Don’t Look Now But The Decline May Be Slowing (PagerDuty Q1 FY12/25 Earnings Review)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Another Sign That Software May Find Support

by Alex King

PagerDuty is a perfectly reasonable niche enterprise software business. The problem is that being a perfectly reasonable niche business isn’t a survivable state in enterprise software. If you aren’t building new product areas or acquiring your way into them, then you’re likely going to end up in someone else’s M&A pipeline.

This, I believe, is the likely fate of PagerDuty ($PD). If so, there is probably some upside for current shareholders - if a sale were announced tomorrow I would guess between 25-50% premium on the current price, based solely on typical acquisition premia and no other inputs.

Absent a sale of the company there is a reasonable chance the stock can start to climb anyway, I think. Fundamentals look to have arrested the decline - this quarter saw the first acceleration in YoY deferred revenue (pre-paid contract) growth in two years. The company is guiding to an acceleration in recognized revenue growth next quarter, which again would be the first in two years if it happens. Cashflow margins are steady and the balance sheet is fine. The company has announced a $100m buyback program but without levering up further I think that spending that much on their own stock would be incautious at this stage, given that they have only around $144m net cash on hand.

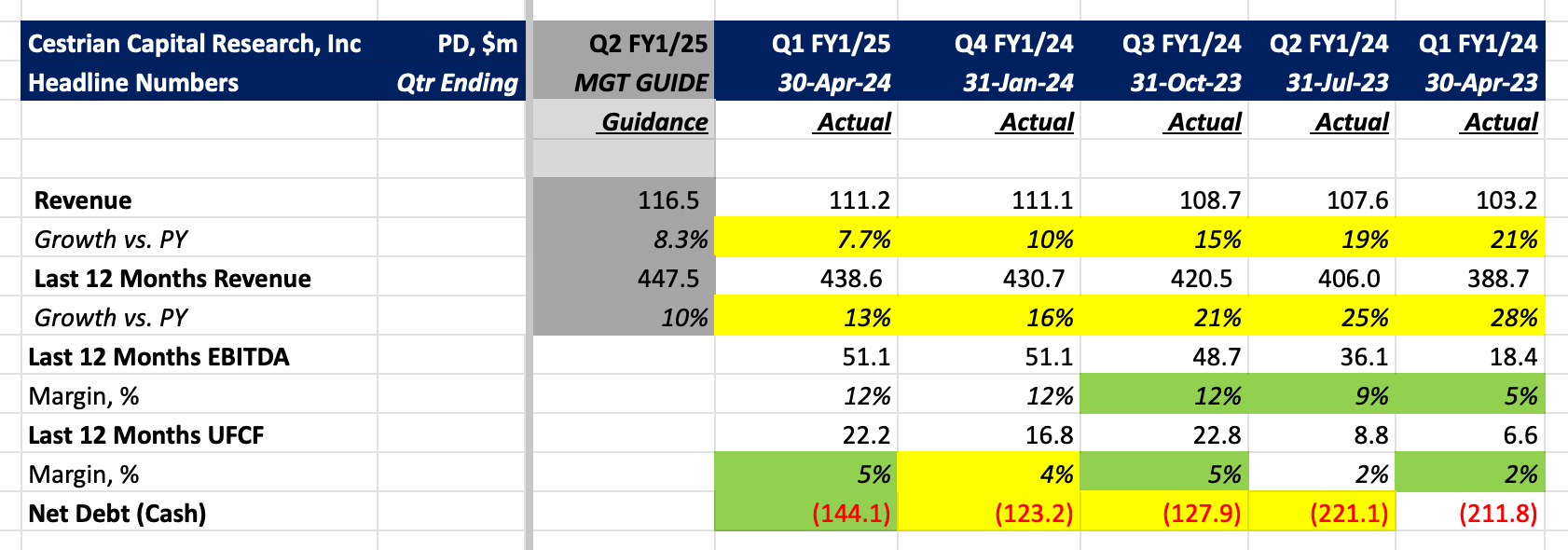

Headline numbers below - then full financial analysis, valuation and our chart take after the paywall.

Headline Numbers