The Problem With Fundamentalism

Why Bother With Fundamentals, Really?

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Prepare To Be Radicalized

If you are running a business as a CEO, or you own a business and you have someone running it for you, numbers are your friend. Designing the right set of numbers and tables to capture what is going on in the business and why, and what is coming down the pike and when, is a magic trick that never gets old. And using those numbers to say, well, we need to do X or Y in order to achieve A or B, and then A or B happening as a result? Thoroughly rewarding. Tick. Numbers are how you read, interpret, analyze, plan and execute a business. Your building blocks are your revenue recognition policy, your gross margin calculation, your operating costs and their proportions of revenue, your accounting profit, above all your unlevered pretax free cashflow and tax rate, all of which form the Metrics That Lead To The Light, being, a Big Ole Pile Of Net Cash On The Balance Sheet. For once you have said Big Ole Pile, and it Yea Verily Be Unassailable, the world is truly your oyster and you have more freedom to do as you please. Simples.

Investing Is Not Managing

Fundamentalists from Graham & Dodd through Buffett to, er, whoever the leading FinTwit numbers bod is these days, would have you believe that investing in companies is a lot like managing companies. I beg to differ, at least when it comes to investing in common stocks issued by public companies.

If you are the manager and/or controlling owner of a business, the numbers to which I refer above can and should form the basis of your actions, and your actions should impact the next set of numbers, hopefully in the way you desired. Take action, measure impact, course correct, measure impact, rinse and repeat and, abracadabra, watch the Pile get higher.

But if you invest in common stocks issued by public companies not under your control, what use are fundamentals? Well, perhaps for very small companies where there is little or no analyst coverage, thinly traded stock, an ill-educated investor base, that kind of thing, then, sure, perhaps you can see something in the numbers that the market cannot, but to be honest, that's unlikely, and to the extent you think you have this gift, you're probably just flattering your own ego. Not least because these types of companies are often a little economical with the actualité - this is the one luxury afforded to them by that very lack of investor interest. But Microsoft? Apple? United Health? Occidental Petroleum? Frankly, anything sizable enough to be actually investable - can you really gain an edge by digging into the fundamentals?

It Depends Who You Are

Who you are determines what numbers you get, and when. Because by the time the 10-Q comes along, there is no edge. The thing prints, machines have read it in a trice and traded according to the rules set by the machines' controllers, who may in fact also be machines at this point.

If you get the numbers - the actual numbers - before the 10-Q or the 10-K, then, sure there is an edge. But that edge is likely short lived, because there's a good change you end up in gaol, and last time we looked, it's hard to run your account from there.

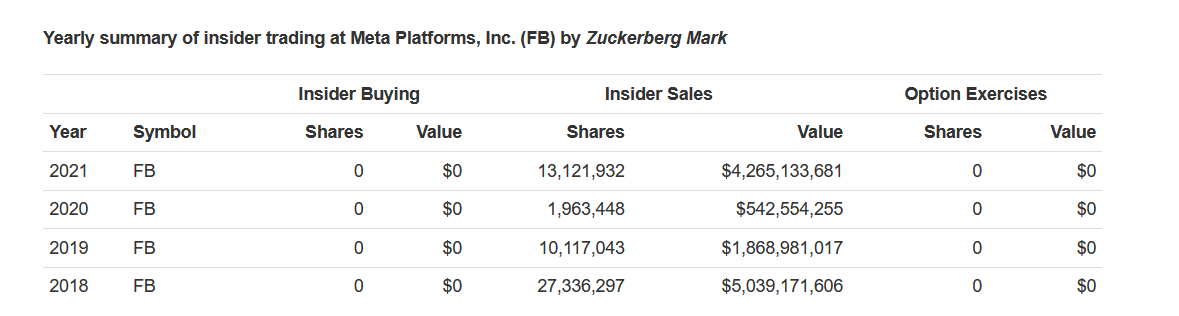

So who has an edge from the numbers? Two groups of people. Firstly, the management team. If the numbers coming down the pike are bad - either company specific (new product is a bust, labor costs in Venezuela are out of control, whatever), or market specific (nobody is clicking on the web page that tells them about high-end dealer-fit options on $100k midsized electric SUVs anymore), you won't know, but the management team will know, and you can see the breadcrumb trail in insider sales. There are myriad examples of this even just in the last couple years, but here's a doozy.

See if you can spot the year that La Zuck dumped the $4.3bn-worth. (Full page chart, here).

Yes! It was the year before $META dumped 78.6% of all the value it had built up in the decade following its post-IPO lows. What an amazing coincidence!

Now, the boy wonder had the same 10-Qs in front of him that you did. Did you dump all your $META ($FB as it was then) in 2021? If not, it's likely because you didn't have the real-time ad spend and user traffic data that the FB team was immersed in all day. Those are the numbers that drove those insider sales, not a line item anomaly deep in the SEC filings that you could have found if only you had studied them more. It was the advance data that did it.

Know the other group of folks that has an edge from the numbers?

Big Money, that's who.

Big Money's job is to read the room. To know at a high level what the surrounding policy is (will Microsoft be permitted to buy Activision, or not?); what the customer intention is (will Federal departments really pay big money to small security vendors like Zscaler and Cloudflare?), and what the company's moves are likely to be (is the company interviewing investment banks for the next big releverage and acquisition?). In this way, Big Money gets its edge.

Want to see what a Big Money edge looks like? Here's wheat futures in 2021. (You can open a full page chart, here).

Big Money's job is to inhabit the corridors of power so closely that it becomes indistinguishable as to who is making policy and who is shaping and informing that policy. The little people - retail and a good many hedge funds too - got all excited about wheat futures after grain exports from Ukraine slowed dramatically. But because Big Money knew that Russia was serious about invading Ukraine - contrary to the narrative that said it was just a military exercise - they had already loaded the boat on wheat. Then along come the marks to buy all that wheat from Big Money in Q1 2022 onwards.

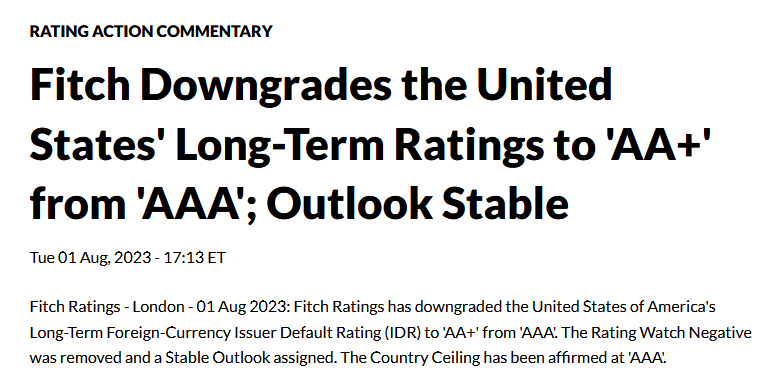

Want to see a real-time example of Big Money at work? Right here.

Yields on 10-Year US T-Bills have been on the rise in recent weeks. Equities pretended not to notice, but yields kept climbing. And now you know why.

How To Be More Like Big Money And Less Like A Seal

A what now?

This is what Big Money does to Little Money time and again, day in, day out.

Source - Twitter.

Orca on the left, seal on the right. Oftentimes a bunch of orcas will toss one of these little guys around, 80ft in the air, between a few of them, for a half hour or so, just for yucks. Sometimes the orcas are hungry. Sometimes, just bored. And this is how Big Money passes the day whenever Little Money comes to play in their yard. So if you want to be the Little Money seal caught between Big Money LLP, and its brethren Large Account Players LLC, Insurance Megacorp, Inc and The Combined Retired Janitors' Fund Of Funds, LP? Go ahead and try to outsmart them. Read everything you can. Each page of all the 10-Ks, everything that the Wall Street Journal has to say, and hey, why not Le Monde, the Financial Times, and Il Sole 24 Ore too?

Want to know how to beat an orca to a tasty catch of fish, if you're a seal? You can't.

Want to know how to have orcas lead you to a tasty catch, without them declaring you the said catch, again you being a seal (or even a sealion. They aren't fussy, those orcas. A bored orca can throw pretty much anything 80ft in the air if it wants to)?

Easy. Follow the contrail. Look hard enough at the ocean and you can see them. And look hard enough at stock charts, and you can see the path to the tasty catch there too. What you won't necessarily know is why the orcas are swimming that way. But it doesn't matter. Only your ego needs to know this - your wallet doesn't care.

Here's the simple, patented, Cestrian Capital Research method of combining technical and fundamental analysis. It's a serial method ie. do (1) first and then do (2) and then (3). The lag between (1) and (2) can be hours, days, weeks, months, or years. You don't know. But this is the method.

(1) Watch chart. Work out direction of chart using your pattern recognition system of choice. Decide which direction you wish to align with (with the trend, because you think it's going to continue, or against the trend, because you think it's going to reverse).

.... wait ....

.... wait ...

.... a Grue enters the room ...

.... wait some more ...

(2) Read in company numbers, or the news, or Twitter, or YouTube, or something else, why that was the trend on the chart. Then nod your head and go, "ah! - there you go!".

And that, seals and sealions, is how to be More Like Big Money, And Less Like Lunch!

Join Us

Thanks for reading our work. If you've yet to do so, and you'd like to step into our Inner Circle service - the apex, the very Politburo of our online offerings - just click the button below to learn all about the service, with signup links for monthly, annual, or extended memberships.

Alex King, Founder-CEO, Cestrian Capital Research, Inc - 2 August 2023.