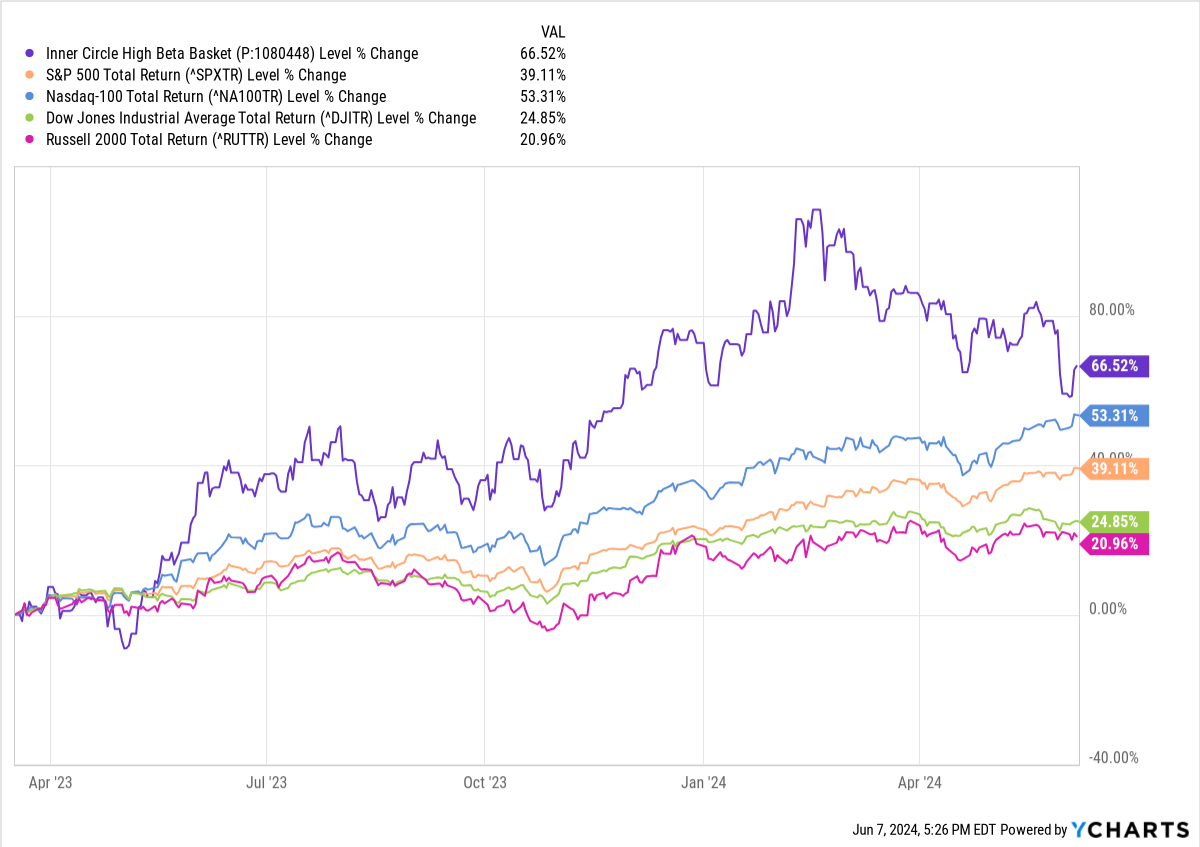

High Beta Stocks - Created 17 March 2023.

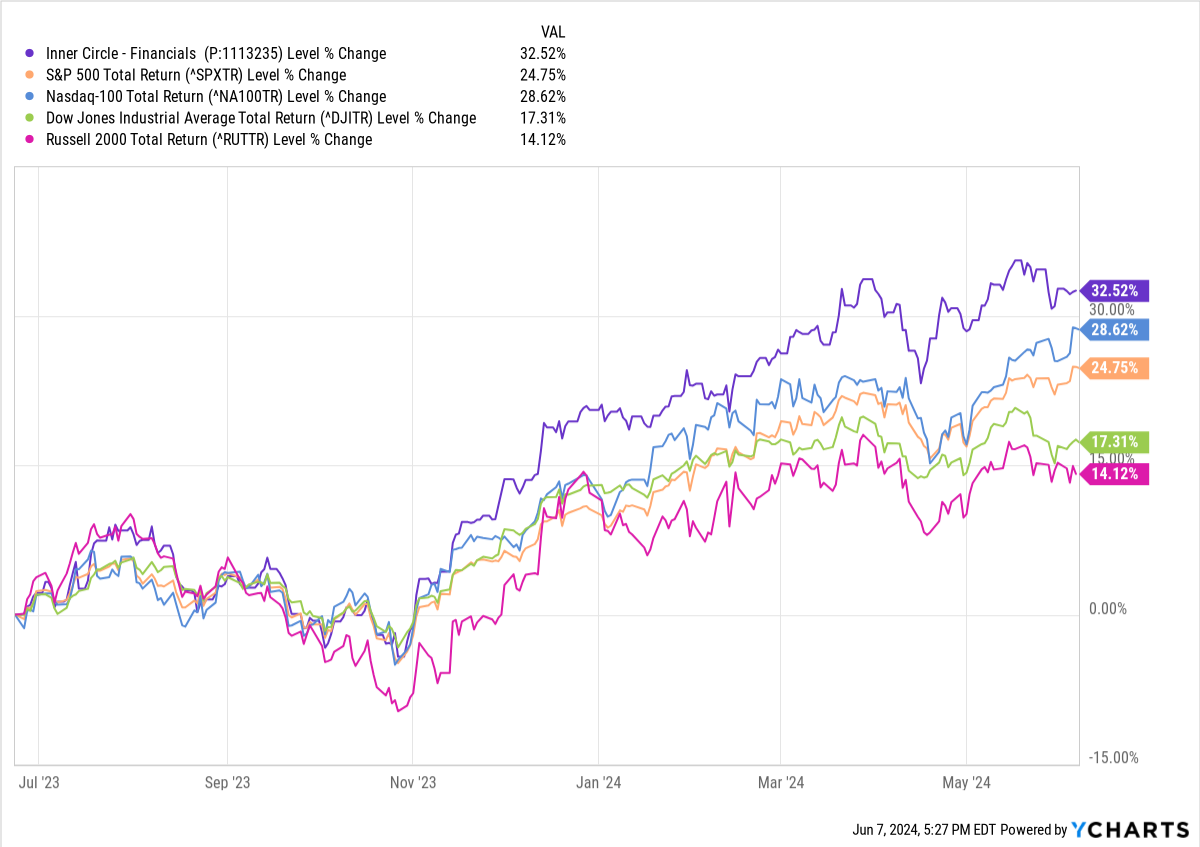

Financial Sector Stocks - Created 23 June 2023.

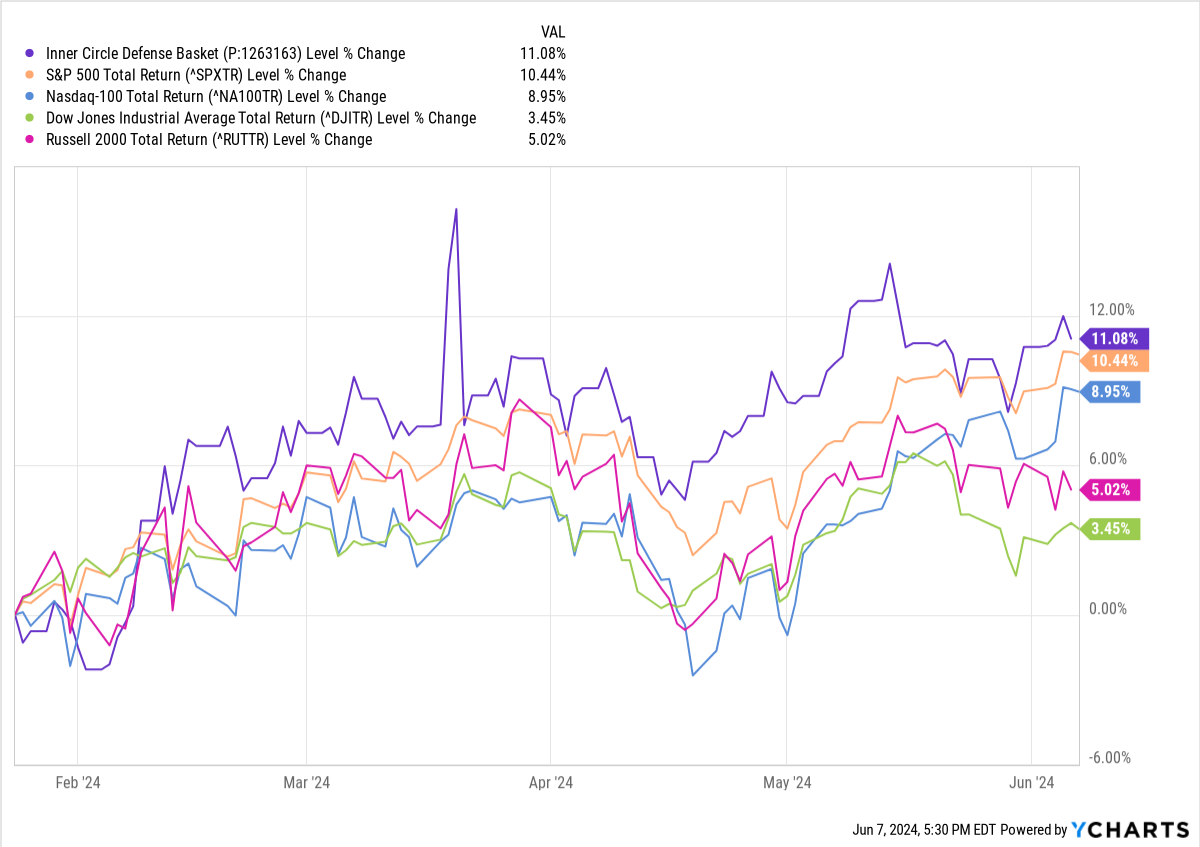

Defense Sector Stocks - Created 24 January 2024.

Note - this was explicitly set up as a defensive portofolio - we expected this to underperform the indices over the long term but saw this as a worthwhile use of capital in the meantime. We're happy to keep it open. It's ahead of the indices for now, which is something of a surprise.

We're working on putting the next model portfolio together. Want to be there on day one? Join our Inner Circle service.

Cestrian Capital Research, Inc - 7 June 2024.