Microsoft (MSFT) Q2 FY6/24 Earnings Review (no paywall)

Summary

- Microsoft's Q2 earnings were strong, with revenue growth of 18% and improved cashflow margins.

- RPO growth is slower than TTM revenue growth, indicating a potential risk of revenue slowing.

- The stock may face short-term challenges but we believe it can perform well in a flat or upward market.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Talking Heads Gonna Talk

by Alex King

I don’t know what was or will be said on CNBC and elsewhere about Microsoft’s Q2 earnings that printed yesterday after the close, because I don’t watch CNBC and I don’t read Wall Street sellside analysis. On account of it being more narrative than reality. So whether Talking Head A or B gets themselves all bent out of shape about division X or Y of Microsoft vs. someone’s expectations, I don’t know.

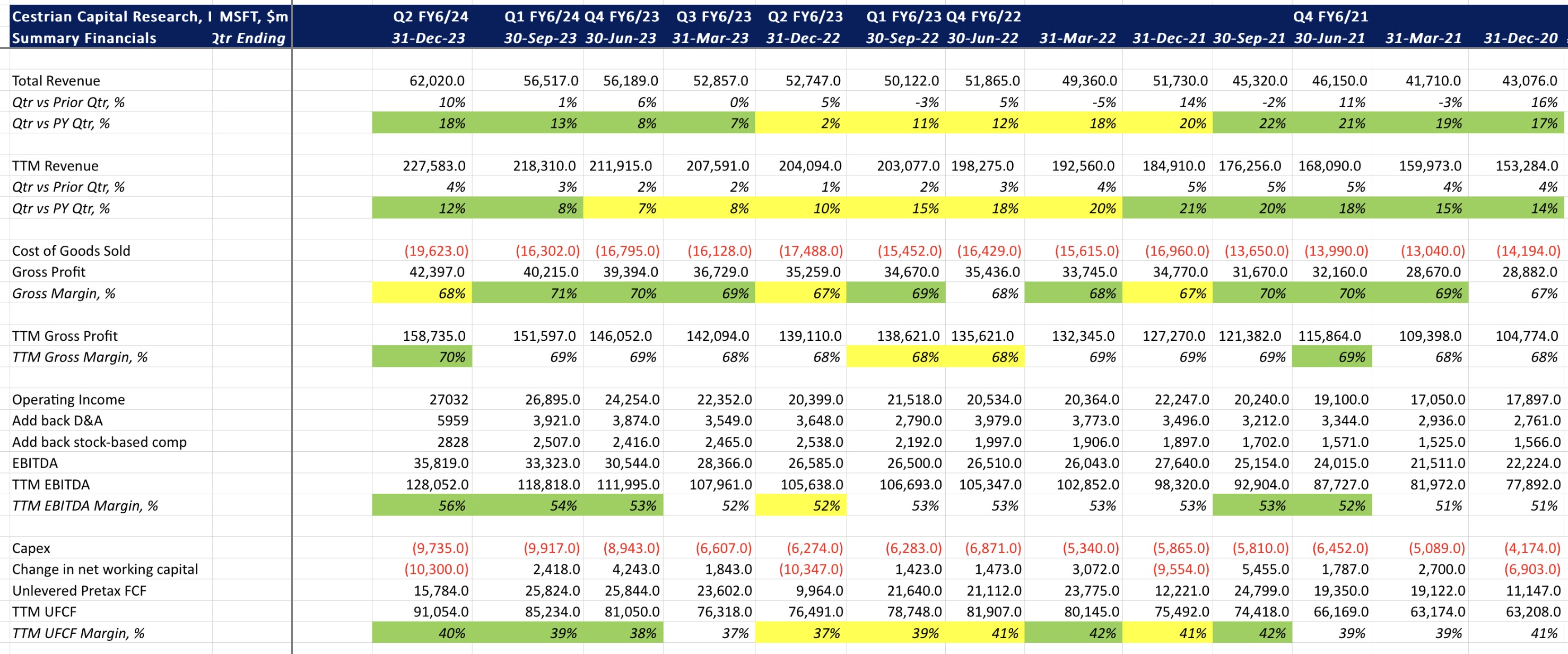

But I DO know that this was another superb quarter for the Big Dog. Revenue growth accelerated - +18% in the quarter, cashflow margins ticked up, and although there is now only a smaller nation-state’s worth of money on the balance sheet, that’s because they just ponied up $70bn or so to pay for Activision, so that’s going to drain the coffers of anyone for a little while.

The stock may take a hit in the short term with FOMC and the general run-up in January, but if this market stays flat or moves up, so too will Microsoft in my opinion.

Numbers, valuation, stock chart and rating follow.

Not a paying member? Subscribe for fundamental and technical analyses of 40+ stocks. Hit the button below now!

Enjoying our work? 🌟 Help us grow by sharing our newsletter with your social network. 🚀

Fundamentals

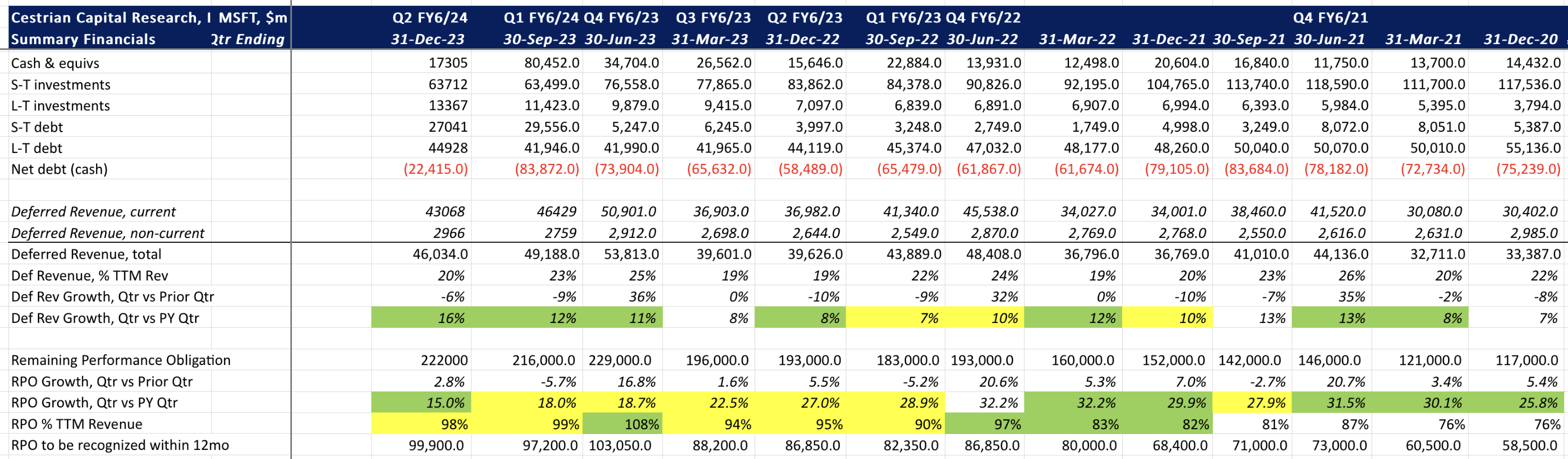

The one negative here to my eye is that RPO growth is now slower than TTM revenue growth. That means the order book isn’t growing as quickly as they are recognizing revenue out of that order book. And that means that maybe there is some revenue slowing underneath the waterline. That won’t be picked up in the stock coverage today (it’s too boring a thing to warrant attention) but it is a slowly-building risk that one needs to be alive to if one is or is thinking of becoming a MSFT shareholder.

Valuation

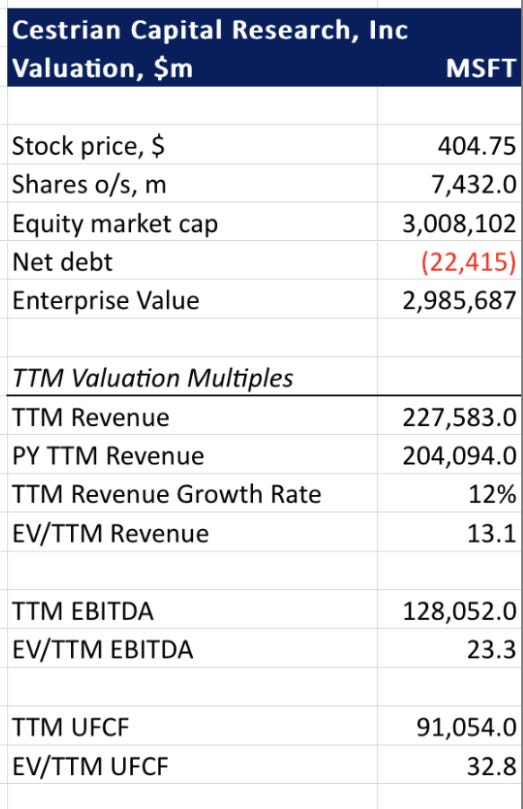

Not cheap, not expensive in my opinion. By way of comparison, a boring defense prime will cost you around 22x TTM UFCF right now. And they aren’t growing at +18% this quarter.

Technicals

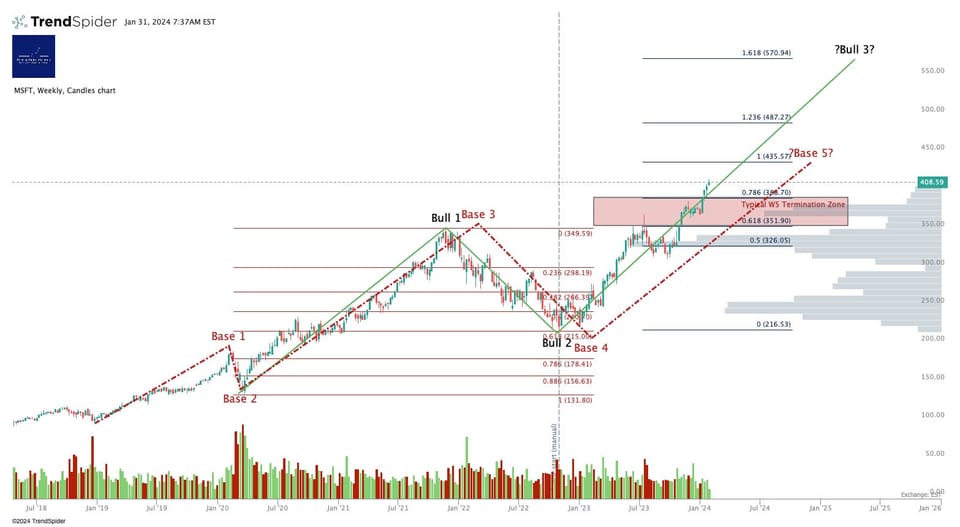

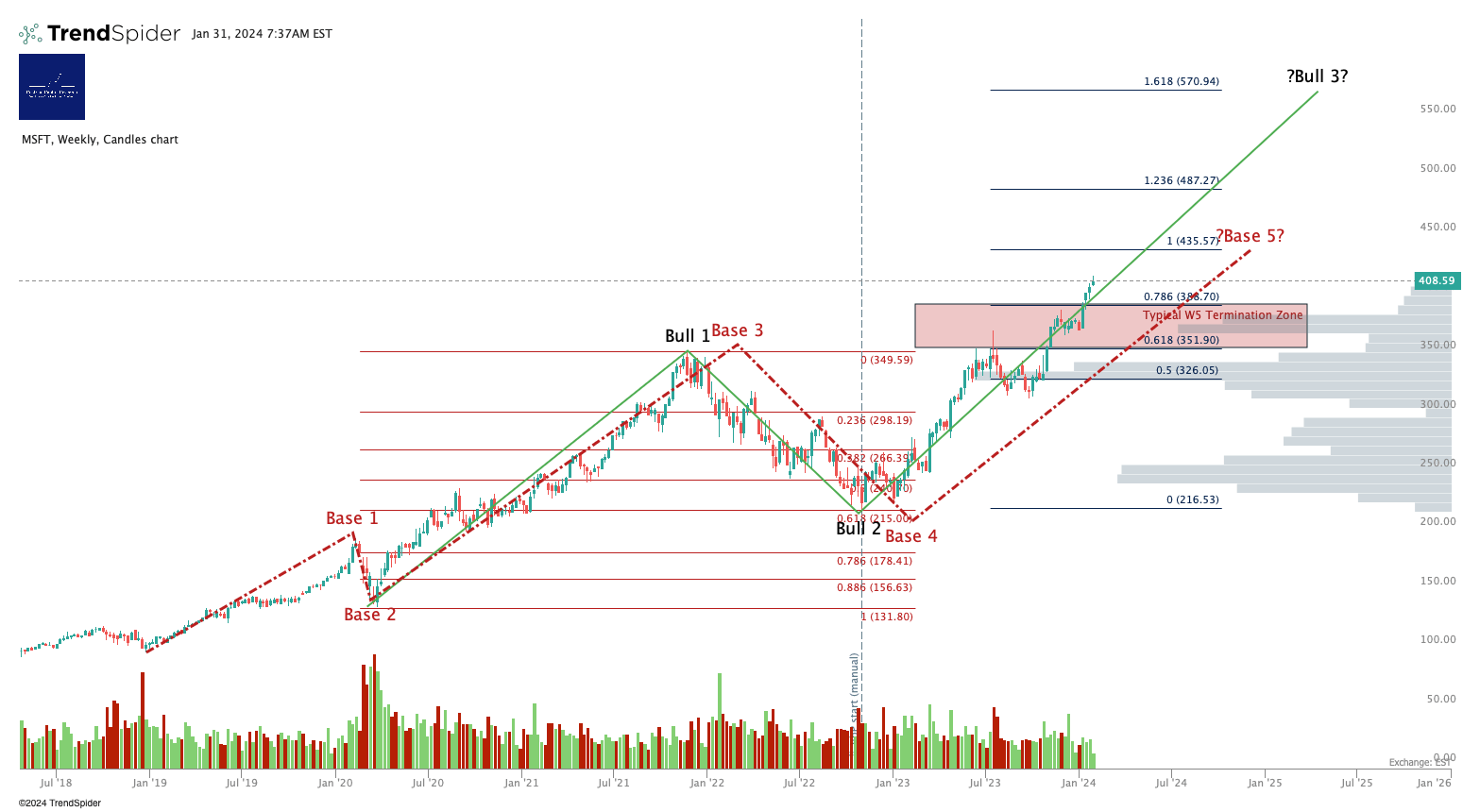

If MSFT stock is finishing the bull run it started in late 2018, which is our base case outlook, then we expect the stock to hit major resistance anywhere from here ($400 and change) to $435 before a big selloff.

If on the other hand, as we believe may be the case, MSFT is in the middle of a bull run that began in March 2020, we think the stock could run to $570 before it catches RSV and keels over.

At a minimum we can say that in the former case - the base case - MSFT has already beaten typical Wave 5 levels. If MSFT > 435 and keeps going, we will be looking to that bull case price target.

Pay attention to this chart, folks. MSFT accounts for 9% of the Invesco QQQ ETF, which tracks the Nasdaq-100® Index. Whichever direction MSFT takes in the coming weeks, the broader market might move in the same direction. You can open a full page version of this chart, here.

Rating: Hold

Enjoyed this article? Hit the ❤️ button — it'll make us smile! 😊

Cestrian Capital Research, Inc - 01 Feb 2024.