The Next Nvidia? The Case For ARM

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Is It About To Be ARM’s Moment In The Sun?

ARM Holdings ($ARM) has its origins in “Reduced Instruction Set Computing”, which whether by skill or luck has in the end led to its dominance in the mobile computing market. If you have any kind of powerful handheld, battery-powered device, there is a good chance that its CPU, or parts of it, were designed by ARM. To simplify dramatically, RISC means lower power requirements than other design methods, and in battery-powered devices where battery life is a competitive dimension for manufacturers, more battery life = doubleplusgood. As smartphones were becoming a thing in the 1990s and early 2000s, Intel ($INTC) had designs on extending its dominance from PCs to mobile; this faltered in part because Intel didn’t really believe that mobile would be a huge market, and in part because ARM (i) did believe it (ii) had fundamental design advantages which meant ARM- or ARM-based CPUs could outperform Intel, AMD or other CPUs and (iii) the company kind of had to win in mobile because - o heresy! - it had been wandering around looking for a purpose for some time at that point.

Today the most important product in semiconductor is the GPU, the Graphics Processing Unit. You could think of a GPU as a whole lot of CPUs lined up in parallel, which means they can process tasks - particularly iterative tasks - much more quickly than can a CPU. Learning and creating are almost by definition iterative tasks which is why GPUs have so big an advantage in (i) machine learning and (ii) generative AI. Nvidia, which is more or less a pureplay GPU business, has both had the right product set to catch this particular wave and has executed exceptionally well from top to bottom, from pricing to supply chain to capital markets marketing. Its supreme stock performance is, in my opinion, very much warranted as a result. (We continue to rate $NVDA at Hold, despite its vertical angle of attack of late).

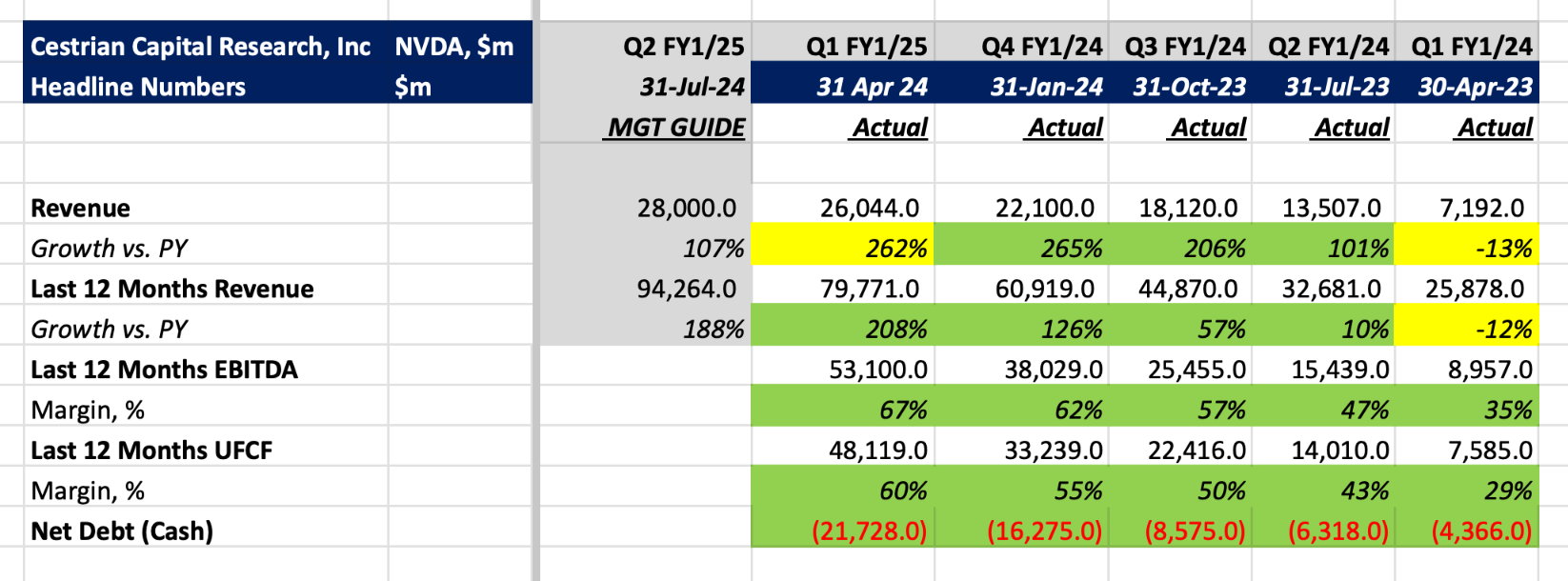

NVDA is now squarely established in that most precious of states desired by all growth-stock investors, the temporary monopoly. You can see it in their growth (the only game in town that anyone grownup wants to buy from) and their cashflow margins (the company knows this and prices accordingly).

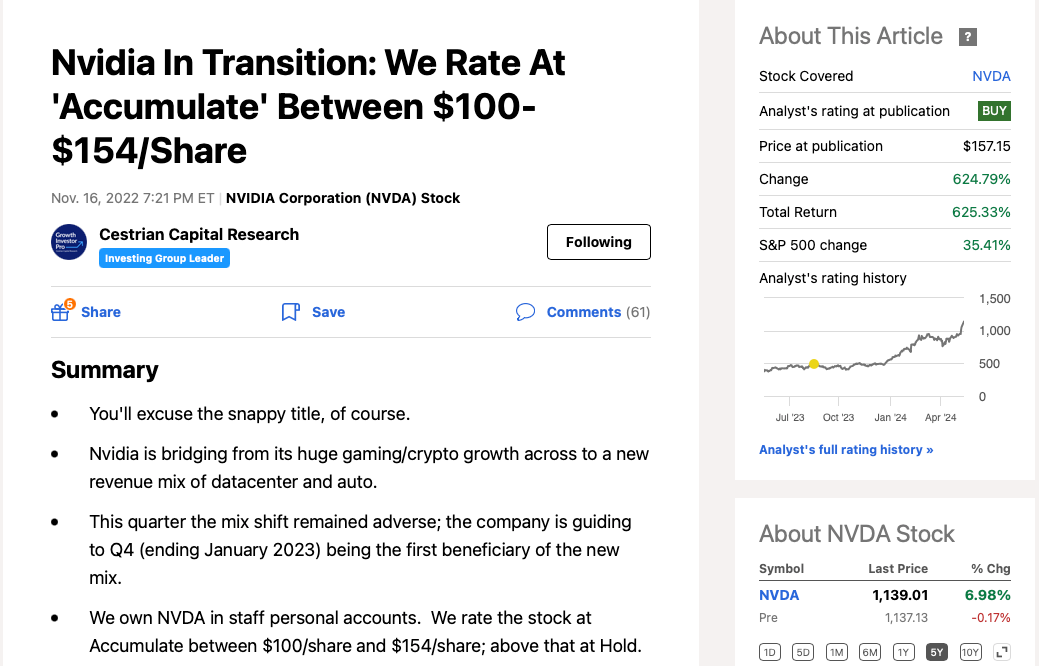

You know by now, unless you have been living under a rock this last couple years, that the stock is on fire. We called ‘Accumulate’ on NVDA between $100-154/share in 2022 in multiple posts around that time. Here’s one of them.

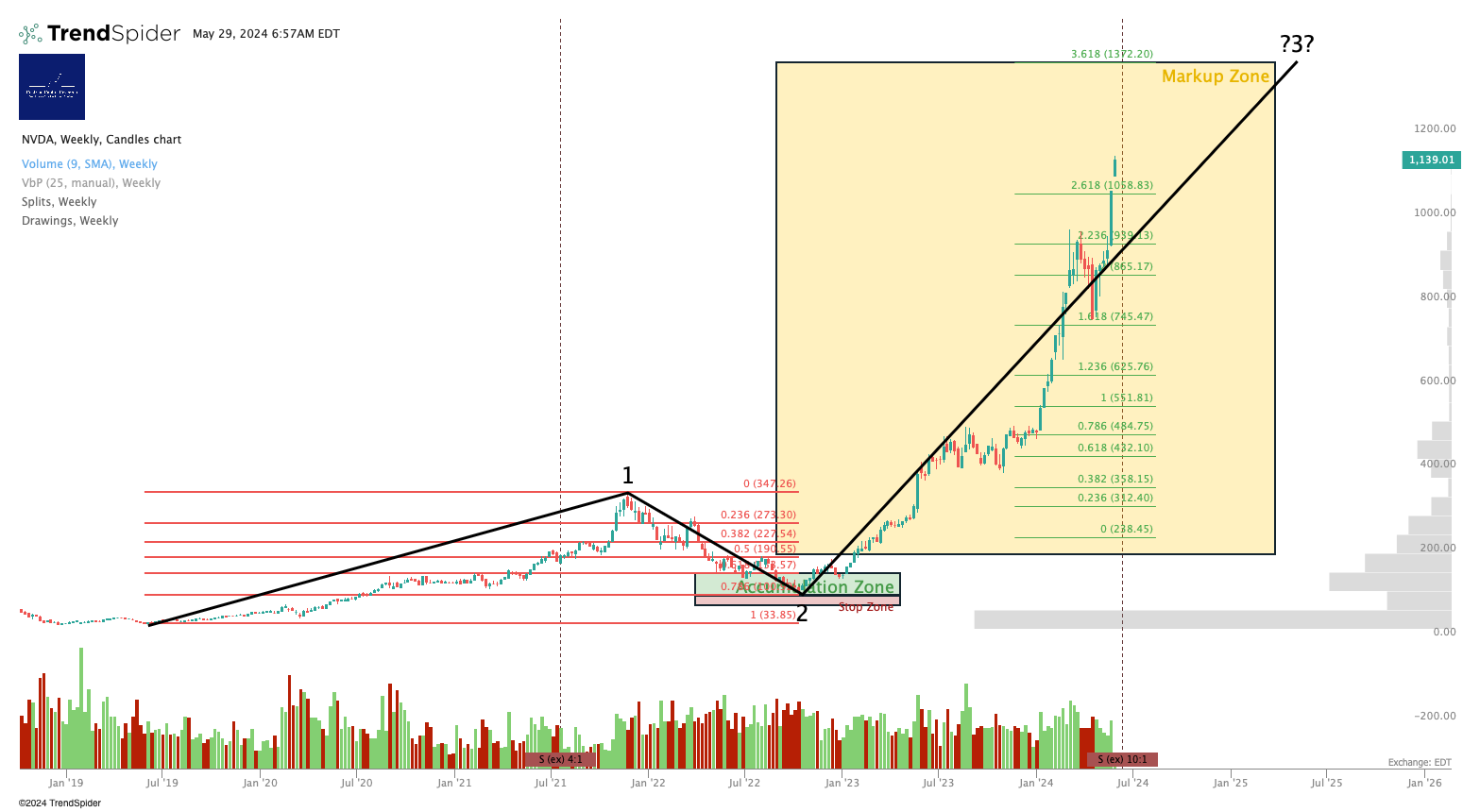

The stock has put in a monster performance, which we believe has plenty of room yet to run. (You can open a full page version of this chart, here).

Now, speaking personally I am both bullish in the medium term on NVDA and simultaneously bearish in the long term.

In the medium term - let’s call it the next couple years - I would expect Nvidia’s financial fundamentals to remain in beast mode. Yes, growth may tail off some; yes, cashflow margins may drop a little; but I believe it will remain a running-on-rails machine of a business. How the stock performs from here will I believe be more a function of appetite or otherwise for risk assets than anything specific to the company. If there is a market tailwind I believe NVDA can keep climbing; any material headwinds and I would expect large account players to start banking the very large profits they will be holding in this name.

In the long term - meaning 5-10 years - I would observe that generally speaking the same temporary monopoly status so cherished and desired by investors when a company is on the way up, becomes hated and despised and indeed resented and deemed unfair by investors as time passes (translated, as they have banked their gains and are looking for the next play). Nvidia is today as Standard Oil and Ma Bell and Microsoft were in the Dayes of Yore.

So the question is, what will deflate Nvidia? Meaning, what will deflate its cashflow margins, spoil its growth, and attract capital away from its stock? For this is what happens in tech; each enfant terrible grows fat, old and lazy and soon enough it becomes the ancien regime which is subjected to wave upon wave of attack by well-funded and well-organized revolutionary militia. The eventual victor can be hard to call this far out - sometimes an entirely orthogonal solution to the problem comes along (as was the case for ARM itself when mobile came calling). But we can try to identify some candidates at least, and for me the first name that comes to mind is ARM.

Why? Because power.

The limiting factor on present-generation GPU may prove to be price/performance (as is normal in tech - at some point along comes a product which promises 10x the performance at 10% of the price) or it may prove to be the other inputs required to coax that price/performance from the GPU. Those other inputs are, (1) power as supplied to the board itself and (2) power as supplied to the cooling equipment which dominates all datacenters not located in the Arctic Circle. Today the cost of power is rising (and dragging up stocks with it - for a simple way to play this theme, consider $XLU by the way) and with current compute architectures I don’t see any real way to contain that spending. AI seems to me to be in its early phases. We’ll likely encounter a Trough of Disillusionment soon, but beyond that the applications of the technology are likely a lot more compelling than Midjourney being able to create a version of OutRun all on its lonesome.

And if power, then ARM. Because RISC, but really, because mobile and because - well, where does ARM go next if not GPU/AI? The company has tried for twenty plus years to conquer the server market, achieving little because when power costs or externalities like exhaust heat output don’t really matter to enough people who control the purse strings, why would you buy ARM-designed chips instead of Intel or AMD or Nvidia? Exactly. You wouldn’t. But the problem of power - meaning the cost of power, because let’s not kid ourselves that anyone writing the checks truly gives a Least Weasel’s Backside about exhaust heat - is going to get worse and fast, and changing that starts with intrinsically low-power designs.

So you have, I think, three factors which may conflate to drive ARM’s market share upwards over time. I don’t mean tomorrow - I mean over a 5-10yr period - nobody swaps out their core datacenter architecture on a whim. And those three factors are:

- Pretty soon everyone currently saying that Nvidia’s success is A Wonderful Thing will decide that it is a Terrible Thing which is Draining The Industry Of Money with its High Prices and it is High Time That Jensen Retired And Made Way For Some Other Companies. In other words … conditions will become ripe for distribution of NVDA stock and accumulation of A.N. Other stock.

- Power requirements are a problem which cannot be solved by today’s GPU designs (and NVDA does not have low-power DNA; you can’t get there from here either).

- ARM is a company looking for its next big market opportunity, and it has plenty of folks who would like it to succeed, not least Apple and others who don’t want to sustain NVDA’s chokehold, and who can build some of their own silicon but in the end do need to license in designs from folks like ARM, Cadence, Synopsys and so forth to complete the picture.

For what it’s worth, let’s take a look at ARM’s numbers and stock chart, though in truth neither of these things are the reason I own the stock myself. I own it because I think it may be able to one day topple The House That Jensen Built. I have a lot more capital in NVDA than I do in ARM, and I hope NVDA has plenty to run; this isn’t a religious war here, I don’t care who succeeds, I just want to be positioned well either way.

Fundamental Financial Analysis

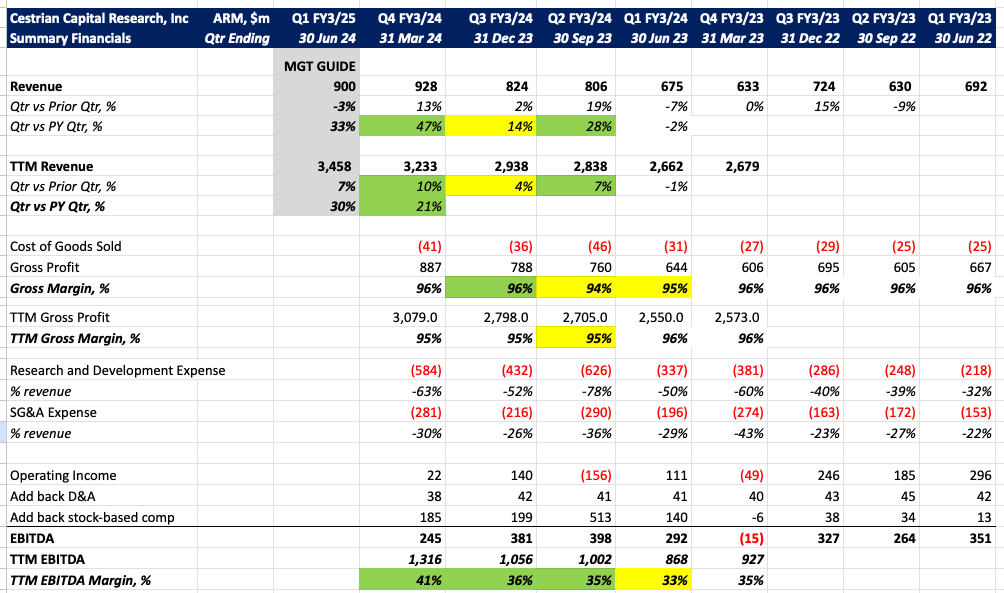

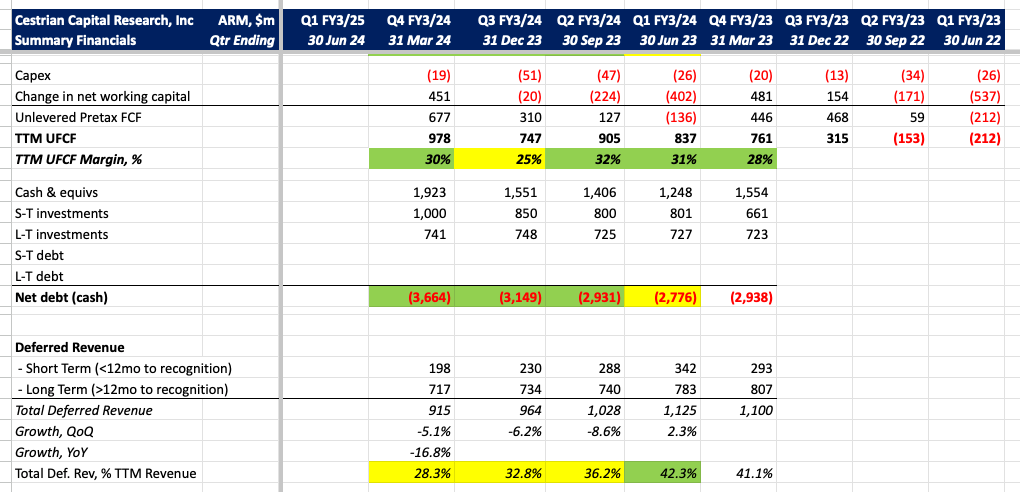

Here’s ARM numbers as filed since the IPO. Growth is good, not wonderful; margins rock solid (particularly gross margins - the joy of the intellectual property licensing model!); balance sheet sound. All in all, very good, not super-wonderful. (Nvidia fundamentals are super-wonderful).

Valuation Analysis

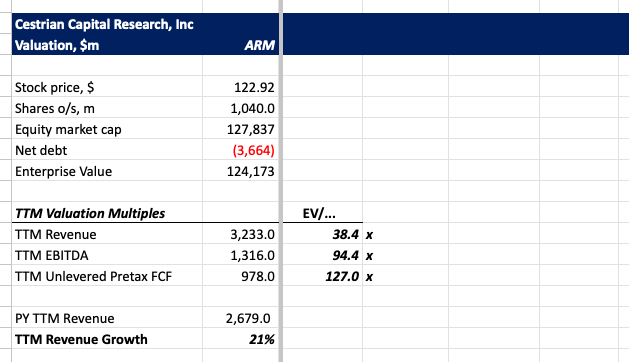

This thing is expensive on fundamentals. It’s trading at about twice NVDA’s cashflow multiple, despite growing more slowly and having lower cashflow margins. It’s almost as if other people also think this thing could be big.

Technical Analysis

For me there has not been enough time passed since the IPO to provide any really useful price patterns. You can open a full page version of this chart, here.

Normally after an IPO one sees a deep decline, usually once insiders start selling bigly. That has yet to happen at ARM; doesn’t mean it won’t happen or will happen, just means it hasn’t happened yet. A real post-IPO low can be a generational buying opportunity in stocks like this - we‘ve yet to see that at ARM.

Stock Rating

We rate ARM at Hold; with a very long term view in mind. A time to buy big might be if a real post-IPO drop sets in.

Cestrian Capital Research, Inc - 29 May 2024.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long position(s) in, inter alia, $AAPL, $ARM, $CDNS, $INTC and $NVDA.