ZScaler Q2 FY7/24 Earnings Review

Still Our Top Pick In Cybersecurity.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Why Scalability Matters

by Alex King

ZScaler ($ZS) reported its Q2 of FY7/24 yesterday after the close. The stock is off a little - around 6% at the time of writing (0915 Eastern) - but the print was good.

Before we delve into the detail I want to rehearse why ZS is our top pick in the cybersecurity sector. This is based on three reasons.

- Superior technical and economic scalability. From inception, ZS has provided an entirely in-network security service. Customers are not required to use proprietary hardware (as they are with Palo Alto Networks or Cisco, for instance), nor to install proprietary software on their own hardware devices (as they are with Crowdstrike and others). Centralization of security means a more scalable product - each additional network resource placed within the ZS perimeter should present no meaningful burden to the ZS infrastructure - and lower cost, because customer IT staff are not required to carry out exntensive rollouts.

- Superior execution. The ZScaler founder-CEO Jay Chaudhry is on his sixth owner-operated software company. Management is a learned skill and repeated experience can help the committed manager raise their game continuously.

- Fundamental financial strength. Large forward order book, high degree of prepaid sales, steadily increasing cashflow margins, rock solid balance sheet, etc.

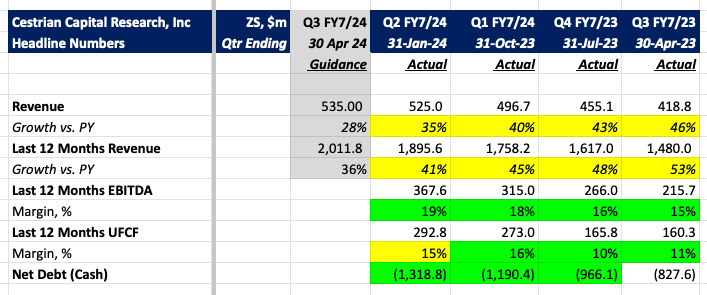

Here’s the headline numbers as of this quarter, including guidance for next quarter.

In short:

- Revenue growth continues to fall - now +35% growth vs PY in the quarter / +41% vs PY on a TTM basis.

- EBITDA margins continue to climb - now 19% on a TTM basis vs. 13% a year ago.

- Unlevered pretax free cashflow margins dropped a touch this quarter - to 15% down from 16% last quarter - but the trend remains up.

- The balance sheet now features $1.3bn net cash - enough to keep the wolf from the door.

This tells a story of a company which continues to mature - that’s why growth rates are falling - but which is navigating the move to lower growth / higher margin rather well.

Let's turn to the stock price outlook, more detailed financials, valuation analysis, and our rating.

Read on!