$SWKS Q2 2024 earnings review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Summary:

- Skyworks Solutions is facing headwinds in the mobile market, which contributes 2/3 of revenue;

- Negative revenue growth and shrinking margins will probably continue for the remainder of the year.

- The stock has held the $90 level and recovered some after a 15% drop.

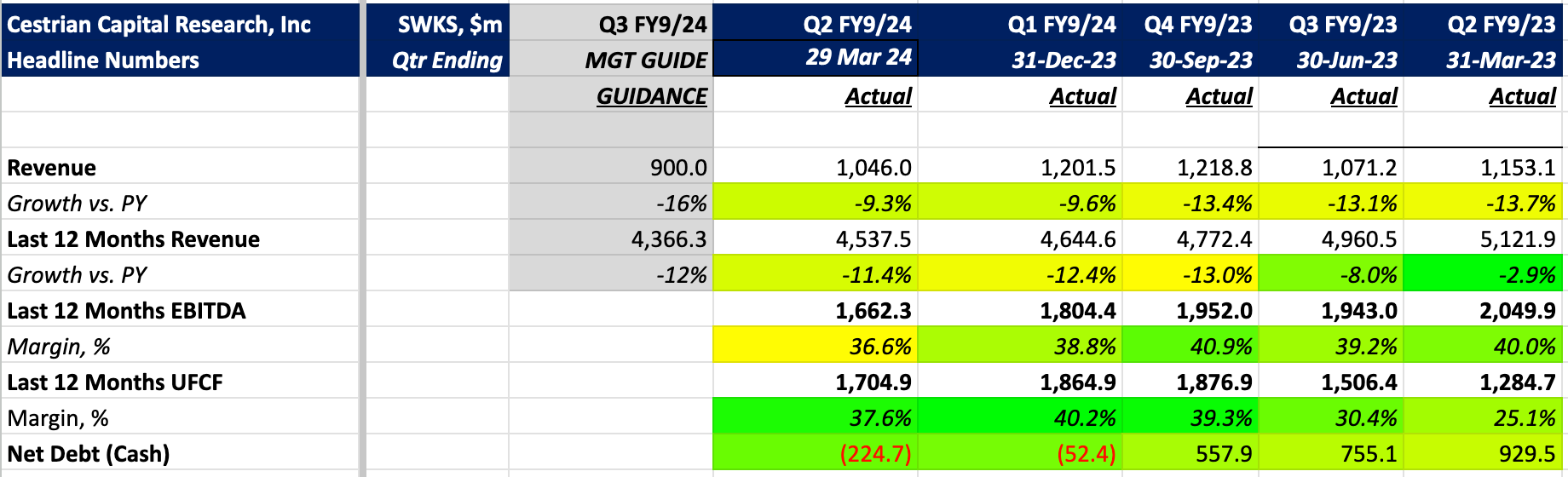

Skyworks Solutions, Inc. reported Q2 2024 earnings on April 30th. Total revenue for the quarter was $1.05 billions, in line with previous guidance and -9% with respect to the same quarter last year. Management is guiding lower for the next quarter, and in fact for the rest of the year.

The stock price dropped 15% back to $90-ish, the bottom of our accumulation zone, and recovered some in the intervening days. We believe the stock is being accumulated at these levels, but high exposure to Apple business and the potential for acquisitions make for a relatively volatile ride.

Headline numbers