Snowflake Q4 FY1/24 Earnings Review

I Liked It So Much I Bought The Dip

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Price Unrelated To Fundamentals, Episode 742

by Alex King

Snowflake ($SNOW) reported its Q4 of FY1/24 on February 28th. The price dumped in a manner reminiscent of markets 100 years ago in the bear market of 2022. Now, having been no fan of SNOW historically - I thought the IPO was way hyped, which is usually a way to attract unsuspecting investors toward a name where existing investors are looking for exit liquidity at compelling prices, and I thought the management team at IPO time was in essence The Traveling Wilburys ie. on one last boondoggle before retirement - I simply thought, well, what do you expect? The thing is overvalued, fundamentals so-so and the management team have one eye on the 19th hole, of course the stock is going to take a beating sometimes.

Except then I did the work and concluded, well, all is not as it seems. Because, one, the fundamentals are solid and it is possible that growth starts to accelerate soon after that inexorable slowing since the 2021 IPO; and because, two, the CEO stood down to spend more time at the golf course and the company hired an ex-Google insider who I think may be on a mission to prove something. So now SNOW is looking a little interesting. I bought a tiny starter position in the name just before the close today, as alerted ahead of time in chat.

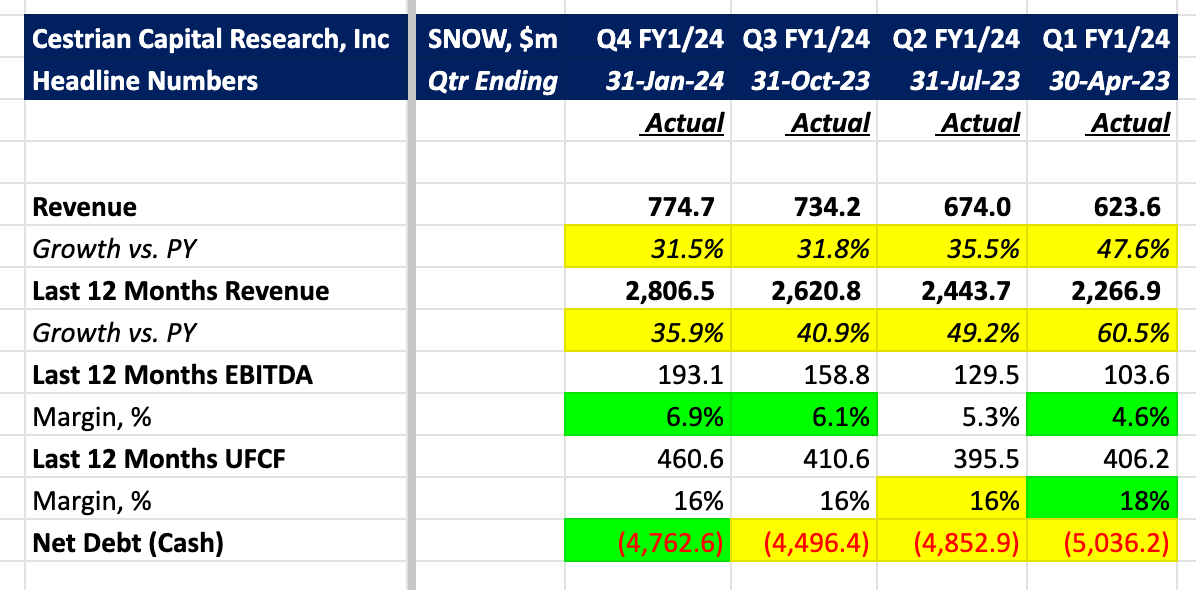

Here’s the headline numbers as of this quarter. The company doesn't provide a full revenue guide for the following quarter, it only guides on product revenue. So there's no guidance column here, unlike pretty much every other stock we cover.

In short:

- Revenue growth continues to fall - but look at the only-slight deceleration this quarter vs last quarter. Could change tomorrow but that suggests that perhaps a trough in growth rates is approaching. If the company can deliver accelerating revenue growth, that can be an upside catalyst for the name.

- EBITDA margins continue to climb - now 6.9% on a TTM basis vs. 4.6% three quarters back.

- TTM unlevered pretax free cashflow margins holding steady at 16%. That's not wonderful but in the context of 36% TTM revenue growth it's OK. And the fact that cashflow margins exceed accounting profit margins by so much tells you that (1) the company bills a lot upfront and (2) it is careful with capex. Good on both fronts.

- $4.8bn of net cash on the balance sheet says the company can probably survive a bad quarter or nine.

Let's turn to the stock price outlook, more detailed financials, valuation analysis, and our rating.

Read on!