The DDOG Delivers Once More

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

$DDOG Q1 FY12/24 Earnings Review

by Alex King

Summary:

- DataDog delivered a nice beat on the revenue line, together with improved EBITDA and cashflow margins. The balance sheet remains rock solid.

- Order book (RPO) growth slowed some, which is OK if it's a one-quarter thing but it would be a material worry if that continued into Q2.

- The stock sold off on the print, down around 11% at the time of writing.

- Read on for our ratings, financial and technical analysis, and price targets.

Another Backgrounder For Normies

DataDog sells software to large companies who use it to monitor other parts of their extensive and complex IT systems. Today this is called things like 'observability'; a hundred years ago when we at Cestrian were young it was called 'systems management software'. If you too are long in the tooth you may remember such names as BMC Software that did for old-line systems a version of what DataDog does for the pesky kids' datacenter systems.

There are few independent vendors of any size left in this segment of enterprise software. Only Dynatrace ($DT), really. Splunk ($SPLK) is in the process of being acquired by Cisco - in our work at Cestrian we had a very nice run with SPLK up to and including a final win on the sale. New Relic (formerly $NEWR) agreed to be acquired by financial investors. And AppDynamics was acquired by, once again, Cisco, way back in 2017 just as the company was about to go public. This degree of consolidation reflects the narrow product positioning of these observability companies; none has really and truly broken out of that box into other aspects of enterprise software. Security is but one standard deviation away; save for a small acquisition by CrowdStrike in the observability sector, there has yet to be any consolidation between the pureplays in each sector, nor have any pureplays successfully expanded into the adjacent opportunity. The silos remain intact and that is what has led to the series of acquisitions by major vendors or by financial buyers. I suspect the same fate may lie ahead for DataDog.

Anyway, that's not today's concern. Let's take a look at the headline numbers, then after the paywall we'll look deeper at the numbers, assess the fundamental valuation, and revisit the stock chart in the light of the earnings response. As always we combine all these factors to come up with our stock rating and price outlook.

Read on!

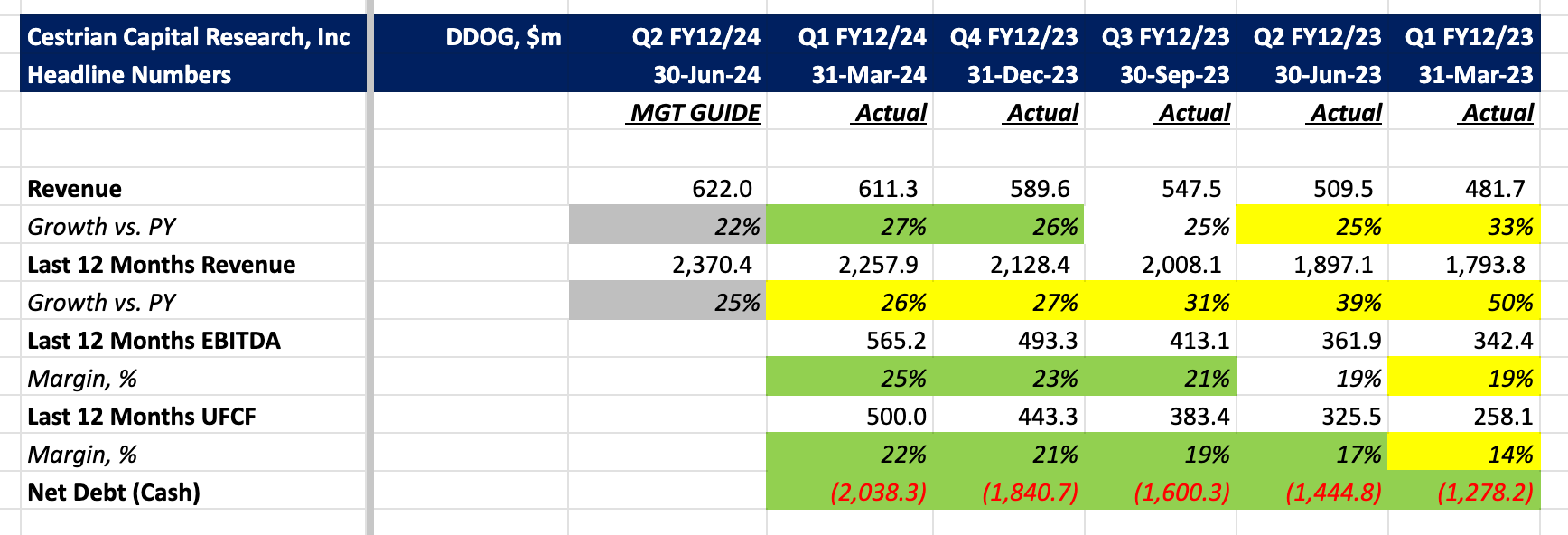

Headline Numbers

Fundamental Analysis, Valuation, Rating, Price Targets

Here's the good stuff - after the paywall of course, because we have to eat.

If you're yet to sign up to one of the pay tiers here, you can choose the 'Market Insight' level if you want just the earnings and daily market notes; if you'd like the full Inner Circle services - real-time trade alerts, 24/7 access to our charts, price targets, stock ratings, live weekly webinars, top-top-quality investor chat? Then choose the, er, Inner Circle tier. The pay stuff here starts at less than $30/month. We are pretty sure you can find that much value in it!