Patience, I Believe, Will Be Rewarded

Spire Global ($SPIR) Q1 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

How To Invest In Tiny Companies, Lesson 406

If you take soundings in your local bar / restaurant / gym / whatever, or ask around on social media, you can always find plenty of geniuses who “saw the potential of company X way early”, bought big, held, and then have either never sold or sold at the top. Now this is a remarkable phenomenon, because venture capital, a whole industry dedicated to doing this professionally and which has had at least 50 years to refine its methods, is not capable of producing reliable, repeatable returns from small companies in anything like a systematic way. But because of the legends that circulate in any social group where money is a topic, everyone wants to chase small companies because THIS COULD BE THE ONE!

For more sensible investors, however, the usual top 3 rules of investing apply, being:

- Manage Risk

- Manage Risk

- Manage Risk

And since you can’t manage the operating-, financial-, market-size-, or any other real-world risk in a small company if you are simply a common stockholder, the only thing you can really manage is position size aka what kind of proportion of your available funds do you have in the stock in question. Being sensible about this means that, probably, you won’t have the same startup war stories as Lyin’ Dave down the road, but then, neither will you face losing your home, childrens’ college funds, car, or anything else if and when the small cap of your dreams suddenly becomes a very much smaller cap, as these things are wont to do.

Personally I have small allocations in two tiny companies at present. One is Spire Global ($SPIR) and one is Enovix ($ENVX). In each case, if the position went to zero I would classify it under the heading “Annoying” but not under the heading “Ruinous”. And that is down to (1) expectations, which is to say sometimes these things moon but very often they do not and (2) as a result of (1), modest allocation sizes.

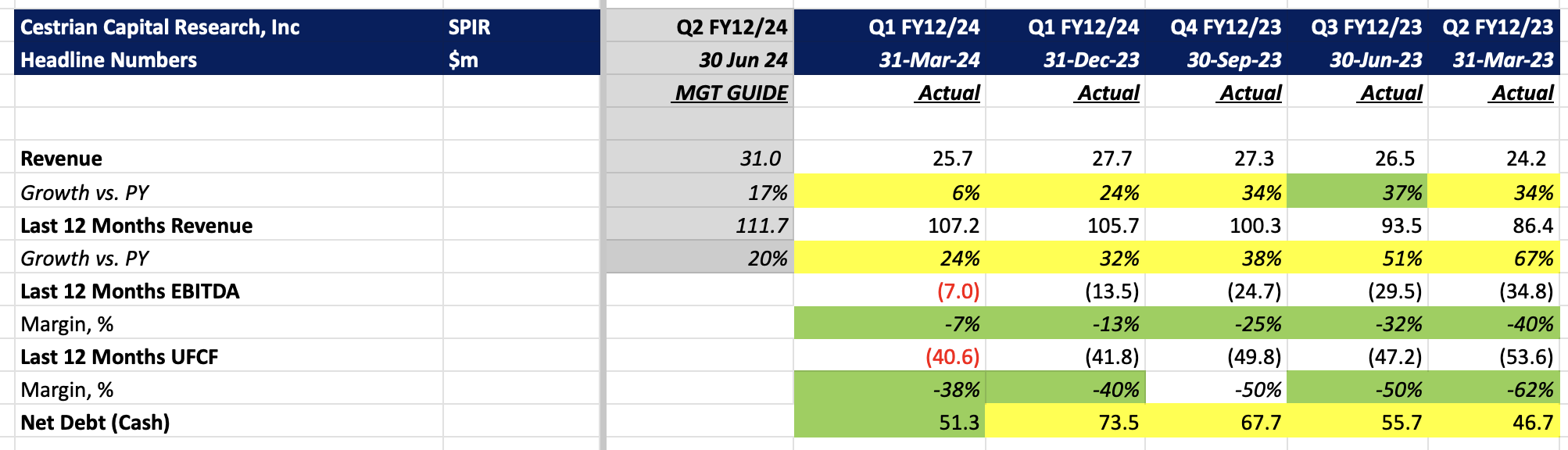

$SPIR reported its Q1 recently, missed its own revenue guide but said warm’n’cuddly things about the future, so whilst the stock has dropped below the $10 line, it has held up better than might be expected. What seems to have gone unnoticed is the remarkable progress the company is making on the EBITDA and cashflow front. Despite its small scale and capex-intensive business model, the company looks on track to be TTM EBITDA positive in maybe 2-3 quarters’ time, and TTM UFCF positive in maybe 12-18 months. That’s a real achievement by the management team in my view.

Below we lay out the headline numbers (before the paywall) and then take a look at the detailed financials, valuation analysis and our stock price projection, technical analysis and rating (after the paywall).

If you’re a free reader here, and you’d like to access the post-paywall stuff, you can sign up below either for our entry-level ‘Market Insight’ tier, or our full-monty ‘Inner Circle’ service. If you have any problems doing so, or you’d like to know more about what the pay services offer, you can reach us anytime using the contact form on this site, here.

Spire Global Headline Financials