Palantir, Trapped

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

$PLTR Q1 FY12/24 Earnings Review

by Alex King

Summary:

- Palantir delivered accelerating and indeed better-than-guide revenue growth this quarter - and the guide for next quarter is for further acceleration. That's good.

- Last quarter we said that we thought cashflow margins had peaked - they were down a lot this quarter (from +28% TTM UFCF to +24% TTM UFCF).

- The chart continues to explain why PLTR stock can't break over $25 and stay there.

- Read on for our ratings, financial and technical analysis, and price targets.

Is It Different This Time Though?

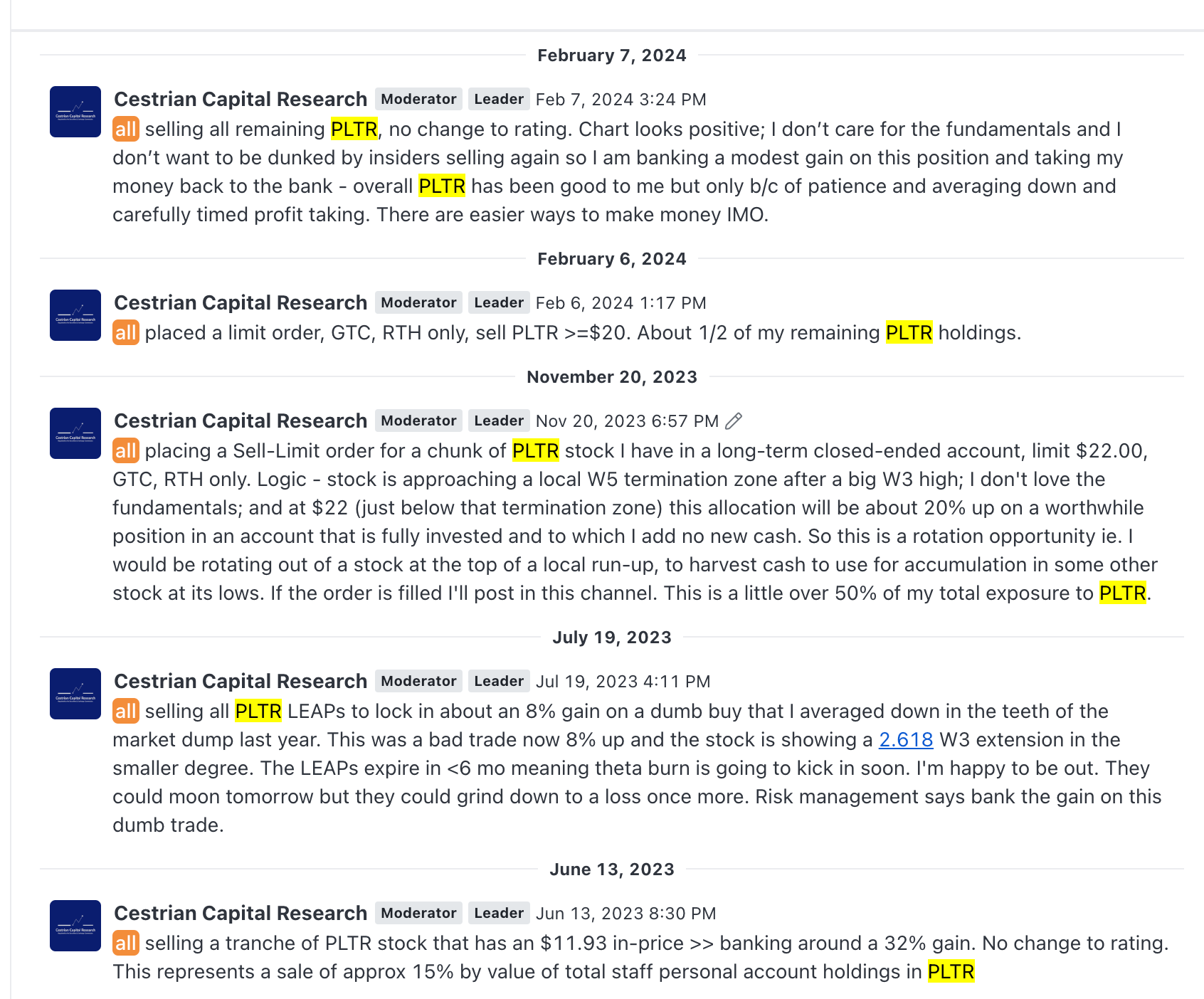

Personally, Palantir stock has been good to me, both via the common stock and via LEAPs. I gradually took gains on various positions and have been out of the stock since February this year.

These are the sells I posted in our Seeking Alpha service from mid-2023 to early 2024.

I have no plans to open a new position.

Why?

Two reasons.

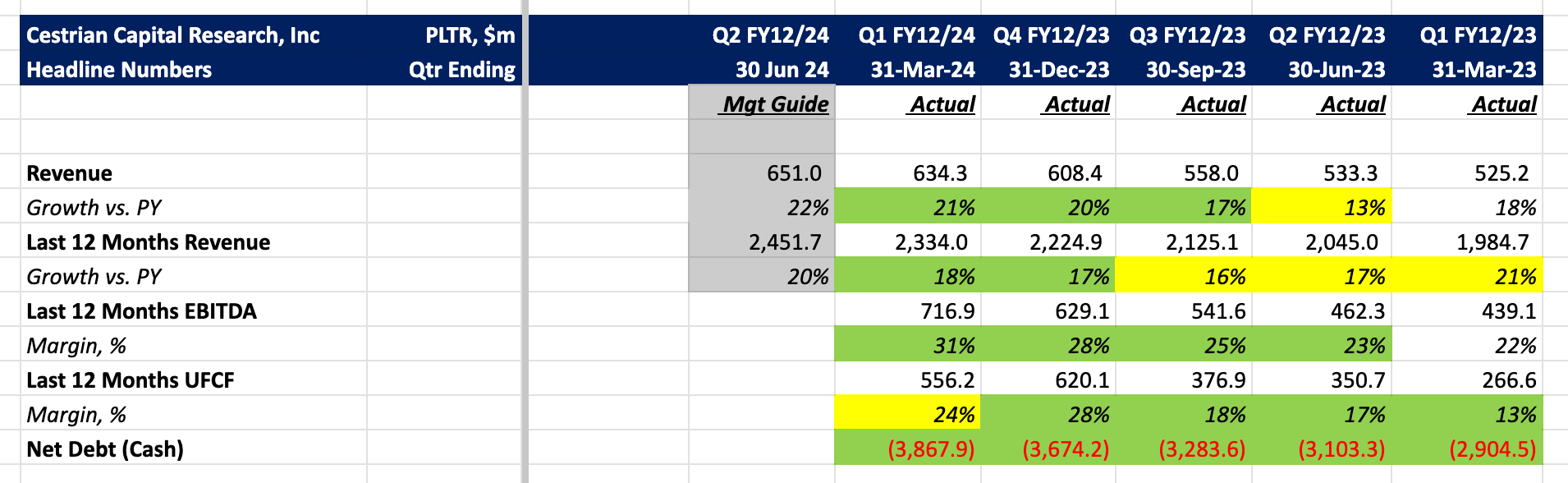

One, because on fundamentals the company looks to be at peak everything. To my eye at least, this business looks not like the Second Coming Of The Prophet Of Your Choice, as the FinTwit chorus would have you believe, but instead like a Second Generation Government Focused Software Company. For a business selling huge applications to huge customers, the fundamentals are excellent - +25% TTM revenue growth on a revenue base of $2bn+, and 22% unlevered pretax FCF margins on a TTM basis, is a superb combination. But ramping growth from here is going to be tough, because government, and ramping margins from here is going to be tough, because government. Yes, there is an enterprise-focused side of the business but that has a way to go before it begins to move the needle on the whole thing.

Two, because volume shelf, the bad kind, which is to say an overhead volume shelf. We'll talk more about that when we cover the stock chart below.

For now, here's the headline numbers.

Headline Numbers

Fundamental Analysis, Valuation, Rating, Price Targets

Here's the good stuff - after the paywall of course, because food isn't getting any cheaper.

If you're yet to sign up to one of the pay tiers here, you can choose the 'Market Insight' level if you want just the earnings and daily market notes; if you'd like the full Inner Circle services - real-time trade alerts, 24/7 access to our charts, price targets, stock ratings, live weekly webinars, top-top-quality investor chat? Then choose the, er, Inner Circle tier. The pay stuff here starts at less than $30/month. We are pretty sure you can find that much value in it!